David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Aurora Spine Corporation (CVE:ASG) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Aurora Spine

What Is Aurora Spine's Debt?

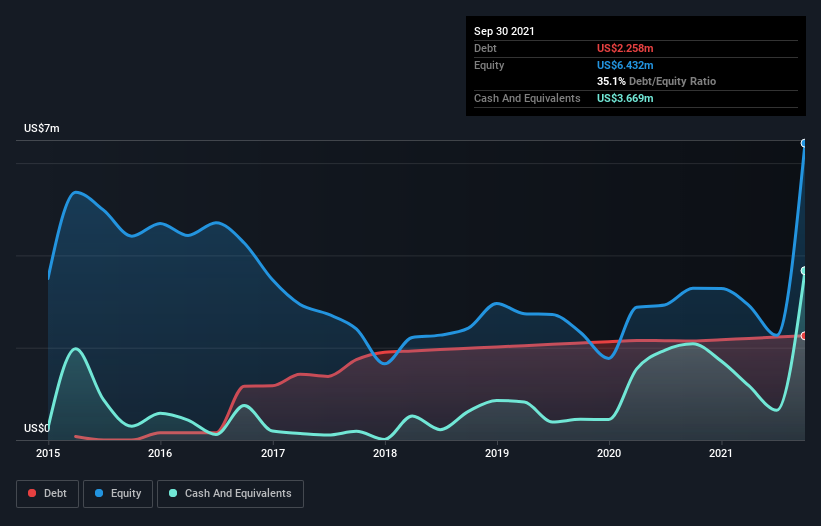

You can click the graphic below for the historical numbers, but it shows that as of September 2021 Aurora Spine had US$2.26m of debt, an increase on US$2.14m, over one year. However, its balance sheet shows it holds US$3.67m in cash, so it actually has US$1.41m net cash.

A Look At Aurora Spine's Liabilities

Zooming in on the latest balance sheet data, we can see that Aurora Spine had liabilities of US$1.93m due within 12 months and liabilities of US$2.32m due beyond that. Offsetting these obligations, it had cash of US$3.67m as well as receivables valued at US$2.67m due within 12 months. So it can boast US$2.09m more liquid assets than total liabilities.

This short term liquidity is a sign that Aurora Spine could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Aurora Spine boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Aurora Spine will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Aurora Spine reported revenue of US$10m, which is a gain of 13%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Aurora Spine?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And in the last year Aurora Spine had an earnings before interest and tax (EBIT) loss, truth be told. And over the same period it saw negative free cash outflow of US$2.8m and booked a US$1.5m accounting loss. But at least it has US$1.41m on the balance sheet to spend on growth, near-term. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 4 warning signs for Aurora Spine you should be aware of, and 1 of them is potentially serious.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:ASG

Aurora Spine

Through its subsidiary, Aurora Spine, Inc., engages in the development and distribution of minimally invasive interspinous fusion systems and devices in Canada.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026