Does Sun Life Offer Value After a 16% Rally and Quarterly Earnings Beat?

Reviewed by Bailey Pemberton

If you've been weighing your next move with Sun Life Financial, you're not alone. The stock has caught quite a bit of attention lately, not just from long-term holders but also from those curious about growth stories in the financial sector. Over the past week, Sun Life Financial climbed 1.1%, and in the last month it notched an impressive 6.3% gain. Year to date, the price is up 2.9%, comfortably outpacing some peers. But it's the longer-term strength that really stands out: 16.2% over the past year, and almost doubling over five years with a 96.8% return.

While global markets have been a bit choppy, investors are leaning into financial services stocks like Sun Life as they look for steady, defensive plays. That growing interest may partly explain the recent uplift in share price, suggesting more confidence in the company's outlook and risk profile. At its last close, the stock settled at $87.38, making some wonder if they've missed their window or if there's more upside to be had.

When it comes to valuation, there's no one-size-fits-all answer, but here's a concrete stat to consider: Sun Life Financial scores a 3 using our value checks, indicating undervaluation in half of the six key criteria we track. In the next section, we'll break down exactly what goes into that score using classic valuation methods. And after that, I'll share what I believe is the most insightful approach to truly understanding where Sun Life stands today.

Why Sun Life Financial is lagging behind its peers

Approach 1: Sun Life Financial Excess Returns Analysis

The Excess Returns valuation model focuses on how effectively a company deploys shareholder capital to generate profits above the cost of equity. It quantifies the extra value created by investing in the business, not just its ability to earn money but to do so more efficiently than simply parking cash elsewhere.

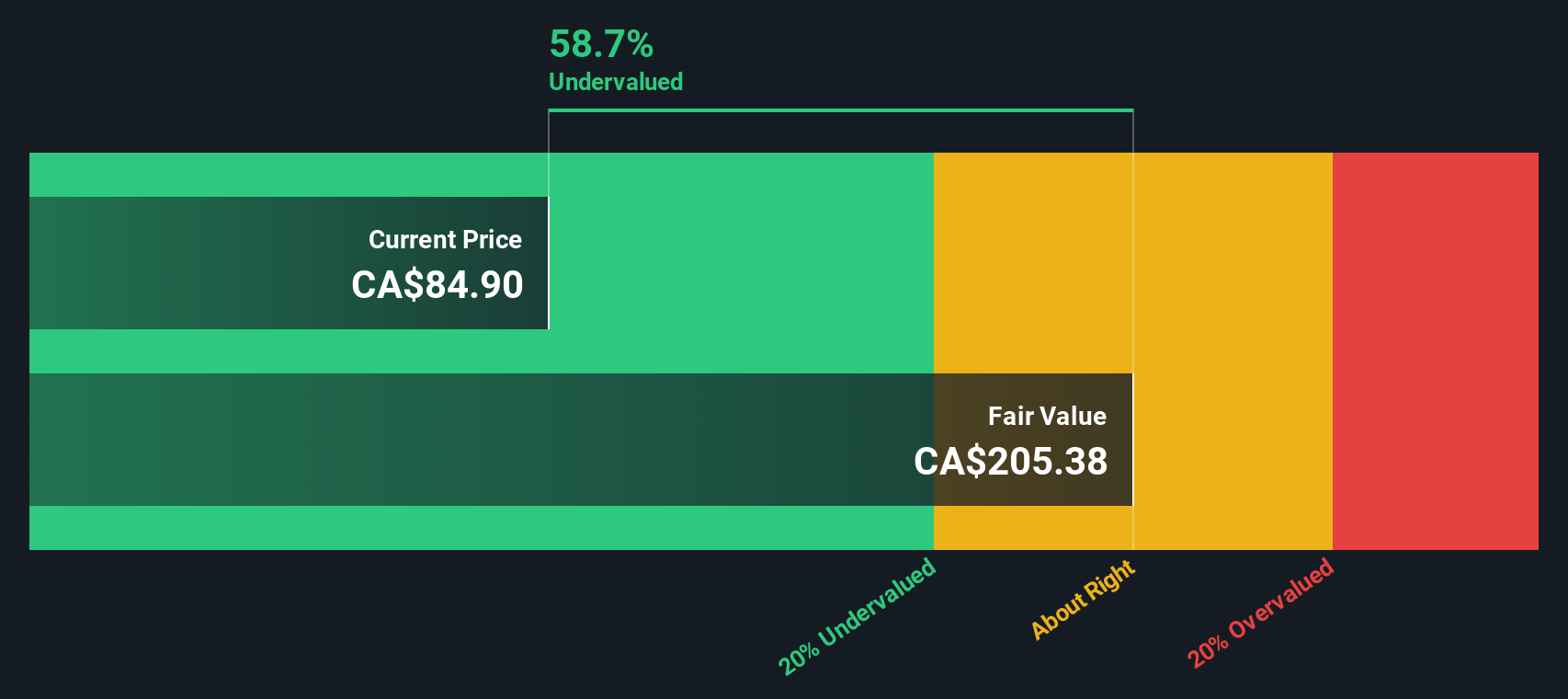

For Sun Life Financial, the numbers present a compelling picture. The company’s current Book Value stands at CA$40.63 per share, while analysts estimate its stable future Book Value at CA$43.58 per share, based on insights from seven analysts. Its stable earnings per share (EPS) is projected at CA$8.04, with these projections supported by return on equity forecasts from six analysts. The Cost of Equity stands at CA$2.60 per share, meaning Sun Life generates an excess return of CA$5.44 per share. With an average Return on Equity (ROE) of 18.45%, Sun Life Financial demonstrates a consistent track record of value creation.

When these metrics are combined, the Excess Returns model calculates an intrinsic value of CA$205.13 per share. At the current price of CA$87.38, the stock appears to be trading at a substantial discount of 57.4% to its intrinsic value. This suggests significant upside potential if these excess returns persist.

Result: UNDERVALUED

Our Excess Returns analysis suggests Sun Life Financial is undervalued by 57.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sun Life Financial Price vs Earnings

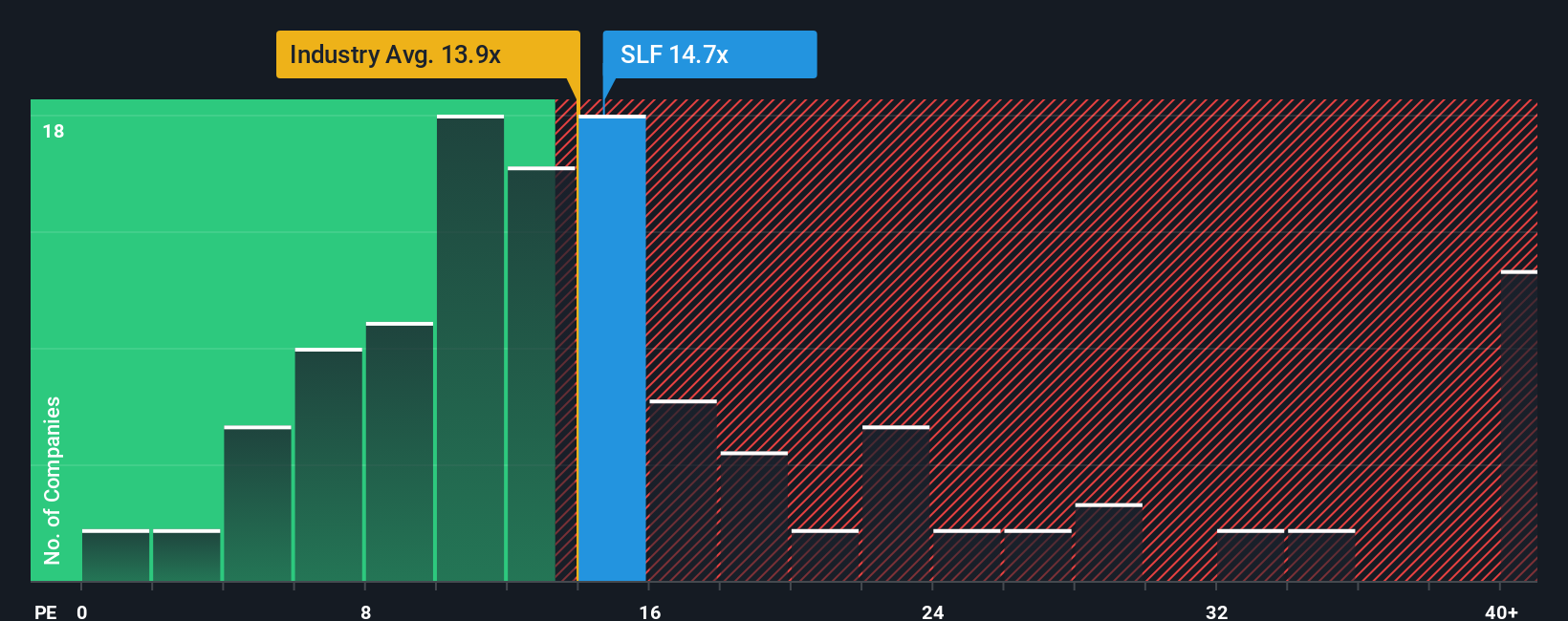

The Price-to-Earnings (PE) ratio remains one of the most informative metrics for valuing profitable companies, especially stable insurers like Sun Life Financial. This ratio captures how much investors are willing to pay for each dollar of earnings. As a result, it directly reflects earnings expectations, risk tolerance, and confidence in future growth. Generally, higher growth and lower risk can justify higher PE multiples, while slowing growth or increased risk often leads investors to prefer a lower PE.

Currently, Sun Life Financial trades at a PE ratio of 15.1x, which is slightly above both the Insurance industry average of 12.27x and the peer group average of 14.32x. This premium suggests the market is expecting above-average performance or stability from Sun Life compared to its peers. Rather than just comparing to these broad benchmarks, it is also valuable to look at the proprietary “Fair Ratio” calculated by Simply Wall St. This ratio incorporates growth outlook, profitability, risk profile, size, and sector-specific trends into a single, more personalized number. For Sun Life, the Fair Ratio stands at 15.40x, a level reflecting its unique strengths and long-term prospects.

Since Sun Life’s actual PE is only slightly below its Fair Ratio (by less than 0.10x), this suggests the market has priced the stock about where it should be based on its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sun Life Financial Narrative

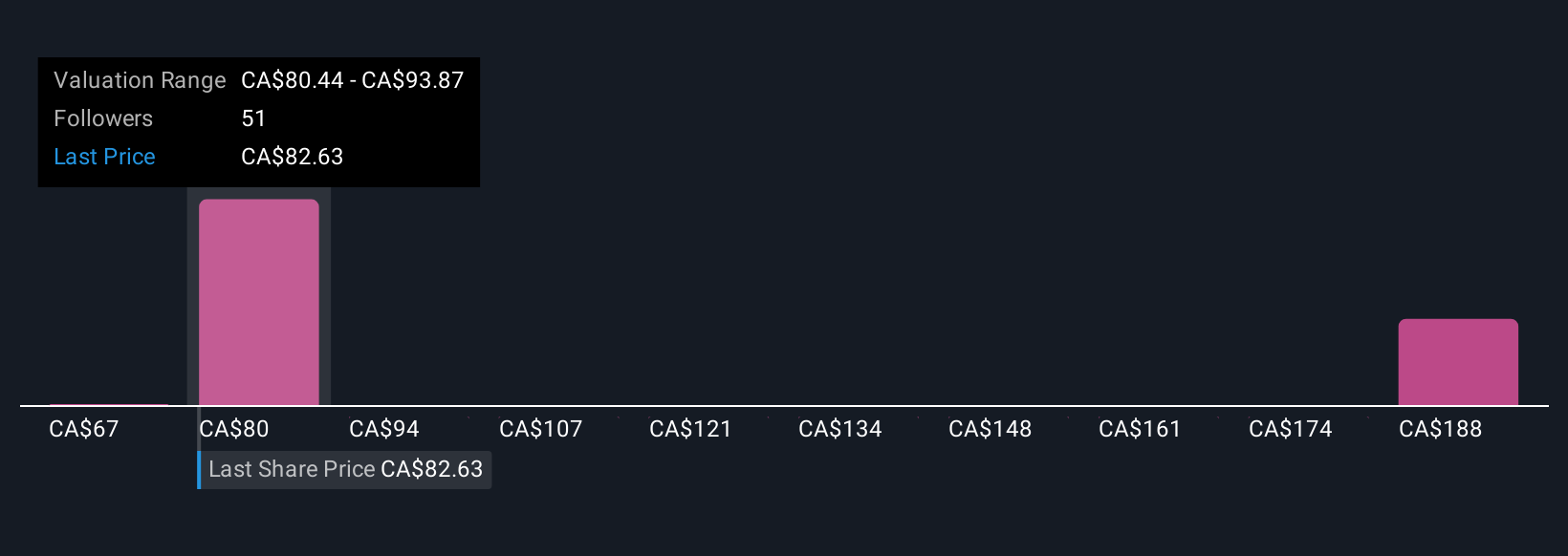

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative goes beyond numbers by combining your perspective on Sun Life Financial’s business, including what you believe about its strategy, markets, and risks, with your financial assumptions such as revenue growth, profit margins, and fair value estimates. This story-driven approach links what you know about a company to a concrete financial forecast and then connects that to an actionable fair value.

On Simply Wall St’s Community page, Narratives are an easy and accessible tool available to every investor. They allow millions to map out their view, compare with others, and watch how consensus shifts as new information comes in. Narratives can help you decide when to buy or sell. If your Narrative’s fair value is above today’s price, it could be a buying signal; if it is below, you might reconsider. Updates are dynamic, so if, for example, Sun Life posts a surprise earnings report or a fresh risk emerges, the Narrative and its fair value adjust straight away.

To illustrate, one Sun Life investor might expect long-term digital growth and Asian market expansion, setting a bullish Narrative with a fair value above $95. Meanwhile, a more cautious peer might worry about U.S. dental headwinds and regulatory risks, resulting in a conservative Narrative closer to $74. Narratives let you capture your own view and see how it stacks up in real time, making smarter decisions easier than ever.

Do you think there's more to the story for Sun Life Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives