- Canada

- /

- Healthtech

- /

- TSX:KSI

Exploring 3 Promising Undervalued Small Caps With Insider Buying In Global

Reviewed by Simply Wall St

As global markets navigate a landscape marked by dovish Federal Reserve comments and subdued economic indicators, small-cap stocks have shown notable resilience, with the Russell 2000 Index outperforming its large-cap counterparts by advancing 5.52%. Amid this backdrop of cautious optimism, identifying promising small-cap opportunities can be particularly rewarding when considering factors such as insider buying and perceived undervaluation.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Speedy Hire | NA | 0.3x | 36.25% | ★★★★★☆ |

| Eastnine | 11.6x | 7.3x | 49.22% | ★★★★★☆ |

| Senior | 23.9x | 0.8x | 26.34% | ★★★★★☆ |

| Eurocell | 16.6x | 0.3x | 39.23% | ★★★★☆☆ |

| Centurion | 3.7x | 3.1x | -57.66% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 45.18% | ★★★★☆☆ |

| Ever Sunshine Services Group | 6.6x | 0.4x | -435.10% | ★★★☆☆☆ |

| PSC | 9.9x | 0.4x | 19.01% | ★★★☆☆☆ |

| Chinasoft International | 21.9x | 0.7x | -1199.49% | ★★★☆☆☆ |

| CVS Group | 46.4x | 1.3x | 25.72% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

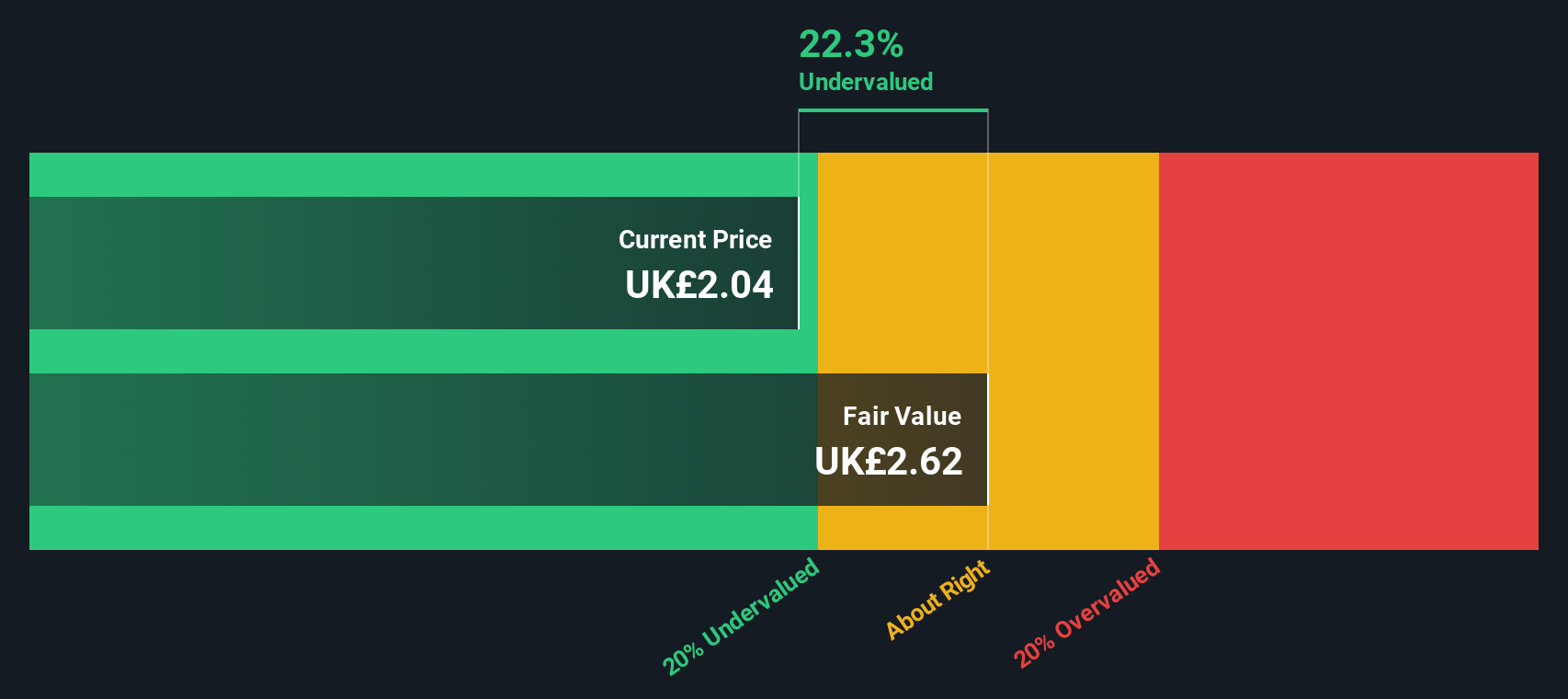

Grainger (LSE:GRI)

Simply Wall St Value Rating: ★★★★☆☆

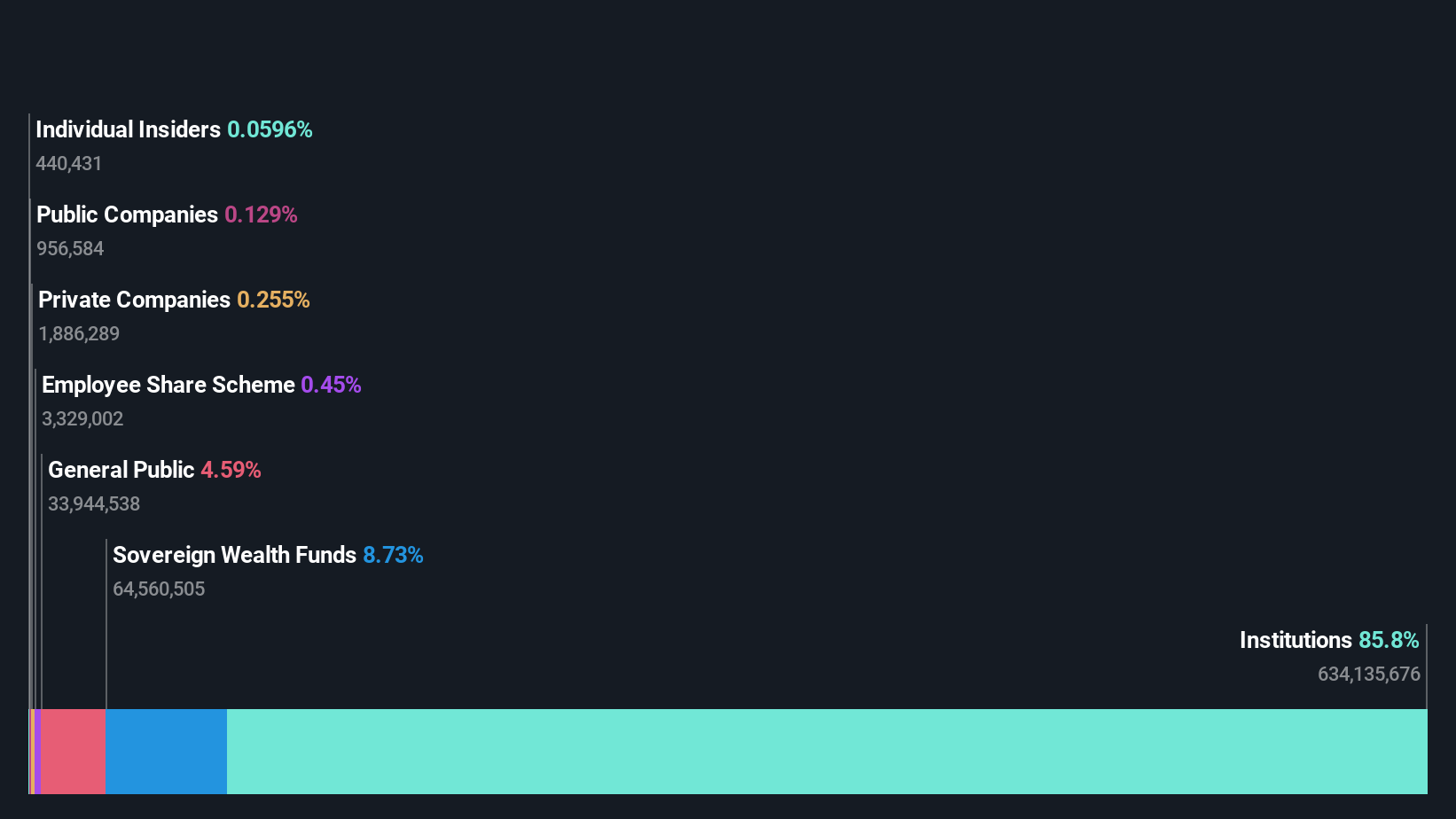

Overview: Grainger is a UK-based residential property company focused on the private rented sector and reversionary property investments, with a market capitalization of £2.20 billion.

Operations: The company's revenue is primarily driven by the Private Rented Sector (PRS) and reversionary segments, totaling £260.7 million. Over recent periods, the gross profit margin has shown an upward trend, reaching 65.17% as of September 2025. Operating expenses are consistently a significant part of the cost structure, with general and administrative expenses being a major component.

PE: 6.7x

Grainger, a standout among smaller stocks, has demonstrated significant insider confidence with recent share purchases. The company reported a substantial rise in net income to £202.6 million for the year ending September 2025, up from £31.2 million previously. Despite having liabilities solely from external borrowing, Grainger's strategic shift to a Real Estate Investment Trust (REIT) and focus on Build to Rent (BTR) have bolstered its market position. Their dividend increase proposal underscores commitment to shareholder returns amidst projected earnings growth through 2029 despite anticipated interest rate challenges.

International Personal Finance (LSE:IPF)

Simply Wall St Value Rating: ★★★★★☆

Overview: International Personal Finance is a financial services company that provides consumer credit through its digital platform and home credit operations in Mexico and Europe, with a market capitalization of £0.31 billion.

Operations: IPF generates revenue primarily from its three segments: IPF Digital, Mexico Home Credit, and European Home Credit. The company's gross profit margin showed a notable trend of fluctuations over the years, peaking at 89.76% in December 2021 before declining to 77.94% by December 2023. Operating expenses form a significant part of the cost structure, with general and administrative expenses being the largest component within operating costs.

PE: 6.1x

International Personal Finance, a smaller company in the financial sector, recently issued SEK 1 billion in senior unsecured notes with a floating interest rate tied to STIBOR plus 5.75%, maturing in 2028. This move highlights their reliance on external borrowing for funding, which carries higher risk compared to customer deposits. Despite these risks, the company's earnings are projected to grow annually by 3.54%. Additionally, their inclusion in multiple FTSE indices suggests increasing market recognition and potential investor interest.

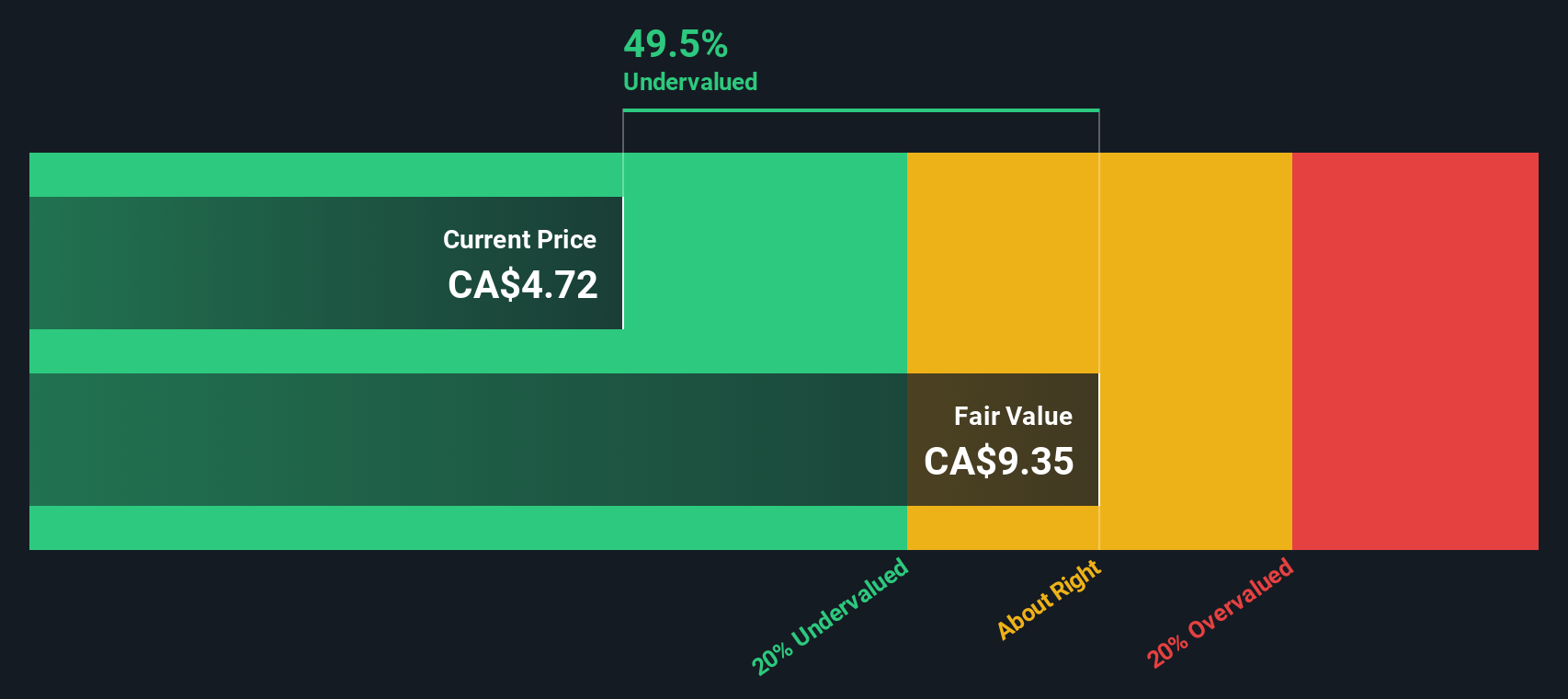

kneat.com (TSX:KSI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kneat.com is a company specializing in software and programming solutions, with a market cap of CA$0.24 billion.

Operations: The company generates revenue primarily from its software and programming segment, with recent figures reaching CA$59.99 million. Its cost of goods sold (COGS) was CA$14.88 million, resulting in a gross profit margin of 75.20%. Operating expenses are significant, including sales and marketing, research and development, and general administrative costs totaling CA$53.45 million in the latest period. Despite the high gross profit margin, the net income remains negative at -CA$1.19 million due to substantial operating expenses and non-operating influences on financial performance.

PE: -377.6x

Kneat.com, a company with promising growth potential, recently reported third-quarter sales of C$16.11 million, up from C$12.76 million the previous year. Despite a net loss of C$0.495 million this quarter compared to last year's profit, their nine-month performance shows improvement with a net income of C$1.27 million versus a prior loss. Insider confidence is evident as the CFO acquired 29,500 shares worth approximately C$118,885 in October 2025. However, reliance on external borrowing poses funding risks despite projected earnings growth of 18% annually.

- Navigate through the intricacies of kneat.com with our comprehensive valuation report here.

Assess kneat.com's past performance with our detailed historical performance reports.

Taking Advantage

- Gain an insight into the universe of 147 Undervalued Global Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KSI

kneat.com

Designs, develops, and supplies software for data and document management within regulated environments in North America, Europe, and the Asia Pacific.

High growth potential and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026