TSX Penny Stocks: Naughty Ventures And 2 Other Promising Picks

Reviewed by Simply Wall St

The Canadian market has been navigating a complex landscape, with recent economic indicators suggesting resilience despite broader global uncertainties. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a compelling area of exploration. These stocks can offer surprising value when backed by strong financials and growth potential, making them intriguing options for those seeking under-the-radar opportunities.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.68 | CA$66.74M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.385 | CA$3.26M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.36 | CA$52.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.38 | CA$878.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.08 | CA$19.82M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.87 | CA$452.18M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.37 | CA$171.04M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.11 | CA$206M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.74 | CA$8.84M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 405 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Naughty Ventures (CNSX:BAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Naughty Ventures Corp. is engaged in the acquisition and exploration of mineral properties in Canada, with a market cap of CA$13.42 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$13.42M

Naughty Ventures, recently rebranded from York Harbour Metals Inc., is navigating the penny stock landscape with a focus on mineral exploration in Canada. The company is pre-revenue and unprofitable, but it holds a significant cash runway exceeding two years. It has recently expanded into hydrogen exploration by acquiring strategic assets in Ontario and Quebec, positioning itself within the promising white hydrogen sector. Despite its volatile share price and inexperienced board, Naughty Ventures remains debt-free with short-term assets covering liabilities. Recent earnings show improvement with net income of CA$2.01 million for Q2 2025, indicating potential financial progress amidst its strategic shifts.

- Click here to discover the nuances of Naughty Ventures with our detailed analytical financial health report.

- Understand Naughty Ventures' track record by examining our performance history report.

International Lithium (TSXV:ILC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: International Lithium Corp. is an exploration stage company focused on the investment, exploration, and development of mineral properties in Canada and Southern Africa, with a market cap of CA$6.81 million.

Operations: International Lithium Corp. does not report any revenue segments as it is in the exploration stage, concentrating on mineral property investment and development in Canada and Southern Africa.

Market Cap: CA$6.81M

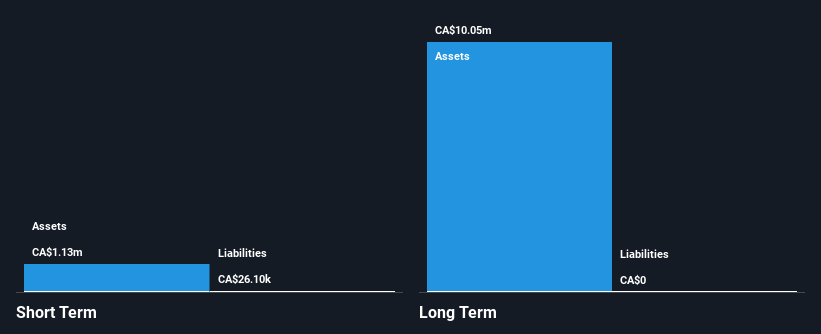

International Lithium Corp. is navigating the exploration stage with a market cap of CA$6.81 million and remains pre-revenue, focusing on mineral property development in Canada and Southern Africa. The company has improved its financial position by reducing net losses significantly year-over-year, reporting a net loss of CA$0.4976 million for Q2 2025 compared to CA$1.28 million previously. Despite high share price volatility, it benefits from being debt-free with short-term assets exceeding liabilities by a substantial margin. A recent private placement aims to raise CA$1 million, potentially strengthening its cash position while involving directors and insiders in the offering.

- Get an in-depth perspective on International Lithium's performance by reading our balance sheet health report here.

- Evaluate International Lithium's historical performance by accessing our past performance report.

Zoomd Technologies (TSXV:ZOMD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zoomd Technologies Ltd. operates as a global marketing technology platform focused on user acquisition and engagement, with a market capitalization of CA$201.68 million.

Operations: The company generates revenue of $69.51 million from its Internet Software & Services segment.

