- Canada

- /

- Healthcare Services

- /

- TSX:AND

Assessing Andlauer Healthcare Group (TSX:AND) Valuation After Recent Share Price Cool-Off

Reviewed by Kshitija Bhandaru

See our latest analysis for Andlauer Healthcare Group.

Andlauer’s share price may have cooled off over the past month, but zooming out shows momentum is very much alive. The stock’s year-to-date share price return stands at nearly 19%, and its total shareholder return over the past twelve months comes in at a robust 34.8%. This pattern suggests investors still see growth potential and are willing to reward steady outperformance, even as the sector mood shifts.

If healthcare’s recent move has you looking for more opportunities, check out the full lineup of innovative companies in our curated See the full list for free..

With shares trading just below analyst targets and a strong year-to-date run behind it, the question for investors is clear: is Andlauer Healthcare Group poised for further upside, or is future growth already accounted for?

Price-to-Earnings of 30.2x: Is it justified?

Andlauer Healthcare Group trades at a price-to-earnings (P/E) ratio of 30.2x, notably lower than its peer group average of 82.4x but more expensive than the North American Healthcare industry average of 21.5x. With shares closing at CA$52.05, its current valuation sits between broader industry norms and specific peer comparisons.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of the company’s earnings. In sectors like healthcare, higher P/E ratios can reflect expectations for growth, stability, or quality of earnings. For Andlauer, this premium may signal market confidence in its track record and prospects.

Relative to direct competitors, Andlauer appears attractively priced, but its P/E sits above the broader North American industry standard. This highlights a potential disconnect. In one context, it looks like a bargain, but through another lens, it is somewhat pricey. Investors may want to consider whether the company's earnings quality and growth trajectory justify paying up compared to the wider market. If a fair ratio benchmark were available, it would offer another layer for validating whether a rerating could unfold from here.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 30.2x (ABOUT RIGHT)

However, if sector sentiment sours or if revenue growth stalls, Andlauer’s recent momentum could quickly come under pressure for investors.

Find out about the key risks to this Andlauer Healthcare Group narrative.

Another View: Is the Stock Actually Undervalued?

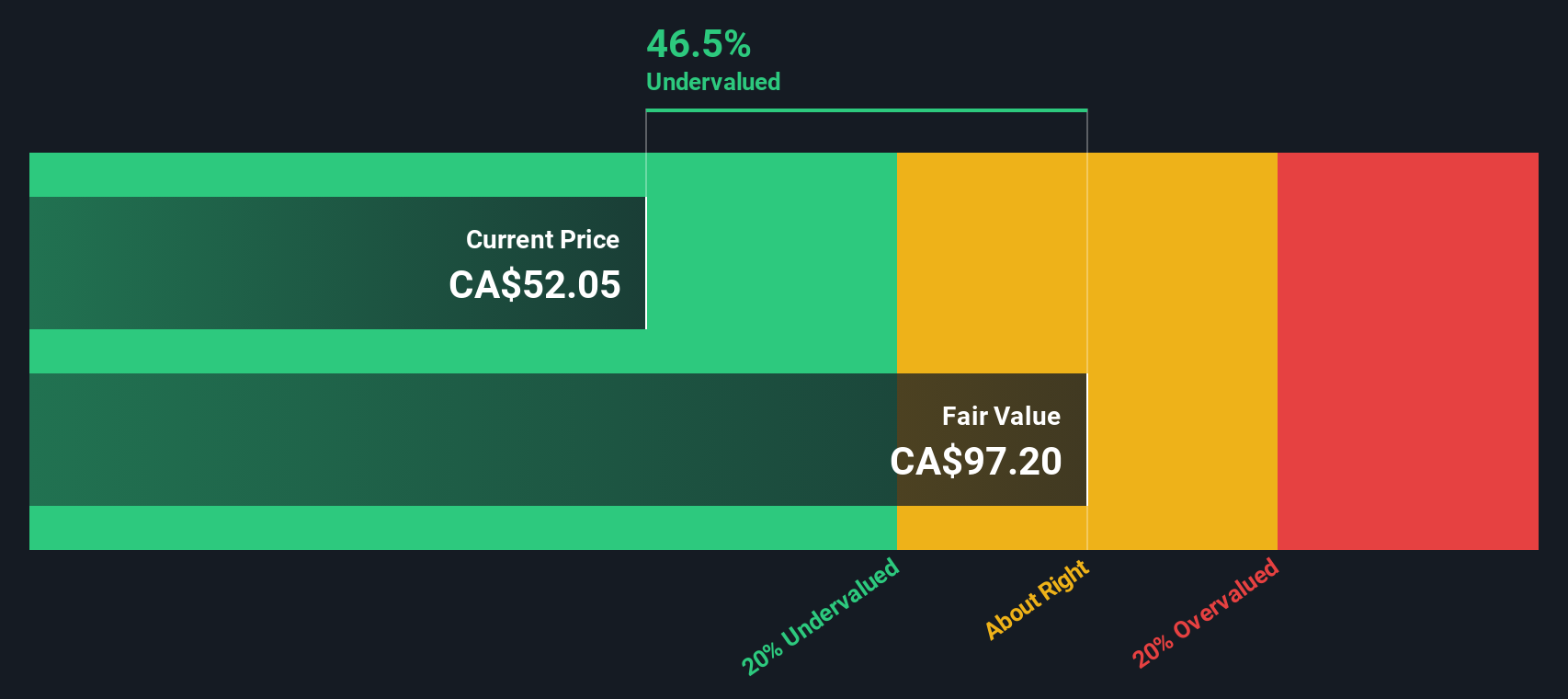

Looking at things through our SWS DCF model provides a different perspective. The model suggests Andlauer Healthcare Group shares could be trading well below their estimated fair value and potentially undervalued by over 47%. Could the market be underestimating future cash flow strength, or does the current price already reflect all the optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Andlauer Healthcare Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Andlauer Healthcare Group Narrative

Keep in mind that if you have your own perspective or want to take a deep dive into the numbers, you can build your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Andlauer Healthcare Group.

Looking for More Investment Ideas?

Stay a step ahead by uncovering promising stocks filtered for momentum, innovation, and sustainability. Act now and avoid missing out on tomorrow's winners.

- Capitalize on strong cash flow opportunities by targeting undervalued stocks with our exclusive access to these 898 undervalued stocks based on cash flows.

- Ride the AI revolution by spotting high-potential disruptors among these 24 AI penny stocks that are reshaping industries worldwide.

- Lock in consistent returns from companies offering yields above 3% when you pursue these 19 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AND

Andlauer Healthcare Group

A supply chain management company, provides a platform of customized third-party logistics (3PL) and specialized transportation solutions for the healthcare sector in Canada and the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives