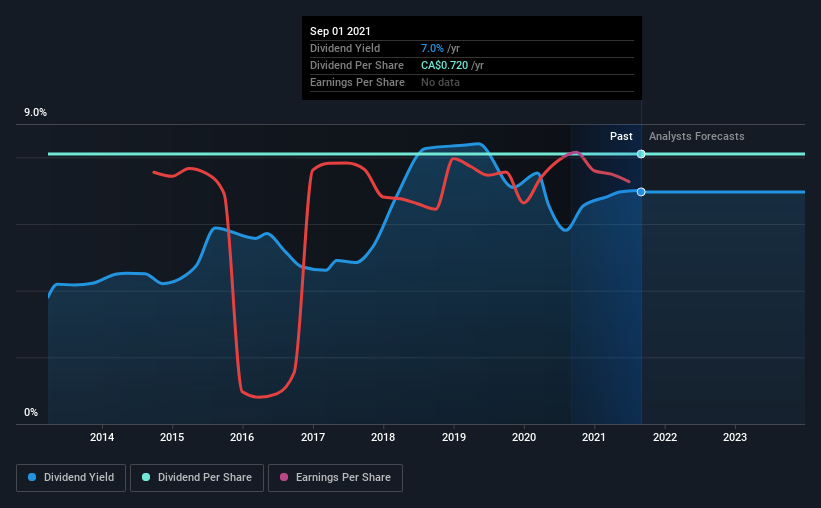

The board of KP Tissue Inc. (TSE:KPT) has announced that it will pay a dividend on the 15th of October, with investors receiving CA$0.18 per share. This makes the dividend yield 7.0%, which will augment investor returns quite nicely.

See our latest analysis for KP Tissue

KP Tissue Might Find It Hard To Continue The Dividend

A big dividend yield for a few years doesn't mean much if it can't be sustained. Even though KP Tissue isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

If the trend of the last few years continues, EPS will grow by 53.4% over the next 12 months. The company seems to be going down the right path, but it will probably take a little bit longer than a year to cross over into profitability. Unfortunately, for the dividend to continue at current levels the company definitely needs to get there sooner rather than later.

KP Tissue Is Still Building Its Track Record

KP Tissue's dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. The payments haven't really changed that much since 8 years ago. KP Tissue hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

The Company Could Face Some Challenges Growing The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. KP Tissue has impressed us by growing EPS at 53% per year over the past five years. The company hasn't been turning a profit, but it running in the right direction. If this trajectory continues and the company can turn a profit soon, it could bode well for the dividend going forward.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We would be a touch cautious of relying on this stock primarily for the dividend income.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, KP Tissue has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about. We have also put together a list of global stocks with a solid dividend.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if KP Tissue might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:KPT

KP Tissue

Through its interest in Kruger Products Inc., produces, distributes, markets, and sells a range of disposable tissue products in Canada and the United States.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives