Top 3 Stocks Estimated To Be Undervalued On The TSX In July 2024

Reviewed by Simply Wall St

Amidst the shifting tides of the Canadian market, where recent trends have seen a decoupling of stock performance and interest rates, investors are keenly observing opportunities for value. In this environment, identifying undervalued stocks on the TSX becomes particularly compelling as it could align well with broader market conditions favoring a potential easing of monetary policies and sustained economic growth.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$187.83 | CA$312.71 | 39.9% |

| Decisive Dividend (TSXV:DE) | CA$7.05 | CA$11.76 | 40% |

| Trisura Group (TSX:TSU) | CA$42.26 | CA$80.16 | 47.3% |

| Kraken Robotics (TSXV:PNG) | CA$1.15 | CA$2.24 | 48.7% |

| Kinaxis (TSX:KXS) | CA$164.93 | CA$264.02 | 37.5% |

| Endeavour Mining (TSX:EDV) | CA$31.07 | CA$49.14 | 36.8% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Amerigo Resources (TSX:ARG) | CA$1.59 | CA$2.74 | 41.9% |

| Green Thumb Industries (CNSX:GTII) | CA$15.30 | CA$28.42 | 46.2% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

Here we highlight a subset of our preferred stocks from the screener.

Sandstorm Gold (TSX:SSL)

Overview: Sandstorm Gold Ltd. is a gold royalty company with a market capitalization of approximately CA$2.37 billion.

Operations: Sandstorm Gold Ltd. generates its revenue primarily from gold royalty streams, with significant contributions from operations in Mercedes, Mexico (CA$23.15 million), Cerro Moro, Argentina (CA$23.52 million), and other key segments including Chapada and Caserones in Brazil and Chile respectively, each contributing around CA$12.86 million and CA$13.05 million.

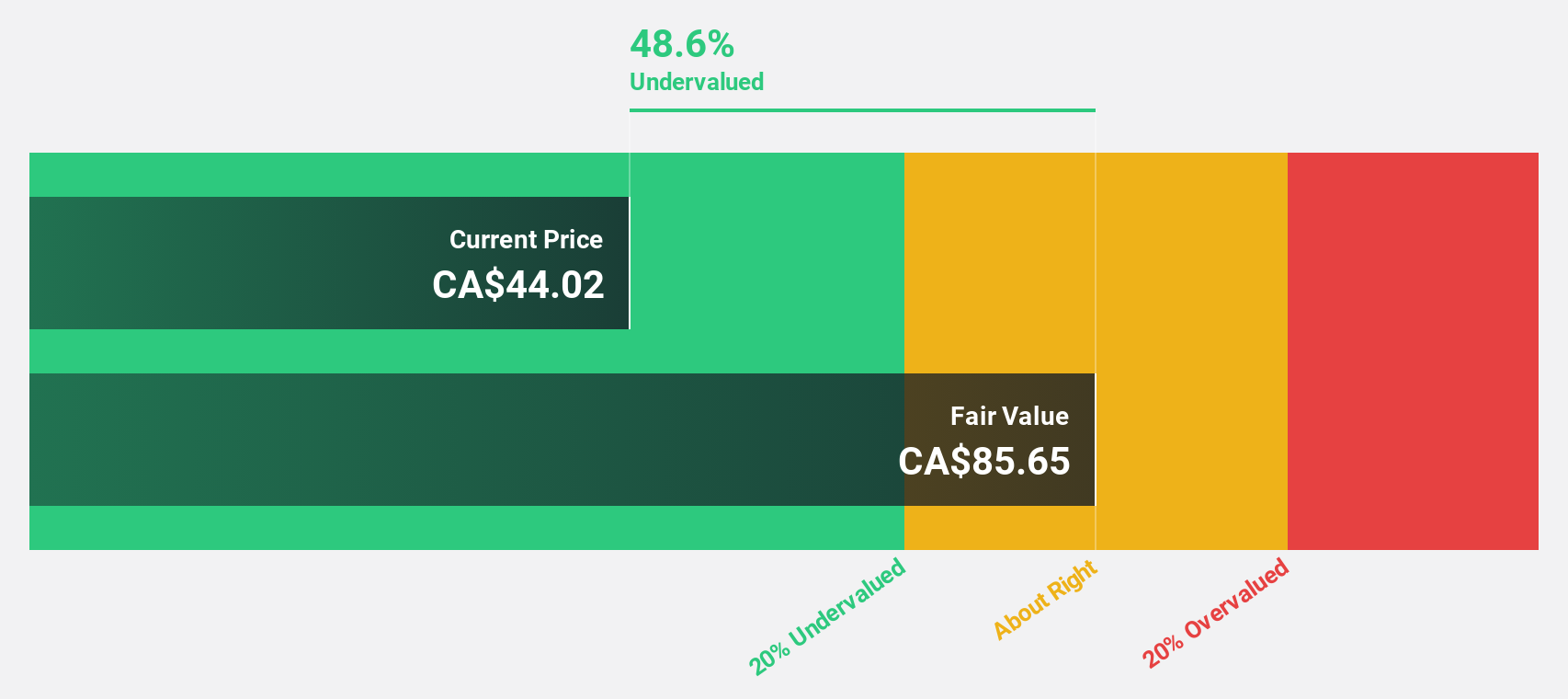

Estimated Discount To Fair Value: 23.8%

Sandstorm Gold Ltd., currently trading at CA$7.97, is perceived as undervalued based on discounted cash flow analysis, with an estimated fair value of CA$10.46. Despite recent operational challenges, including a decrease in gold equivalent ounces sold and revenue year-over-year for Q2 2024, the company maintains a robust forecast with expected significant earnings growth over the next three years. Analysts predict a potential price increase of 27.3%, reflecting optimism about its future performance relative to its current market valuation.

- Our earnings growth report unveils the potential for significant increases in Sandstorm Gold's future results.

- Click to explore a detailed breakdown of our findings in Sandstorm Gold's balance sheet health report.

TerrAscend (TSX:TSND)

Overview: TerrAscend Corp., with a market capitalization of CA$617.81 million, engages in the cultivation, processing, and sale of medical and adult-use cannabis across Canada and the United States.

Operations: The company generates its revenue primarily from the cultivation and sale of cannabis, totaling CA$328.56 million.

