Amidst a backdrop of cautious interest rate cuts by the Bank of Canada and a pause from the Federal Reserve, Canadian consumers are exhibiting signs of fatigue even as they continue to drive economic growth. With inflation showing signs of moderation and stock markets reaching new heights, this environment underscores the potential stability that high-yielding dividend stocks can offer, particularly in times when diversification remains a key strategy for managing risk.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.79% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.22% | ★★★★★★ |

| Enghouse Systems (TSX:ENGH) | 3.46% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.54% | ★★★★★☆ |

| Secure Energy Services (TSX:SES) | 3.33% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.91% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.49% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.30% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.23% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 9.13% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bank of Nova Scotia (TSX:BNS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: The Bank of Nova Scotia, operating internationally with a focus on the Americas, offers a wide range of banking products and services, boasting a market capitalization of CA$76.64 billion.

Operations: The Bank of Nova Scotia generates revenue through its Canadian Banking segment at CA$11.46 billion, International Banking at CA$9.60 billion, Global Wealth Management at CA$5.43 billion, and Global Banking and Markets at CA$5.35 billion.

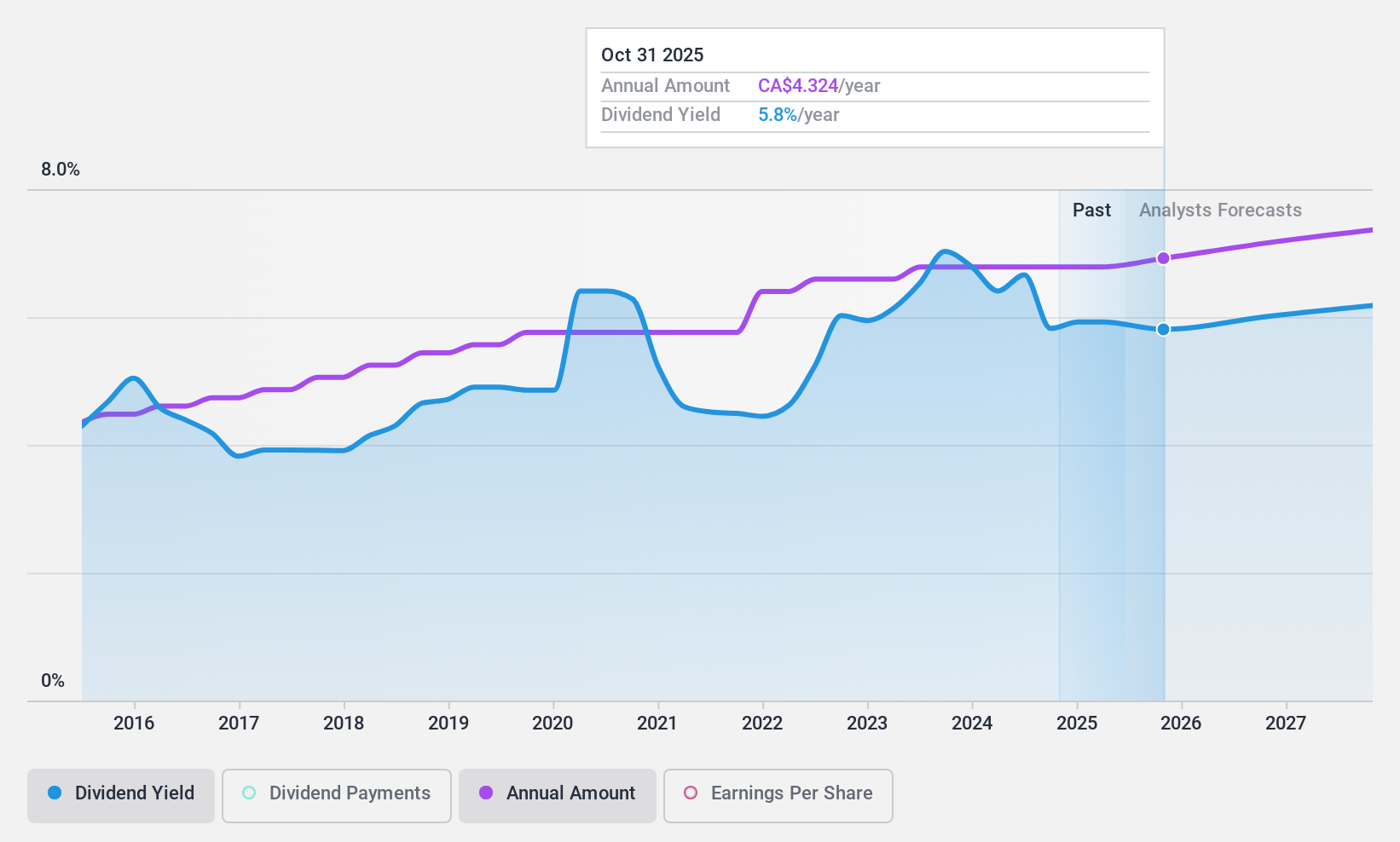

Dividend Yield: 6.8%

Bank of Nova Scotia's dividend yield stands at a competitive 6.79%, placing it in the top 25% of Canadian dividend payers. The bank has demonstrated a consistent ability to cover its dividends, with a current payout ratio of 69.7% and an anticipated coverage from earnings in three years at a 61.3% payout ratio. Despite some shareholder dilution over the past year, the dividends per share have been stable for the last decade, underscoring reliability for income-focused investors. Recent strategic fixed-income offerings suggest active capital management, enhancing its financial flexibility while maintaining commitment to shareholder returns.

- Click here to discover the nuances of Bank of Nova Scotia with our detailed analytical dividend report.

- According our valuation report, there's an indication that Bank of Nova Scotia's share price might be on the cheaper side.

PHX Energy Services (TSX:PHX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PHX Energy Services Corp. offers horizontal and directional drilling services, along with renting and selling performance drilling motors and equipment to oil and natural gas companies in Canada, the U.S., Albania, the Middle East, and globally, with a market capitalization of approximately CA$435.37 million.

Operations: PHX Energy Services Corp. generates CA$656.44 million primarily from its horizontal oil and natural gas well drilling services.

Dividend Yield: 8.6%

PHX Energy Services offers a high dividend yield of 8.62%, ranking it among the top 25% in Canada, though its sustainability is questionable with a cash payout ratio of 138.3%. While earnings grew by 35.6% last year, forecasts predict a decline averaging 4.3% annually over the next three years. Dividends have increased over the past decade but have shown volatility and unreliable patterns in payouts. Recent actions include affirming quarterly dividends and completing significant share buybacks totaling CAD 11.3 million, enhancing shareholder value despite mixed financial performance indicators.

- Unlock comprehensive insights into our analysis of PHX Energy Services stock in this dividend report.

- In light of our recent valuation report, it seems possible that PHX Energy Services is trading behind its estimated value.

Power Corporation of Canada (TSX:POW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada, an international management and holding company, operates in the financial services sector across North America, Europe, and Asia with a market capitalization of CA$24.95 billion.

Operations: Power Corporation of Canada generates revenue primarily through its Lifeco segment at CA$23.51 billion, Power Financial - IGM at CA$3.67 billion, and Alternative Asset Investment Platforms and Other at CA$1.59 billion.

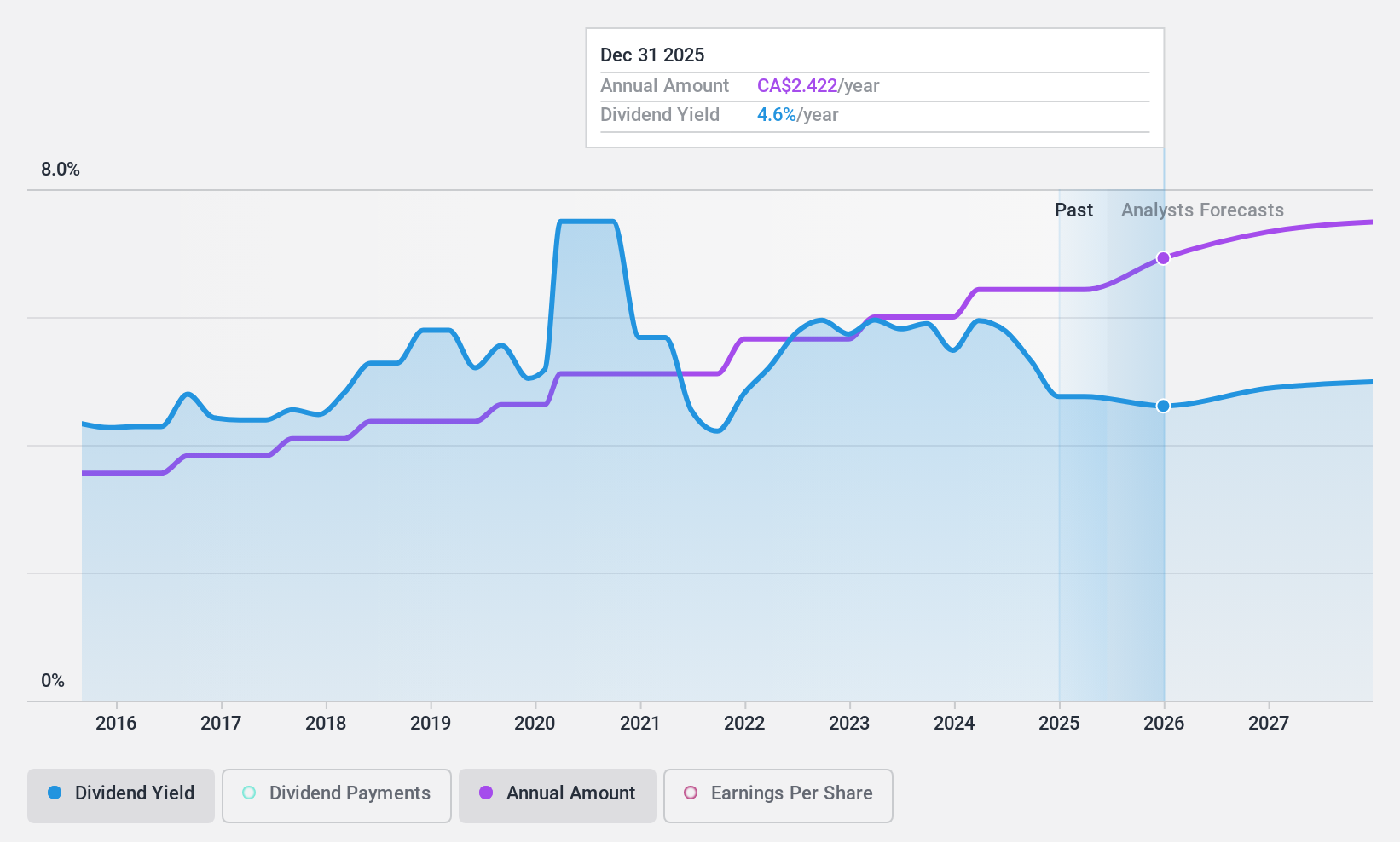

Dividend Yield: 5.8%

Power Corporation of Canada maintains a stable dividend, with a 5.82% yield, lower than the top Canadian dividend payers. Dividends are well-supported by earnings and cash flows, with payout ratios at 49.9% and 28.4%, respectively. Recent significant earnings growth (63.1% year-over-year) and conservative payout ratios suggest sustainability despite its yield being below the market's top quartile for dividends. Recent shareholder proposals focusing on ESG and compensation were not approved, indicating stable current management practices without major shifts expected soon.

- Navigate through the intricacies of Power Corporation of Canada with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Power Corporation of Canada is priced lower than what may be justified by its financials.

Where To Now?

- Investigate our full lineup of 33 Top TSX Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nova Scotia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BNS

Bank of Nova Scotia

Provides various banking products and services in Canada, the United States, Mexico, Peru, Chile, Colombia, the Caribbean and Central America, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives