How a CA$1 Billion Debt Offering at Sun Life Financial (TSX:SLF) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Earlier in September 2025, Sun Life Financial completed a CA$1 billion offering of Series 2025-1 Subordinated Unsecured Fixed/Floating Debentures due 2037, with proceeds directed toward general corporate purposes including potential acquisitions within its SLC Management affiliates.

- This significant fundraising move highlights Sun Life’s confidence in capitalizing on subsidiary investments and enhancing financial flexibility for future growth.

- We'll examine how Sun Life’s recent debt issuance supports its ongoing acquisition strategy and the company’s evolving investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Sun Life Financial Investment Narrative Recap

Owning Sun Life Financial stock is about believing in the company’s ability to grow through diversified insurance and asset management, especially its Asian markets and alternative investment platform, while managing ongoing US regulatory and operating risks. The recent CA$1 billion debt issuance could provide near-term flexibility to accelerate investments in its SLC Management affiliates, but does not materially alter the most important short-term catalyst: Sun Life’s ability to execute and integrate acquisitions, or the biggest risk centered on challenges in its US Dental and asset management businesses.

Among the latest developments, Sun Life’s Q2 2025 earnings showed steady momentum, with net income rising to CA$735 million compared to CA$666 million last year. This financial resilience supports the company’s capacity for future investments and helps underpin confidence as it deploys new capital raised through the recent bond issuance to reinforce its acquisition pipeline or shore up its balance sheet.

Yet, in contrast, investors should be aware of ongoing pressure from potential net outflows at MFS, which could...

Read the full narrative on Sun Life Financial (it's free!)

Sun Life Financial's narrative projects CA$49.3 billion revenue and CA$4.5 billion earnings by 2028. This requires 13.0% yearly revenue growth and a CA$1.3 billion earnings increase from CA$3.2 billion.

Uncover how Sun Life Financial's forecasts yield a CA$87.17 fair value, a 5% upside to its current price.

Exploring Other Perspectives

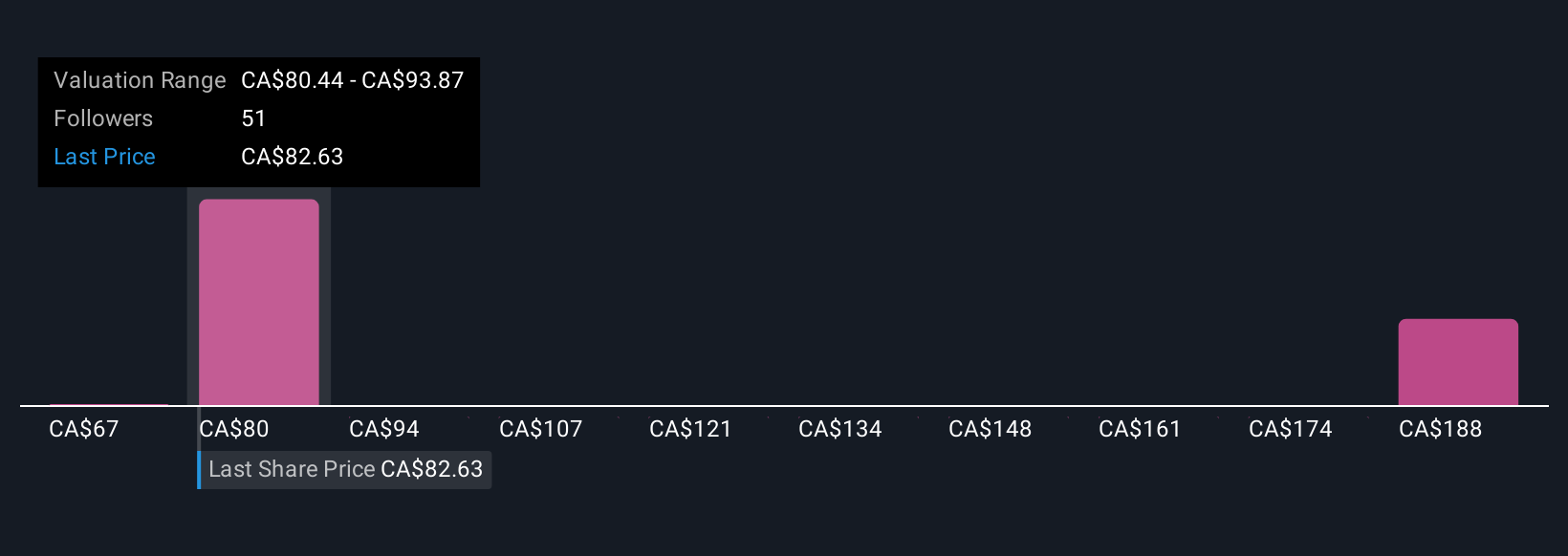

Simply Wall St Community members provided six fair value estimates on Sun Life Financial, spanning from CA$67 to CA$201, reflecting wide valuation differences. While several see upside potential, the company still faces the possibility of prolonged fee income pressure at MFS, keeping investor opinion sharply divided.

Explore 6 other fair value estimates on Sun Life Financial - why the stock might be worth over 2x more than the current price!

Build Your Own Sun Life Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sun Life Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Sun Life Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sun Life Financial's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives