Manulife Financial (TSX:MFC): Valuation Check After Strong Q3 2025 Earnings Beat and AM Best Rating Reaffirmation

Reviewed by Simply Wall St

Manulife Financial (TSX:MFC) just posted stronger than expected third quarter 2025 core earnings, powered by double digit growth in Asia, and then received a vote of confidence as AM Best reaffirmed its superior credit ratings.

See our latest analysis for Manulife Financial.

Those solid results and the AM Best reaffirmation help explain why the share price has climbed to $49.44, with a strong 90 day share price return of 15.76% and an impressive 5 year total shareholder return of 183.87%. This suggests momentum is still building rather than fading.

If Manulife’s trajectory has you thinking about where else capital is quietly compounding, this is a good moment to explore stable growth stocks screener (None results).

Yet with the stock hovering just below analyst targets, but still trading at a steep discount to some intrinsic value estimates, is Manulife quietly undervalued here, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 4.8% Undervalued

With Manulife closing at CA$49.44 against a narrative fair value of roughly CA$51.94, the storyline leans toward modest upside still on the table.

The acquisition of Comvest Credit Partners meaningfully scales Manulife's private markets platform and introduces high-growth, fee-based private credit capabilities. By leveraging Manulife's global distribution, especially into Asia's fast-growing wealth pools, this is expected to drive a higher mix of stable, capital-light fee income, which may improve net margins and support core EPS and ROE growth.

Curious how steady fee income, shifting margins and a future earnings multiple come together to justify that valuation gap? The full narrative unpacks the precise growth math.

Result: Fair Value of $51.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained earnings momentum could be challenged if Asian growth slows or if credit losses in below-investment-grade loans and legacy real estate worsen.

Find out about the key risks to this Manulife Financial narrative.

Another View: Market Multiples Paint a Tighter Picture

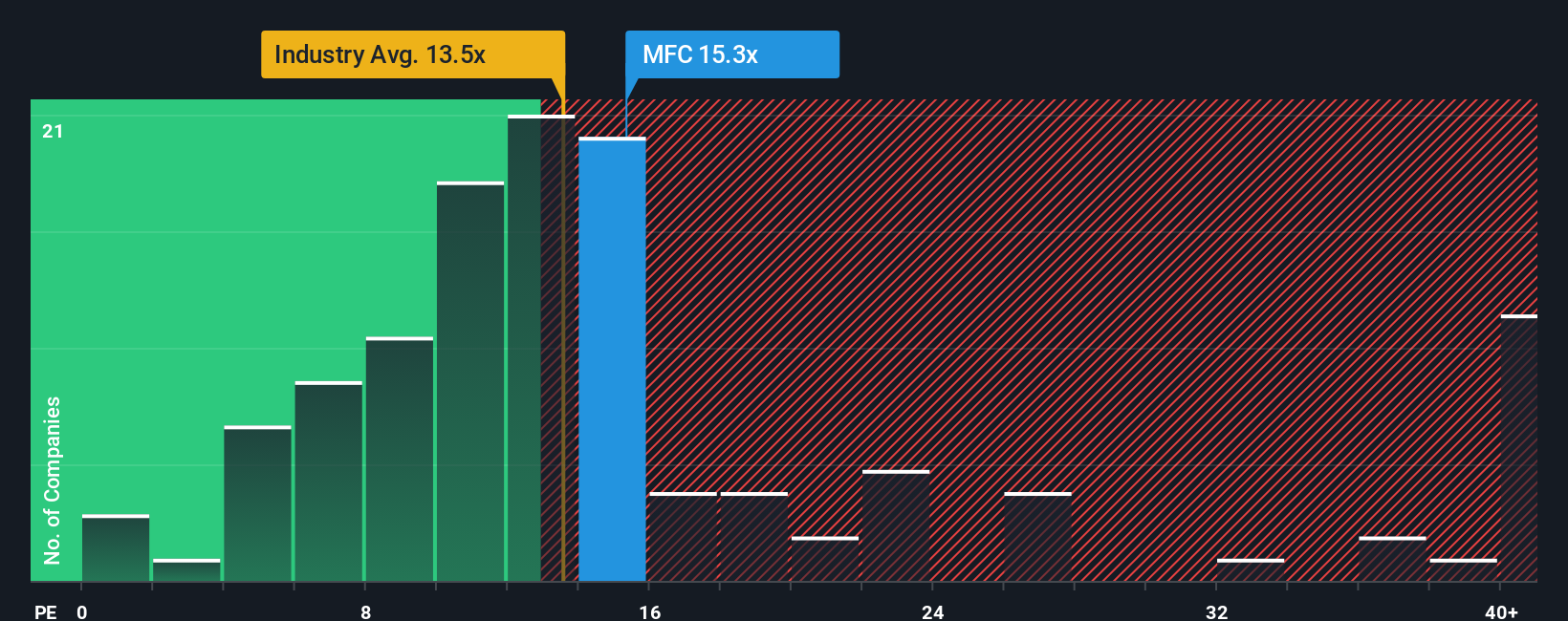

On a simple price to earnings basis, Manulife looks less generous. The stock trades around 15.4 times earnings, slightly richer than both North American insurance peers at 13.5 times and its own 16 times fair ratio, which hints more at valuation risk than a clear bargain.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Manulife Financial Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a custom view in just minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Manulife Financial.

Looking for more investment ideas?

Before you move on, consider your next move with a few focused screens that surface opportunities most investors overlook but you can act on today.

- Explore potential compounding by scanning these 915 undervalued stocks based on cash flows that trade below their estimated cash flow value yet still show solid business momentum.

- Consider positioning in the next tech wave by targeting these 25 AI penny stocks that may benefit from advances in artificial intelligence.

- Review income-focused ideas by zeroing in on these 13 dividend stocks with yields > 3% that combine meaningful yield with sustainable payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MFC

Manulife Financial

Provides financial products and services in the United States, Canada, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)