Market Cap: CA$201.68M

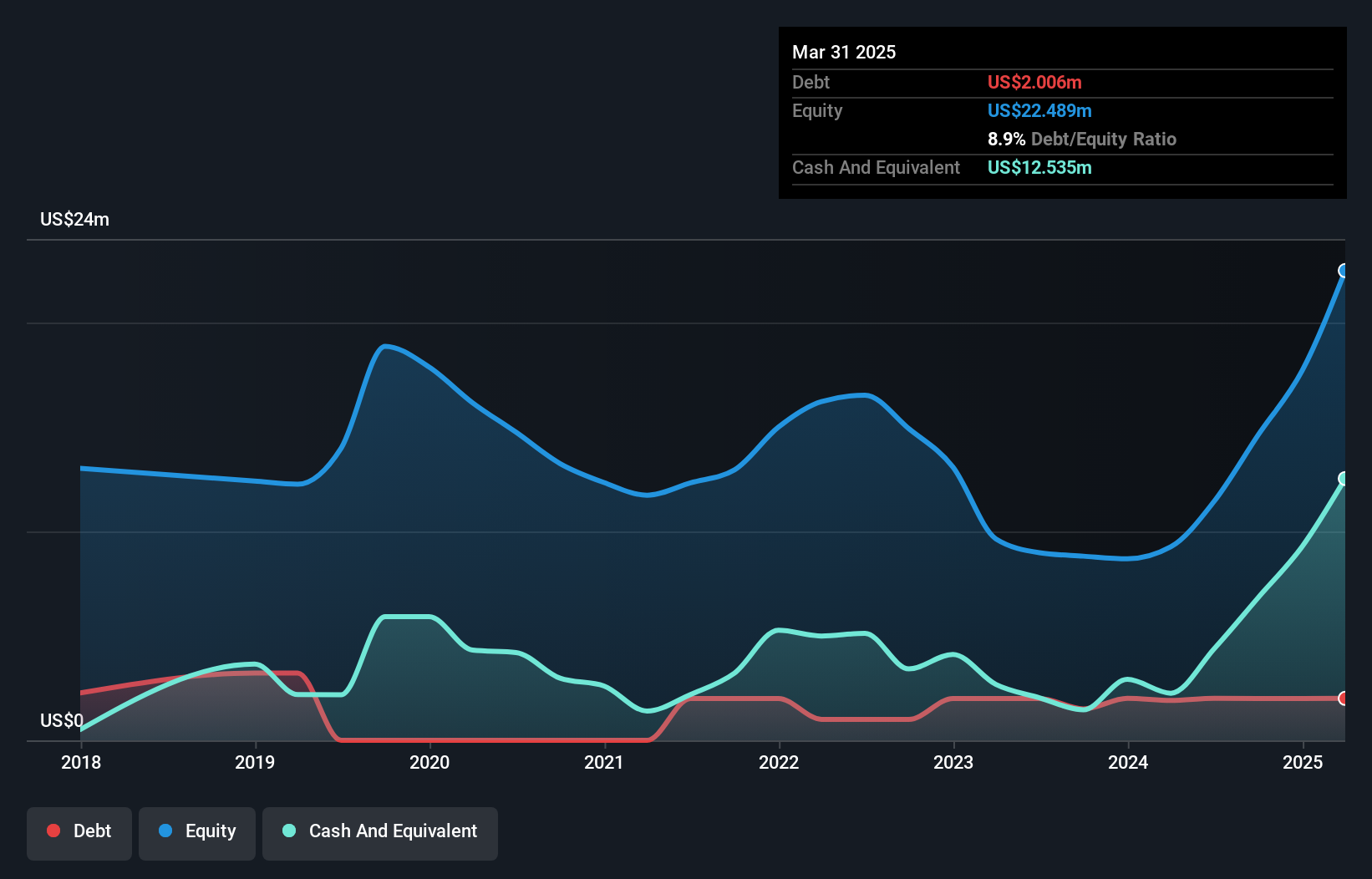

Zoomd Technologies Ltd. stands out in the penny stock landscape with a market cap of CA$201.68 million, demonstrating robust financial performance and growth. The company reported Q2 2025 sales of US$19.56 million, up from US$13.98 million a year earlier, with net income rising to US$6.08 million from US$2.15 million over the same period, reflecting substantial earnings growth and improved profit margins at 24.5%. Zoomd is debt-free and its short-term assets comfortably cover both short- and long-term liabilities, indicating strong financial health while maintaining stable weekly volatility at 10%.

- Click here and access our complete financial health analysis report to understand the dynamics of Zoomd Technologies.

- Learn about Zoomd Technologies' historical performance here.

Seize The Opportunity

- Jump into our full catalog of 405 TSX Penny Stocks here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoomd Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZOMD

Zoomd Technologies

Operates as a marketing technology user-acquisition and engagement platform worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives