- Canada

- /

- Oil and Gas

- /

- TSX:CNQ

Top 3 TSX Dividend Stocks For February 2025

Reviewed by Simply Wall St

As the Canadian market navigates potential challenges from tariffs and trade uncertainties, investors are focusing on diversification to manage risk and maintain returns. In this environment, dividend stocks can offer a reliable income stream and stability, making them an attractive option for those seeking to bolster their portfolios amidst economic fluctuations.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.49% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.62% | ★★★★★★ |

| Olympia Financial Group (TSX:OLY) | 6.58% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.05% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.50% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.04% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.90% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.79% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.31% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 3.97% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

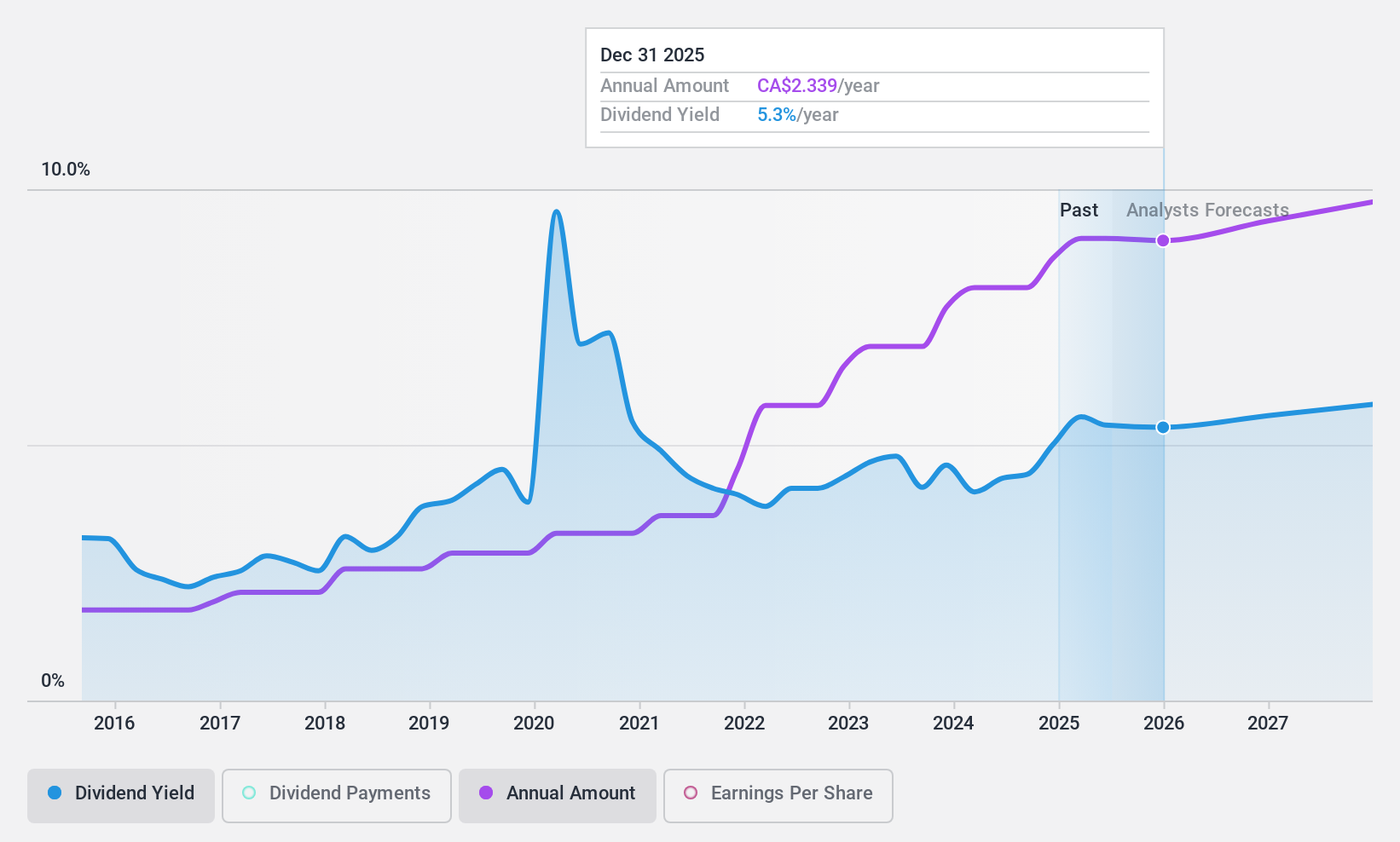

Canadian Natural Resources (TSX:CNQ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Natural Resources Limited engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) with a market cap of CA$93.24 billion.

Operations: Canadian Natural Resources Limited generates revenue from several segments, including Oil Sands Mining and Upgrading (CA$16.30 billion), Exploration and Production - North America (CA$17.21 billion), Exploration and Production - North Sea (CA$537 million), Exploration and Production - Offshore Africa (CA$557 million), and Midstream and Refining (CA$937 million).

Dividend Yield: 4.9%

Canadian Natural Resources offers a reliable dividend yield of 4.9%, supported by a sustainable payout ratio of 58.4% from earnings and 45.6% from cash flows, indicating solid coverage. The company has consistently grown its dividend over the past decade with minimal volatility. Recent acquisitions, including Chevron's Alberta assets, are expected to enhance production and free cash flow, potentially supporting future dividends despite the yield being lower than top-tier Canadian payers at 6.51%.

- Delve into the full analysis dividend report here for a deeper understanding of Canadian Natural Resources.

- Our valuation report here indicates Canadian Natural Resources may be undervalued.

