- Canada

- /

- Healthcare Services

- /

- TSX:AND

Should You Be Adding Andlauer Healthcare Group (TSE:AND) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Andlauer Healthcare Group (TSE:AND). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Andlauer Healthcare Group

How Fast Is Andlauer Healthcare Group Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Like a wedge-tailed eagle on the wind, Andlauer Healthcare Group's EPS soared from CA$0.82 to CA$1.22, in just one year. That's a impressive gain of 49%.

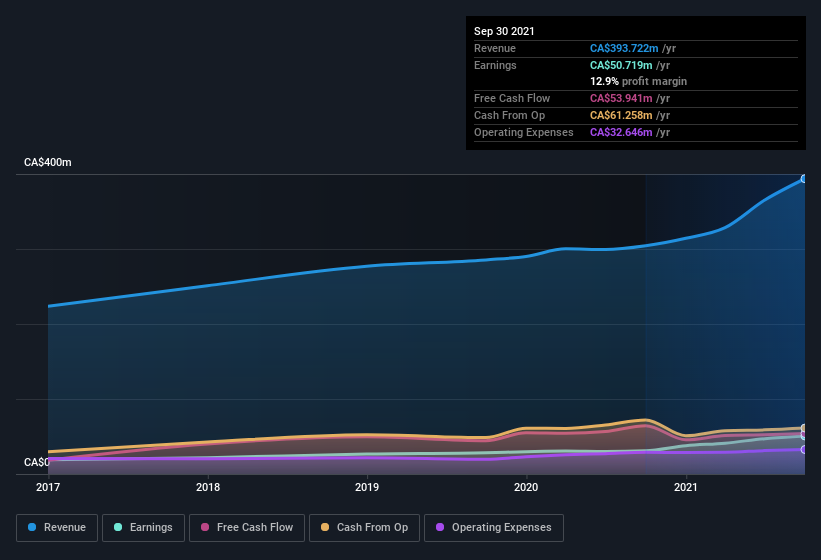

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Andlauer Healthcare Group's EBIT margins were flat over the last year, revenue grew by a solid 29% to CA$394m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Andlauer Healthcare Group EPS 100% free.

Are Andlauer Healthcare Group Insiders Aligned With All Shareholders?

I like company leaders to have some skin in the game, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. As a result, I'm encouraged by the fact that insiders own Andlauer Healthcare Group shares worth a considerable sum. To be specific, they have CA$16m worth of shares. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.7% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like Andlauer Healthcare Group with market caps between CA$1.3b and CA$4.1b is about CA$2.5m.

The CEO of Andlauer Healthcare Group only received CA$720k in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Andlauer Healthcare Group Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Andlauer Healthcare Group's strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. This may only be a fast rundown, but the takeaway for me is that Andlauer Healthcare Group is worth keeping an eye on. However, before you get too excited we've discovered 2 warning signs for Andlauer Healthcare Group that you should be aware of.

Although Andlauer Healthcare Group certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:AND

Andlauer Healthcare Group

A supply chain management company, provides a platform of customized third-party logistics (3PL) and specialized transportation solutions for the healthcare sector in Canada and the United States.

Flawless balance sheet and fair value.