- Canada

- /

- Healthcare Services

- /

- TSX:CSH.UN

Here's Why We Think Chartwell Retirement Residences' (TSE:CSH.UN) CEO Compensation Looks Fair

Key Insights

- Chartwell Retirement Residences will host its Annual General Meeting on 4th of June

- Total pay for CEO Vlad Volodarski includes CA$752.0k salary

- Total compensation is 72% below industry average

- Chartwell Retirement Residences' EPS declined by 68% over the past three years while total shareholder return over the past three years was 10%

The performance at Chartwell Retirement Residences (TSE:CSH.UN) has been rather lacklustre of late and shareholders may be wondering what CEO Vlad Volodarski is planning to do about this. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 4th of June. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We think CEO compensation looks appropriate given the data we have put together.

Check out our latest analysis for Chartwell Retirement Residences

Comparing Chartwell Retirement Residences' CEO Compensation With The Industry

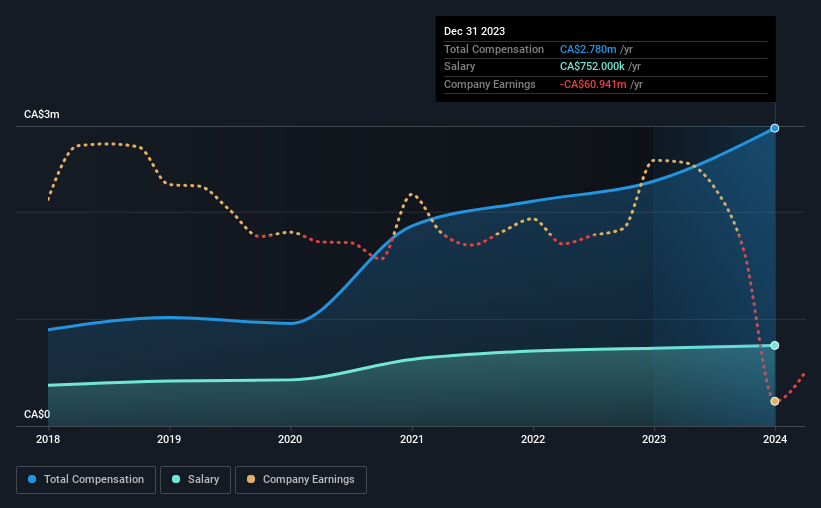

According to our data, Chartwell Retirement Residences has a market capitalization of CA$3.0b, and paid its CEO total annual compensation worth CA$2.8m over the year to December 2023. Notably, that's an increase of 22% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at CA$752k.

On comparing similar companies from the Canadian Healthcare industry with market caps ranging from CA$1.4b to CA$4.4b, we found that the median CEO total compensation was CA$9.9m. In other words, Chartwell Retirement Residences pays its CEO lower than the industry median. Moreover, Vlad Volodarski also holds CA$394k worth of Chartwell Retirement Residences stock directly under their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$752k | CA$725k | 27% |

| Other | CA$2.0m | CA$1.6m | 73% |

| Total Compensation | CA$2.8m | CA$2.3m | 100% |

Talking in terms of the industry, salary represented approximately 52% of total compensation out of all the companies we analyzed, while other remuneration made up 48% of the pie. It's interesting to note that Chartwell Retirement Residences allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Chartwell Retirement Residences' Growth

Over the last three years, Chartwell Retirement Residences has shrunk its earnings per share by 68% per year. In the last year, its revenue is up 6.7%.

Overall this is not a very positive result for shareholders. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Chartwell Retirement Residences Been A Good Investment?

Chartwell Retirement Residences has generated a total shareholder return of 10% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Shareholder returns while positive, need to be looked at along with earnings, which have failed to grow and this could mean that the current momentum may not continue. These concerns could be addressed to the board and shareholders should revisit their investment thesis to see if it still makes sense.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for Chartwell Retirement Residences (1 is potentially serious!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CSH.UN

Chartwell Retirement Residences

Chartwell is in the business of serving and caring for Canada's seniors, committed to its vision of Making People's Lives BETTER and to providing a happier, healthier, and more fulfilling life experience for its residents.

Reasonable growth potential with proven track record and pays a dividend.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026