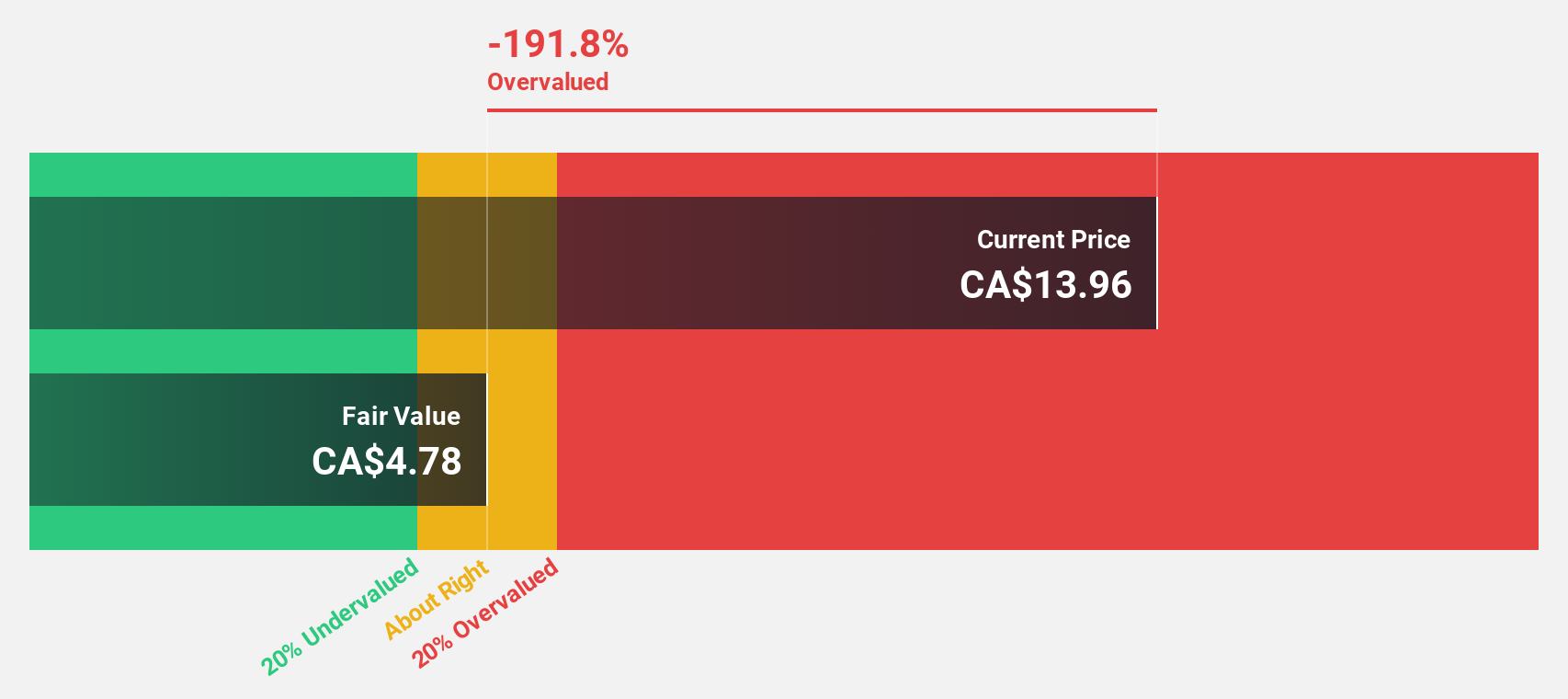

Estimated Discount To Fair Value: 11.2%

TerrAscend, currently priced at CA$1.76, appears undervalued relative to our fair value estimate of CA$1.98. Despite a highly volatile share price and recent shareholder dilution, the company's strategic expansions into new retail locations underscore its growth trajectory in the cannabis sector. With reported sales increasing to US$80.63 million from US$69.4 million year-over-year and a reduced net loss, TerrAscend is forecasted to achieve profitability within three years, supported by revenue growth projections that surpass the Canadian market average.

- Insights from our recent growth report point to a promising forecast for TerrAscend's business outlook.

- Dive into the specifics of TerrAscend here with our thorough financial health report.

Trisura Group (TSX:TSU)

Overview: Trisura Group Ltd. is a specialty insurance provider with operations in surety, risk solutions, corporate insurance, and reinsurance across Canada, the United States, and internationally, boasting a market capitalization of approximately CA$2.01 billion.

Operations: The company generates revenue through its operations in the U.S. and Canada, with segments reporting CA$2.04 billion and CA$900.81 million respectively.

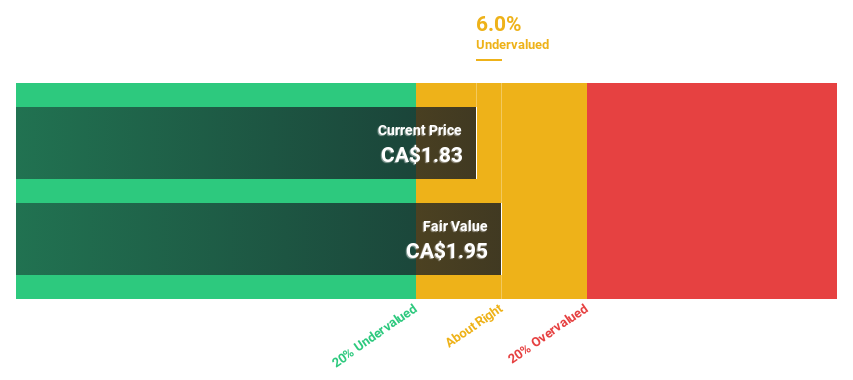

Estimated Discount To Fair Value: 47.3%

Trisura Group Ltd., trading at CA$42.26, is significantly below our fair value estimate of CA$80.16, indicating a potential undervaluation based on cash flows. The company's earnings have surged by 385% over the past year and are expected to grow by 31.6% annually, outpacing the Canadian market forecast of 14.7%. Recent executive changes aim to enhance strategic leadership and expand North American operations, potentially bolstering future performance despite some concerns over shareholder dilution and significant insider selling recently.

- Our expertly prepared growth report on Trisura Group implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Trisura Group.

Taking Advantage

- Click this link to deep-dive into the 22 companies within our Undervalued TSX Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TerrAscend might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TSND

TerrAscend

TerrAscend Corp. cultivates, processes, and sells medical and adult use cannabis in Canada and the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives