Investors Still Aren't Entirely Convinced By Valeo Pharma Inc.'s (TSE:VPH) Revenues Despite 68% Price Jump

Valeo Pharma Inc. (TSE:VPH) shares have continued their recent momentum with a 68% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 41% in the last twelve months.

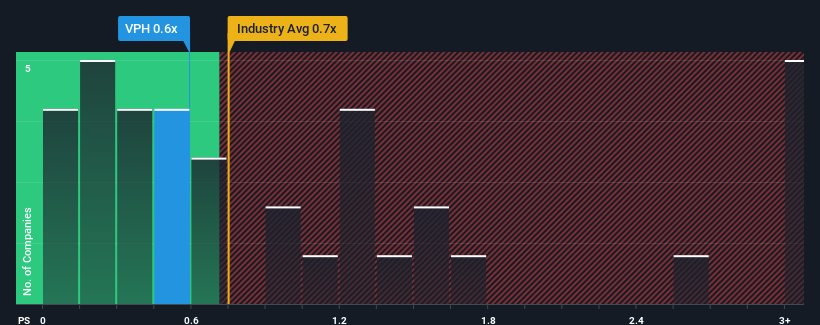

Even after such a large jump in price, there still wouldn't be many who think Valeo Pharma's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in Canada's Healthcare industry is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Valeo Pharma

What Does Valeo Pharma's P/S Mean For Shareholders?

Recent times have been advantageous for Valeo Pharma as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Valeo Pharma.Is There Some Revenue Growth Forecasted For Valeo Pharma?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Valeo Pharma's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 190%. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 31% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 15% growth forecast for the broader industry.

In light of this, it's curious that Valeo Pharma's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Valeo Pharma appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Valeo Pharma's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 9 warning signs with Valeo Pharma (at least 2 which can't be ignored), and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:VPH

Valeo Pharma

A specialty pharmaceutical company, engages in the acquisition, in-licensing brands, and sale of pharmaceuticals and hospital specialty products for unmet medical needs in Canada.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives