Does iA Financial’s (TSX:IAG) EVO Platform Push Reveal a Shift in Digital Strategy?

Reviewed by Sasha Jovanovic

- iA Financial Group recently announced the launch of the web version of its EVO Insurance platform, providing more than 30,000 financial security advisors nationwide with easier and faster digital access for submitting personalized insurance applications from any device.

- This expanded platform adoption highlights iA’s ongoing commitment to technological innovation and reflects its central role in Canada’s evolving digital insurance landscape.

- We’ll explore how the EVO platform’s enhanced digital efficiencies could shape iA Financial’s investment narrative moving forward.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is iA Financial's Investment Narrative?

To see iA Financial as a compelling investment, you have to appreciate the bigger story behind its steady profit growth, expanding dividend, and proactive capital allocation through buybacks. The newly launched web version of the EVO Insurance platform could represent more than just a tech upgrade; it might accelerate advisor productivity, enhance customer experience, and help sustain margin improvements. While the impact of this upgrade on iA’s immediate financials is uncertain, given recent gains and already robust returns, it signals potential for near-term differentiation as digital ease increasingly shapes insurance markets. At the same time, with shares trading close to consensus price targets and with earnings growth forecasts modest compared to the broader Canadian market, investor focus is likely to remain on execution risks and the company's ability to translate digital advances into sustainable growth. Also, evolving competition and a relatively low return on equity remain on the watchlist as investors weigh near-term catalysts against long-standing sector pressures.

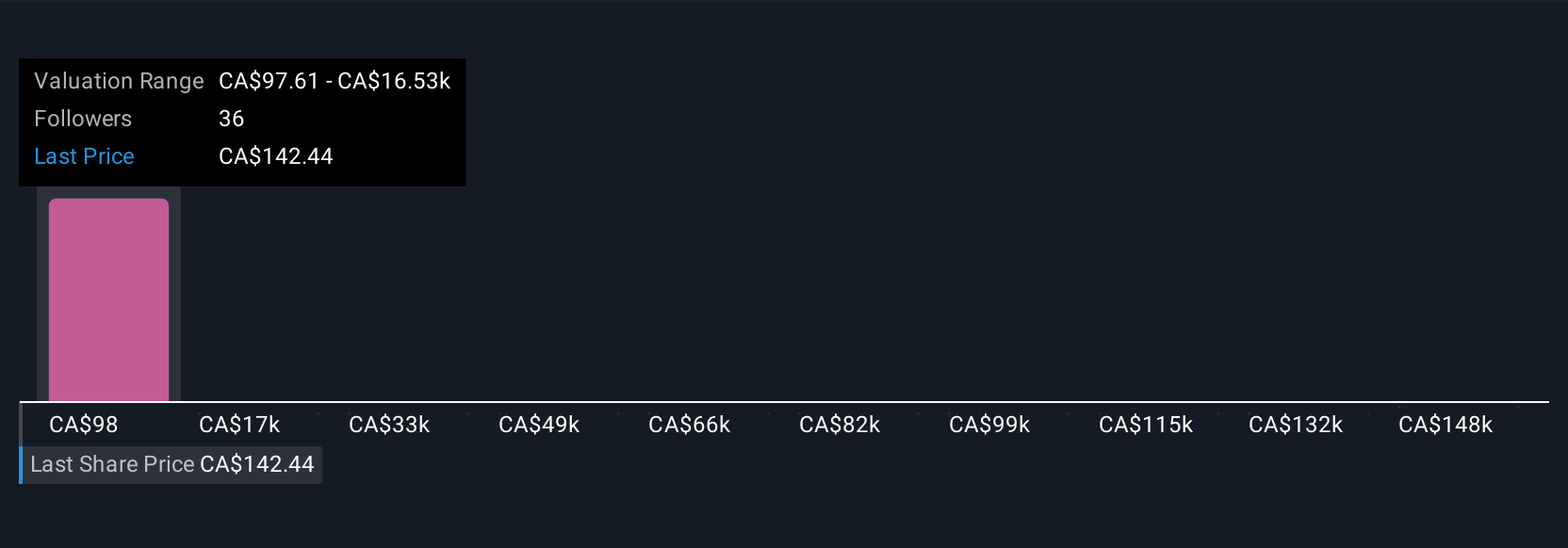

But will digital upgrades offset sector-wide pressure on return on equity going forward? Despite retreating, iA Financial's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 6 other fair value estimates on iA Financial - why the stock might be worth over 2x more than the current price!

Build Your Own iA Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your iA Financial research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free iA Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate iA Financial's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iA Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IAG

iA Financial

Provides insurance and wealth management services for individual and group basis in Canada and the United States.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives