- Canada

- /

- Personal Products

- /

- TSX:MAV

These 4 Measures Indicate That MAV Beauty Brands (TSE:MAV) Is Using Debt In A Risky Way

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that MAV Beauty Brands Inc. (TSE:MAV) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for MAV Beauty Brands

How Much Debt Does MAV Beauty Brands Carry?

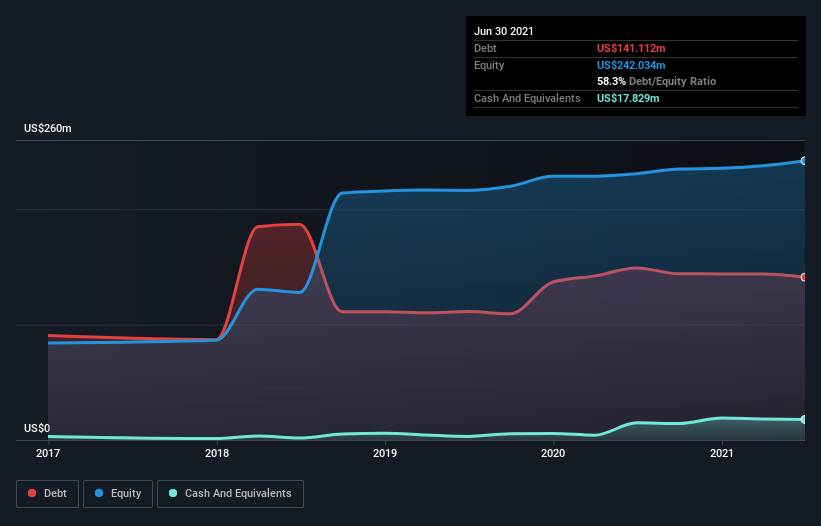

As you can see below, MAV Beauty Brands had US$141.1m of debt at June 2021, down from US$149.1m a year prior. On the flip side, it has US$17.8m in cash leading to net debt of about US$123.3m.

A Look At MAV Beauty Brands' Liabilities

Zooming in on the latest balance sheet data, we can see that MAV Beauty Brands had liabilities of US$20.7m due within 12 months and liabilities of US$161.7m due beyond that. Offsetting these obligations, it had cash of US$17.8m as well as receivables valued at US$20.8m due within 12 months. So it has liabilities totalling US$143.8m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the US$72.1m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, MAV Beauty Brands would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

With a net debt to EBITDA ratio of 5.8, it's fair to say MAV Beauty Brands does have a significant amount of debt. However, its interest coverage of 2.9 is reasonably strong, which is a good sign. Even worse, MAV Beauty Brands saw its EBIT tank 37% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine MAV Beauty Brands's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, MAV Beauty Brands recorded free cash flow of 34% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

On the face of it, MAV Beauty Brands's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability to convert EBIT to free cash flow isn't such a worry. After considering the datapoints discussed, we think MAV Beauty Brands has too much debt. That sort of riskiness is ok for some, but it certainly doesn't float our boat. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 4 warning signs with MAV Beauty Brands (at least 1 which is potentially serious) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:MAV

Old MAV Wind-Down

Old MAV Wind-Down Ltd. operates as a personal care company worldwide.

Good value with imperfect balance sheet.