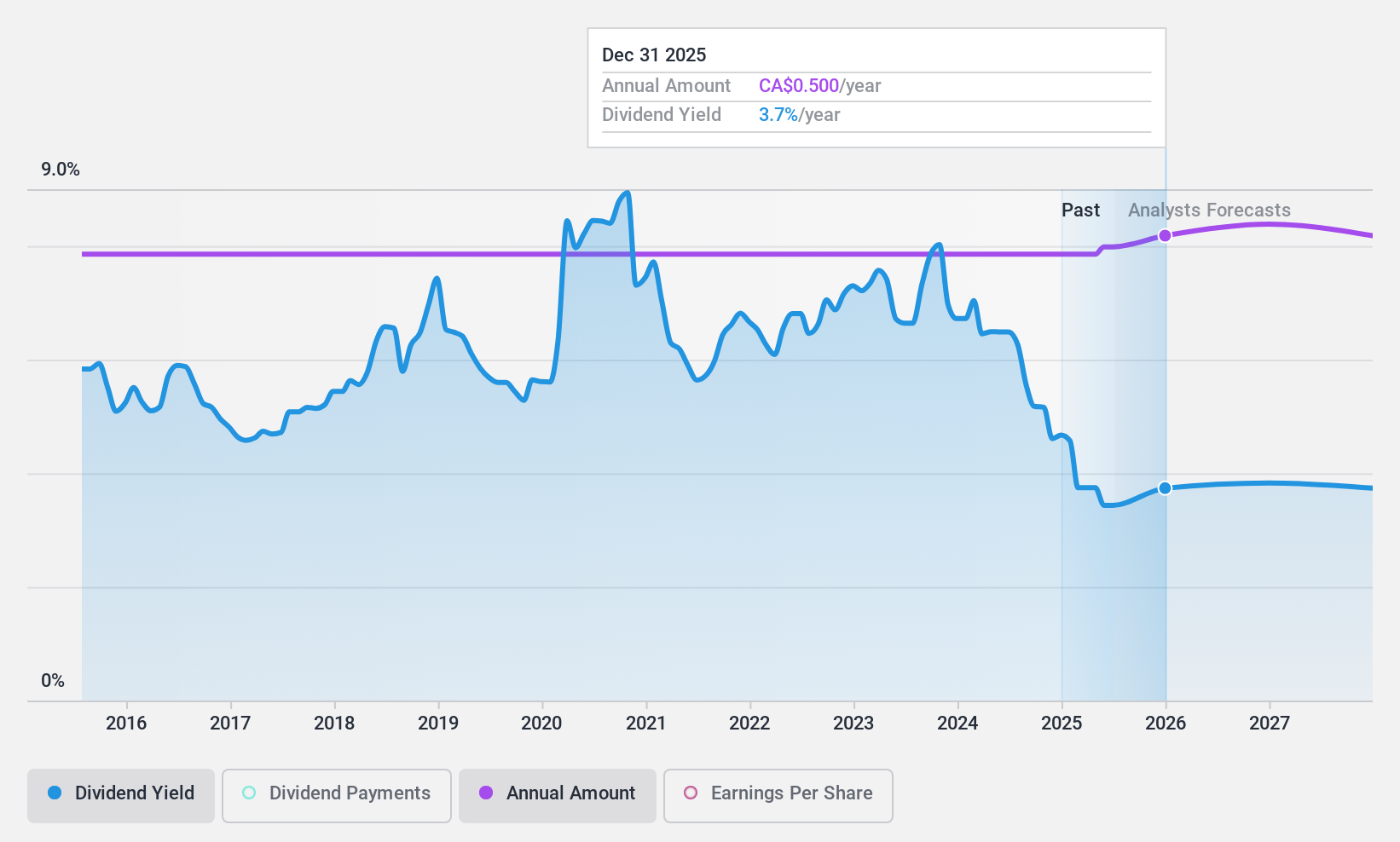

Extendicare (TSX:EXE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Extendicare Inc., with a market cap of CA$909.79 million, operates in Canada through its subsidiaries to provide care and services for seniors.

Operations: Extendicare Inc.'s revenue is derived from its Long-Term Care segment at CA$808.94 million, Home Health Care at CA$545.46 million, and Managed Services at CA$70.43 million.

Dividend Yield: 4.5%

Extendicare offers a dividend yield of 4.47%, which is lower than the top 25% of Canadian payers but backed by a sustainable payout ratio of 63.3% from earnings and 41.5% from cash flows, ensuring coverage. Despite stable dividends over the past decade, there has been no growth in payouts, reflecting potential volatility concerns. The company recently affirmed monthly dividends at CAD$0.04 per share, maintaining regular payments despite its high debt levels impacting financial flexibility.

- Navigate through the intricacies of Extendicare with our comprehensive dividend report here.

- Our valuation report unveils the possibility Extendicare's shares may be trading at a discount.

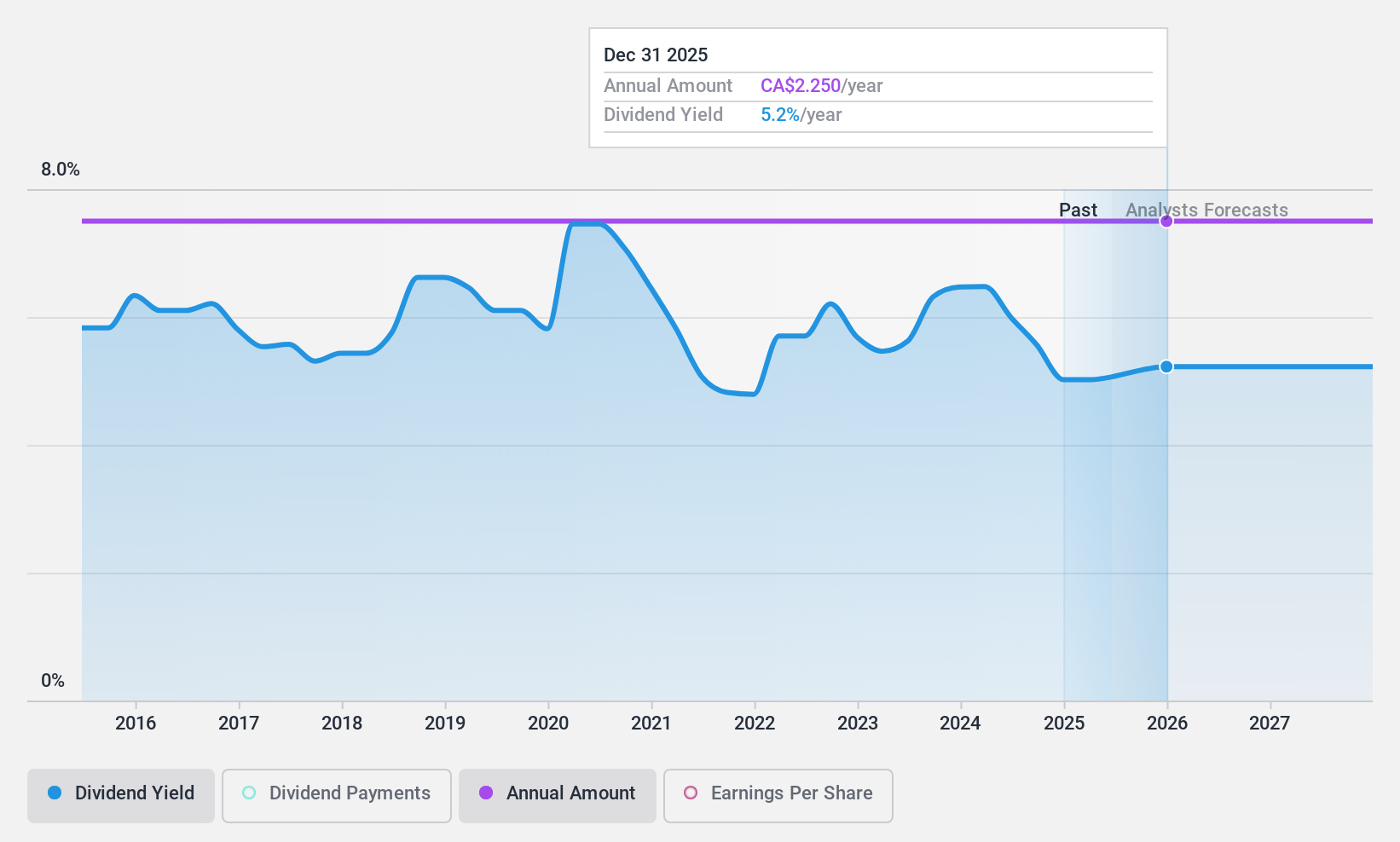

IGM Financial (TSX:IGM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. operates in the asset management sector in Canada and has a market capitalization of approximately CA$10.51 billion.

Operations: IGM Financial Inc.'s revenue is primarily derived from its Wealth Management segment, which generates CA$2.45 billion, and its Asset Management segment, contributing CA$1.26 billion.

Dividend Yield: 5%

IGM Financial's dividend yield of 5.04% is lower than the top Canadian payers but remains reliable and stable, supported by a payout ratio of 57.2% from earnings and 51.6% from cash flows, ensuring coverage. Dividends have grown over the past decade without volatility. Recent earnings showed a decline in net income to C$933.51 million, yet dividends were affirmed at C$0.5625 per share for April 2025, reflecting ongoing commitment to shareholder returns amidst buyback plans.

- Click here to discover the nuances of IGM Financial with our detailed analytical dividend report.

- Our expertly prepared valuation report IGM Financial implies its share price may be lower than expected.

Taking Advantage

- Click this link to deep-dive into the 27 companies within our Top TSX Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNQ

Canadian Natural Resources

Engages in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas, and natural gas liquids (NGLs) in Western Canada, the United Kingdom sector of the North Sea, and Offshore Africa.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion