- Canada

- /

- Healthcare Services

- /

- TSXV:PHA

Investors Aren't Entirely Convinced By Premier Health of America Inc.'s (CVE:PHA) Revenues

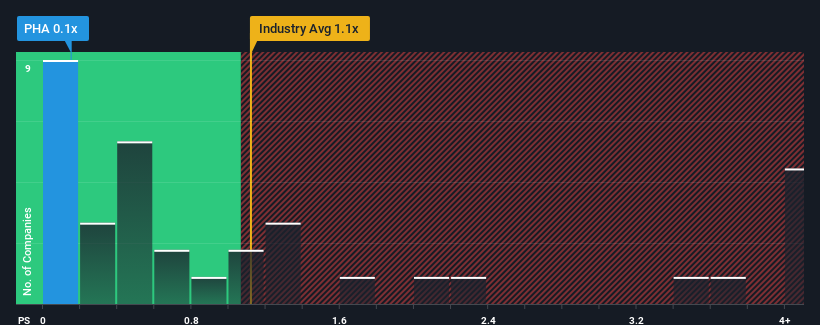

With a price-to-sales (or "P/S") ratio of 0.1x Premier Health of America Inc. (CVE:PHA) may be sending bullish signals at the moment, given that almost half of all the Healthcare companies in Canada have P/S ratios greater than 0.9x and even P/S higher than 3x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Premier Health of America

What Does Premier Health of America's P/S Mean For Shareholders?

Recent times have been advantageous for Premier Health of America as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Premier Health of America.How Is Premier Health of America's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Premier Health of America's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 48% gain to the company's top line. The latest three year period has also seen an excellent 204% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% each year during the coming three years according to the two analysts following the company. That's shaping up to be materially higher than the 7.1% per year growth forecast for the broader industry.

In light of this, it's peculiar that Premier Health of America's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Premier Health of America's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Premier Health of America (2 don't sit too well with us!) that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:PHA

Premier Health of America

Engages in the provision of staffing and outsourced service solutions for healthcare needs in Canada.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives