- Canada

- /

- Medical Equipment

- /

- TSXV:SQD.H

Health Check: How Prudently Does SQI Diagnostics (CVE:SQD) Use Debt?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies SQI Diagnostics Inc. (CVE:SQD) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for SQI Diagnostics

What Is SQI Diagnostics's Net Debt?

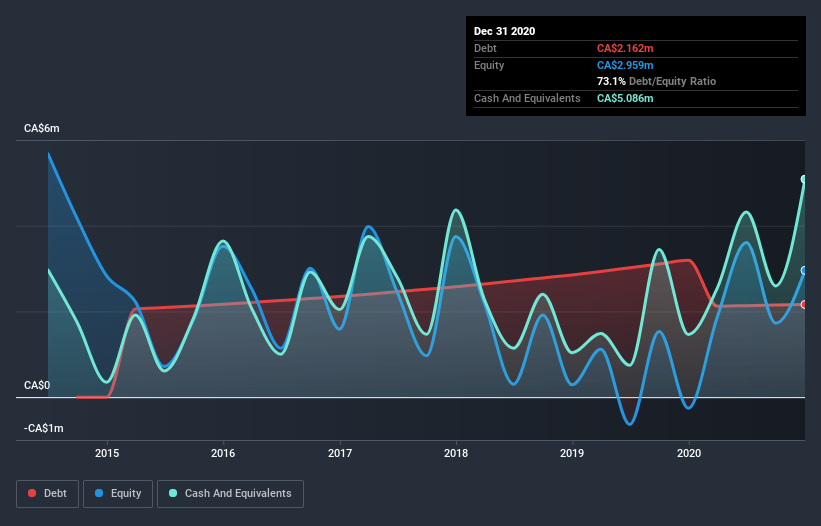

You can click the graphic below for the historical numbers, but it shows that SQI Diagnostics had CA$2.16m of debt in December 2020, down from CA$3.20m, one year before. But on the other hand it also has CA$5.09m in cash, leading to a CA$2.92m net cash position.

A Look At SQI Diagnostics' Liabilities

We can see from the most recent balance sheet that SQI Diagnostics had liabilities of CA$2.27m falling due within a year, and liabilities of CA$4.83m due beyond that. Offsetting this, it had CA$5.09m in cash and CA$138.0k in receivables that were due within 12 months. So it has liabilities totalling CA$1.87m more than its cash and near-term receivables, combined.

Having regard to SQI Diagnostics' size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the CA$126.8m company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, SQI Diagnostics also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since SQI Diagnostics will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, SQI Diagnostics made a loss at the EBIT level, and saw its revenue drop to CA$977k, which is a fall of 46%. To be frank that doesn't bode well.

So How Risky Is SQI Diagnostics?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that SQI Diagnostics had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of CA$6.6m and booked a CA$10m accounting loss. With only CA$2.92m on the balance sheet, it would appear that its going to need to raise capital again soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 6 warning signs for SQI Diagnostics (3 don't sit too well with us) you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade SQI Diagnostics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:SQD.H

SQI Diagnostics

A precision medicine company, discovers, develops, and commercializes rapid diagnostic testing services for healthcare providers, patients, and consumers worldwide.

Medium-low and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion