As Canadian markets navigate the complexities of rising tariffs and trade negotiations, investors remain cautiously optimistic amid resilient economic data and stable inflation rates. In this environment, dividend stocks on the TSX can offer a reliable income stream and potential stability, making them an attractive option for those looking to weather market volatility.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.14% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 3.84% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.42% | ★★★★★☆ |

| Quebecor (TSX:QBR.A) | 3.30% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.43% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.26% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 4.85% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.85% | ★★★★★☆ |

| Atrium Mortgage Investment (TSX:AI) | 9.23% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.35% | ★★★★★☆ |

Click here to see the full list of 25 stocks from our Top TSX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce is a diversified financial institution offering a range of financial products and services to personal, business, public sector, and institutional clients across Canada, the United States, and internationally with a market cap of CA$94.32 billion.

Operations: Canadian Imperial Bank of Commerce generates revenue from several segments, including Canadian Personal and Business Banking (CA$9.29 billion), Capital Markets (CA$6.21 billion), Canadian Commercial Banking and Wealth Management (CA$6.02 billion), and U.S. Commercial Banking and Wealth Management (CA$2.74 billion).

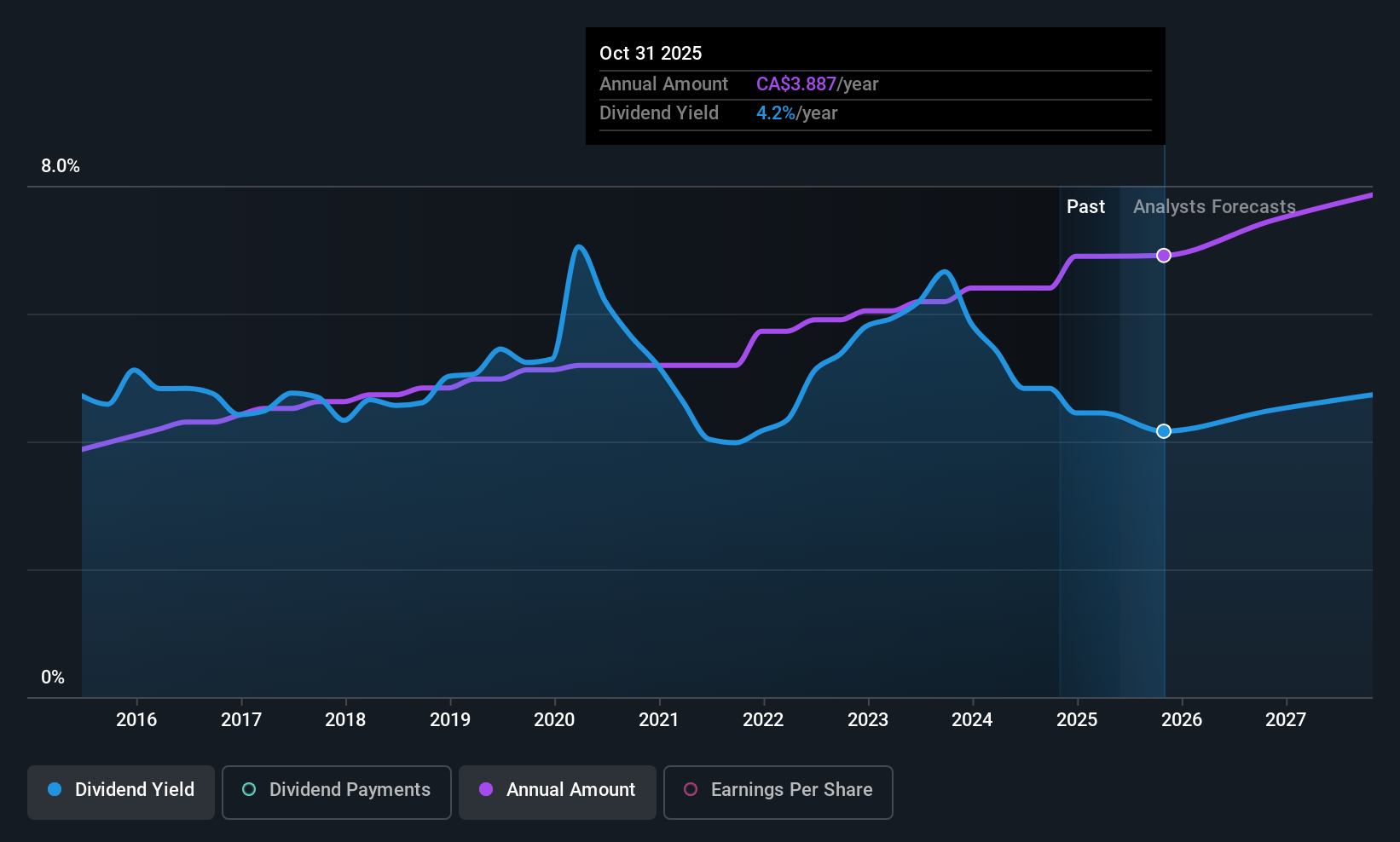

Dividend Yield: 3.9%

Canadian Imperial Bank of Commerce's dividends are well-covered by earnings with a payout ratio near 46.9%, and are expected to remain covered over the next three years, reflecting sustainability. Despite a relatively low dividend yield of 3.85% compared to top Canadian payers, its dividends have been stable and growing over the past decade. Recent fixed-income offerings, including $95 million in notes due in 2027, indicate ongoing strategic financial maneuvers supporting capital management.

- Click to explore a detailed breakdown of our findings in Canadian Imperial Bank of Commerce's dividend report.

- Our valuation report unveils the possibility Canadian Imperial Bank of Commerce's shares may be trading at a discount.

Power Corporation of Canada (TSX:POW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada is an international management and holding company offering financial services across North America, Europe, and Asia with a market cap of approximately CA$35.08 billion.

Operations: Power Corporation of Canada's revenue is primarily derived from its Lifeco segment at CA$31.02 billion, followed by IGM at CA$3.56 billion, and Alternative Asset Investment Platforms at CA$2.39 billion.

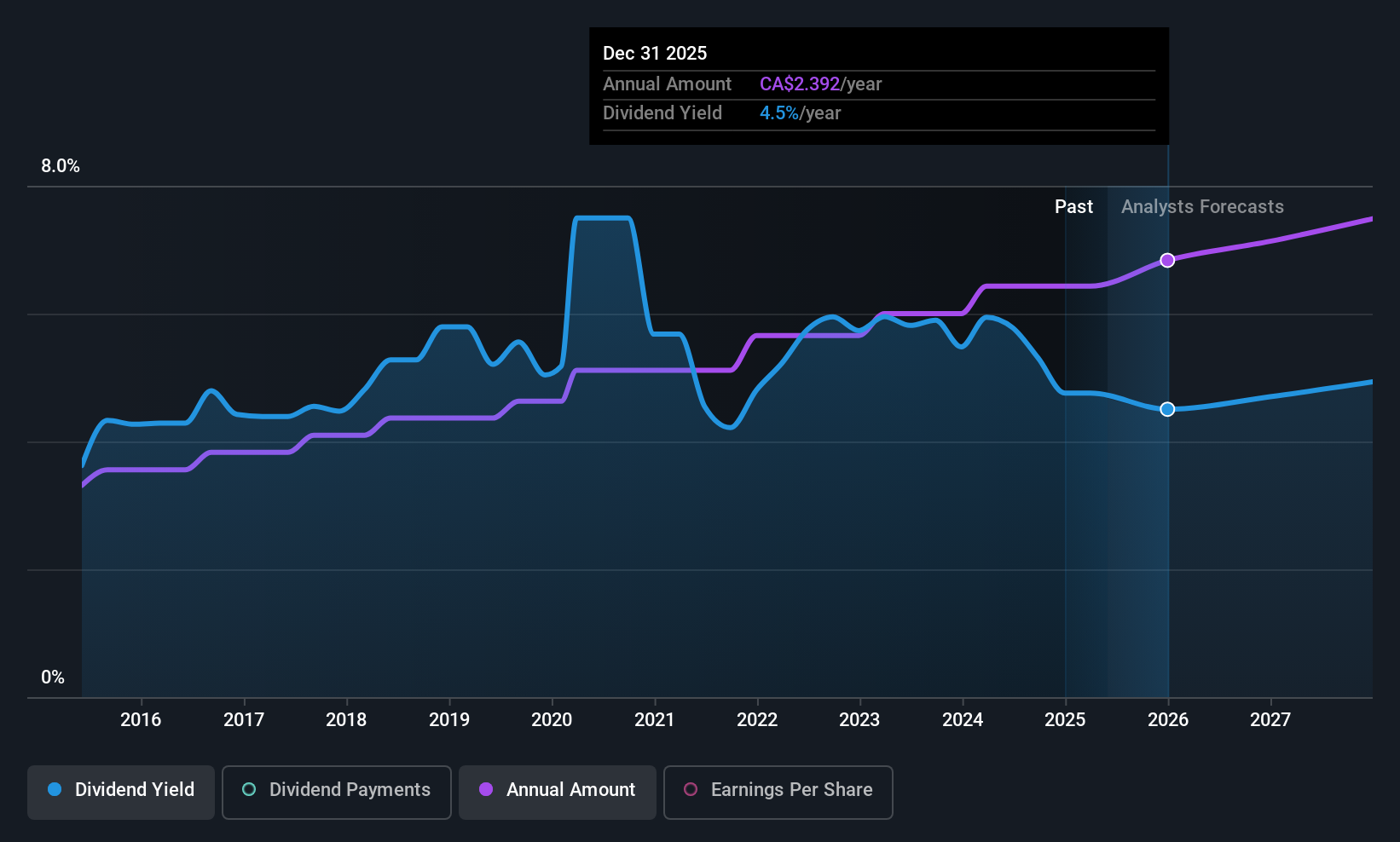

Dividend Yield: 4.4%

Power Corporation of Canada maintains a reliable dividend history, with recent affirmations of CAD 0.6125 per share for August 2025. The dividends are well-covered by earnings and cash flows, boasting payout ratios of 53.4% and 35.2%, respectively. Despite trading below its estimated fair value, the dividend yield of 4.43% is modest compared to top Canadian payers but has shown stability and growth over the past decade, supported by strategic buybacks totaling CAD 68 million recently completed.

- Unlock comprehensive insights into our analysis of Power Corporation of Canada stock in this dividend report.

- Our valuation report here indicates Power Corporation of Canada may be undervalued.

Rogers Sugar (TSX:RSI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rogers Sugar Inc. is involved in refining, packaging, marketing, and distributing sugar and maple products across Canada, the United States, Europe, and internationally with a market cap of CA$731.53 million.

Operations: Rogers Sugar Inc.'s revenue is primarily derived from its Sugar segment, contributing CA$1.04 billion, and its Maple Products segment, which adds CA$248.86 million.

