Saputo (TSX:SAP): Valuation Check After Insider Buying and Renewed Institutional Confidence

Reviewed by Simply Wall St

Recent insider buying in Saputo (TSX:SAP), supported by steady institutional interest, has given the stock fresh momentum, and investors are asking whether this renewed confidence lines up with the company’s fundamentals and growth outlook.

See our latest analysis for Saputo.

That insider activity is landing on top of an already strong run, with Saputo’s share price up 63.05 percent year to date and delivering a 59.56 percent total shareholder return over the past 12 months. This signals that momentum is clearly building rather than fading.

If insider conviction at Saputo has you thinking about where else confidence and growth might be lining up, it is a good time to explore fast growing stocks with high insider ownership.

Yet despite the rally, Saputo still trades at a steep discount to some intrinsic value estimates while sitting slightly above the average analyst target. This raises a key question: is this a fresh buying opportunity, or is future growth already priced in?

Most Popular Narrative: 6.4% Overvalued

With Saputo last closing at CA$40.78 against a narrative fair value of CA$38.32, the valuation gap is modest but directionally significant.

Analysts have nudged our Saputo price target higher to C$38.32 from C$37.86, as modestly stronger long term revenue growth and margin expectations, reflected in recent target increases across the Street, support a slightly richer fair value multiple.

Curious what kind of earnings recovery and margin rebuild could justify that richer multiple, even as growth remains steady rather than explosive, and buybacks reshape the share count? Explore how those moving parts combine into this fair value assessment.

Result: Fair Value of $38.32 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural shifts toward plant based alternatives and rising environmental regulation could pressure Saputo’s core dairy volumes and margins, which may challenge today’s upbeat expectations.

Find out about the key risks to this Saputo narrative.

Another View: Cash Flows Tell a Different Story

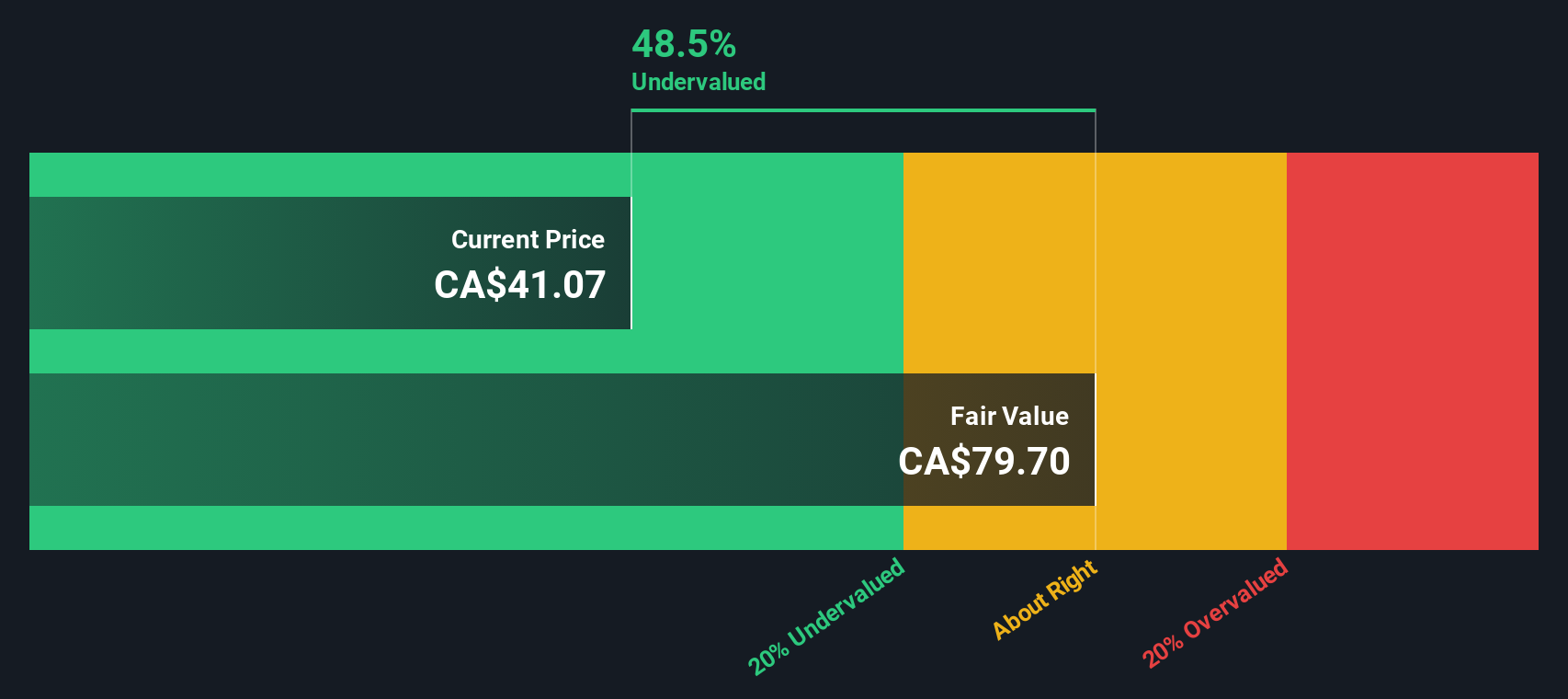

While the narrative fair value suggests Saputo is modestly overvalued, our DCF model paints the opposite picture, indicating the shares trade roughly 49 percent below intrinsic value at about CA$79.70. If cash flows really are this strong, is the market overlooking a deeper rerating story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Saputo for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Saputo Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in minutes with Do it your way.

A great starting point for your Saputo research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before sentiment shifts again, sharpen your edge with fresh opportunities identified by the Simply Wall Street Screener, built to uncover focused themes and strong fundamentals.

- Capitalize on mispriced quality by running through these 908 undervalued stocks based on cash flows that cash flows suggest the market has not fully appreciated yet.

- Ride powerful innovation trends by targeting these 26 AI penny stocks that could shape the next wave of productivity and earnings growth.

- Strengthen your income stream by filtering for these 13 dividend stocks with yields > 3% that may offer steadier returns through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SAP

Saputo

Produces, markets, and distributes dairy products in Canada, the United States, Australia, Argentina, and the United Kingdom.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)