Sun Life Financial (TSX:SLF) Valuation Check After CA$1 Billion Subordinated Debenture Financing Move

Reviewed by Simply Wall St

Sun Life Financial (TSX:SLF) just lined up CA$1 billion in new subordinated debentures, a material move that reshapes its capital stack and signals how management is thinking about growth and balance sheet flexibility.

See our latest analysis for Sun Life Financial.

The stock has been drifting rather than surging this year, with a modest recent uptick in share price returns alongside a much stronger three and five year total shareholder return that underlines steady long term compounding as investors reassess growth and capital deployment.

If this kind of deliberate balance sheet move has you thinking more broadly about the sector, it could be a good moment to scout healthcare stocks as potential long term compounders too.

With Sun Life trading slightly below analyst targets but boasting hefty multi year returns and solid earnings growth, the real question now is whether today’s price leaves enough upside or if markets already reflect tomorrow’s expansion.

Most Popular Narrative: 9.6% Undervalued

With Sun Life closing at CA$82.23 against a narrative fair value near CA$90.93, the story tilts toward upside driven by steady, compounding fundamentals.

Ongoing investment in digital initiatives such as generative AI tools, straight through processing, and real time underwriting is improving operational efficiency and customer experience, supporting margin expansion and enabling scalable future growth.

Curious how disciplined cost cuts, ambitious growth targets, and a lower future earnings multiple can still point to upside from here? The narrative reveals the full playbook.

Result: Fair Value of $90.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing challenges in U.S. Dental and sustained net outflows at MFS could pressure margins and undermine the otherwise constructive long term thesis.

Find out about the key risks to this Sun Life Financial narrative.

Another View: Market Ratios Flash a Caution Light

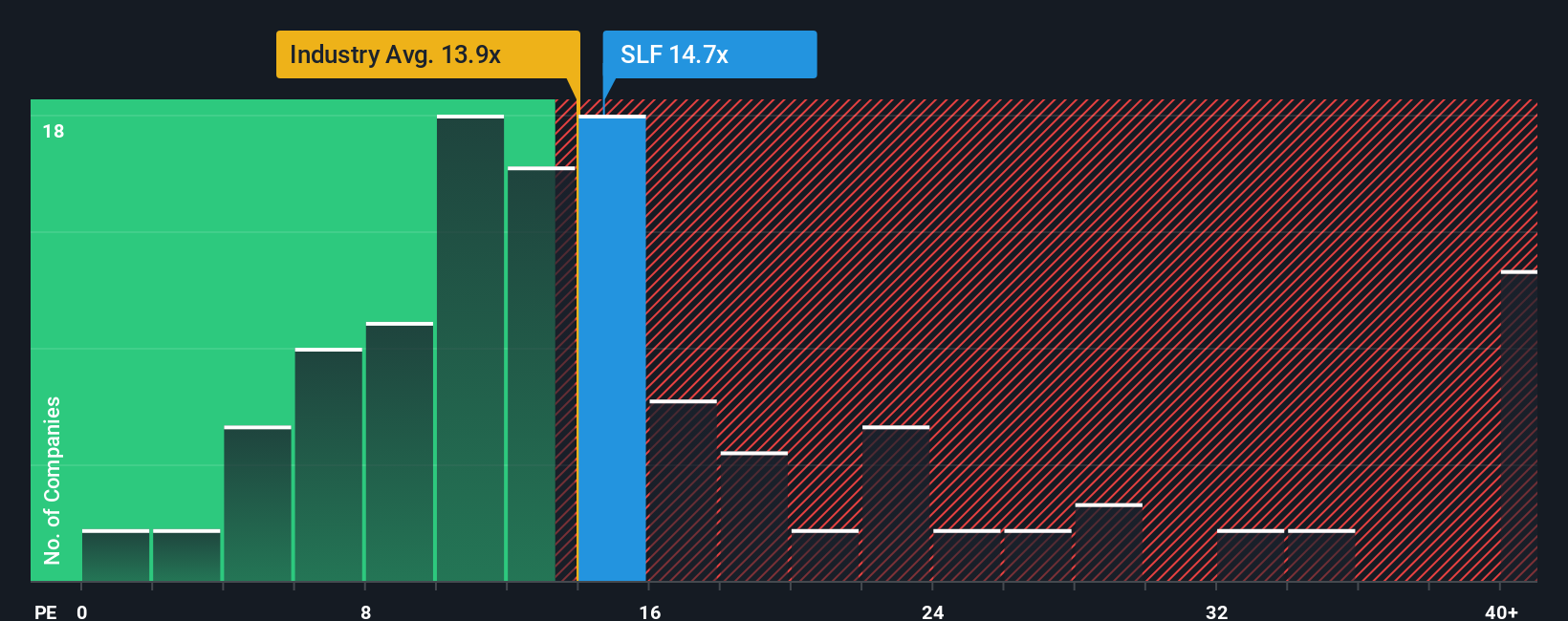

Our fair value work suggests upside, but the market’s go to yardstick tells a different story. Sun Life trades on a 15.3x price to earnings ratio, richer than both the North American insurance pack at 13.5x and its peer average of 15x, and above a fair ratio of 14.6x.

That premium hints investors are already paying up for quality and stability, leaving less room for error if growth or margins disappoint from here. Is this a solid franchise deserving a higher tag, or a name where expectations have quietly crept ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sun Life Financial Narrative

If this angle does not quite match your view, or you prefer digging into the numbers yourself, you can build a fresh take in minutes: Do it your way.

A great starting point for your Sun Life Financial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a fuller watchlist by using Simply Wall Street’s powerful screeners to uncover fresh, data backed opportunities beyond Sun Life.

- Capture price swings and early stage potential by scanning these 3605 penny stocks with strong financials that already show credible financial strength behind the volatility.

- Seek exposure to automation and analytics by focusing on these 25 AI penny stocks that are building businesses on top of transformative technology.

- Support your margin of safety by targeting these 904 undervalued stocks based on cash flows where current prices can be compared with long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026