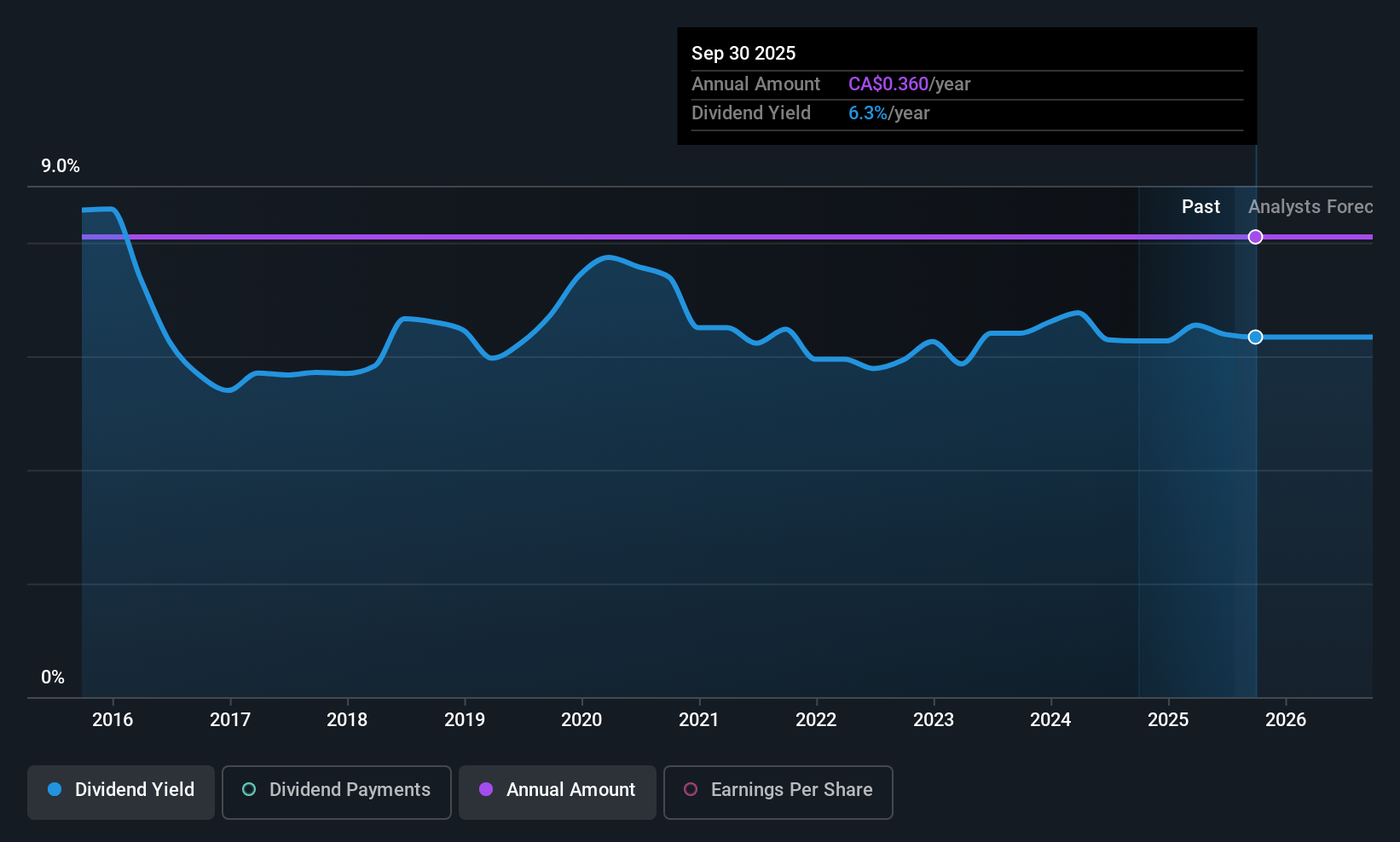

Dividend Yield: 6.3%

Rogers Sugar Inc. offers a high dividend yield of 6.32%, ranking in the top 25% of Canadian payers, though it faces challenges with sustainability due to lack of free cash flow coverage and unreliable growth over the past decade. Recent earnings improvements, with net income rising to CAD 20.54 million for Q2 2025, support dividend payments despite limited cash flow coverage. The company also secured a five-year sugar beet supply agreement, reinforcing its production capabilities in Canada.

- Click here and access our complete dividend analysis report to understand the dynamics of Rogers Sugar.

- Our expertly prepared valuation report Rogers Sugar implies its share price may be lower than expected.

Summing It All Up

- Gain an insight into the universe of 25 Top TSX Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:POW

Power Corporation of Canada

An international management and holding company, provides financial services in North America, Europe, and Asia.

Undervalued established dividend payer.

Market Insights

Community Narratives