- Canada

- /

- Healthtech

- /

- TSX:KSI

Announcing: kneat.com (CVE:KSI) Stock Increased An Energizing 226% In The Last Three Years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But when you pick a company that is really flourishing, you can make more than 100%. For example, the kneat.com, inc. (CVE:KSI) share price has soared 226% in the last three years. How nice for those who held the stock! Also pleasing for shareholders was the 47% gain in the last three months. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report.

Check out our latest analysis for kneat.com

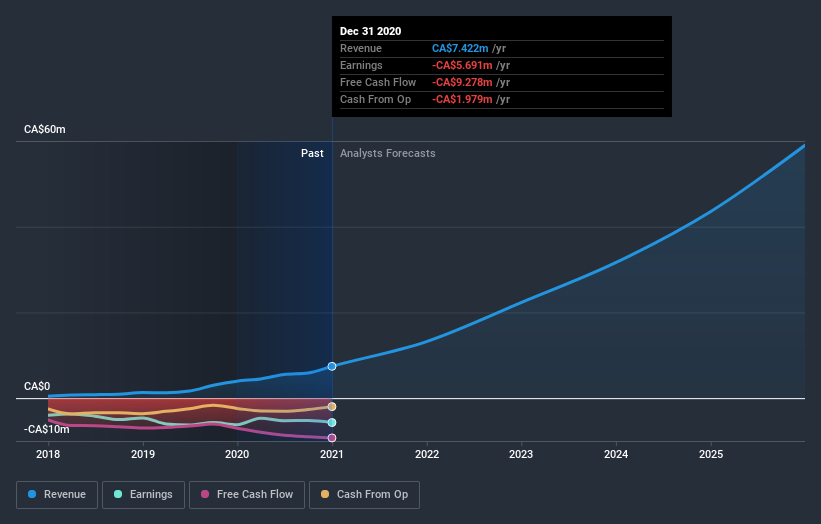

kneat.com isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years kneat.com has grown its revenue at 80% annually. That's much better than most loss-making companies. Meanwhile, the share price performance has been pretty solid at 48% compound over three years. This suggests the market has recognized the progress the business has made, at least to a significant degree. Nonetheless, we'd say kneat.com is still worth investigating - successful businesses can often keep growing for long periods.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So it makes a lot of sense to check out what analysts think kneat.com will earn in the future (free profit forecasts).

A Different Perspective

Pleasingly, kneat.com's total shareholder return last year was 74%. So this year's TSR was actually better than the three-year TSR (annualized) of 48%. Given the track record of solid returns over varying time frames, it might be worth putting kneat.com on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with kneat.com (at least 2 which shouldn't be ignored) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you’re looking to trade kneat.com, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:KSI

kneat.com

Designs, develops, and supplies software for data and document management within regulated environments in North America, Europe, and the Asia Pacific.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives