Saputo (TSX:SAP): Evaluating Fair Value After Earnings Growth and Dividend Raise

Reviewed by Kshitija Bhandaru

Saputo (TSX:SAP) just reported its Q1 2025 results, showing a 1% year-over-year revenue increase and a 13% jump in adjusted earnings per share. The company also raised its quarterly dividend by 5.3%, which is a sign of ongoing confidence.

See our latest analysis for Saputo.

Beyond today’s earnings update, Saputo’s stock has generally drifted sideways over the past year, with a total shareholder return of just 0.2% and little momentum from recent events. Despite improved profits, the subdued share price suggests investors are still waiting for a stronger signal before enthusiasm builds over the long term.

If you’re interested in what insiders are buying or where growth stories may be emerging, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With Saputo’s earnings and improved dividend now on the table, investors are left asking whether the current share price reflects all that upside or if there is still value waiting to be unlocked in the months ahead.

Most Popular Narrative: 1.5% Undervalued

Saputo’s most-followed narrative places fair value just slightly above the last closing price, highlighting nearly matched expectations between the analyst consensus and market reality. The next catalyst is hidden in operational changes, not one-off events or sentiment.

Accelerating operational efficiency initiatives, including recent large-scale capital investments in automation, network optimization, and SG&A reduction, are driving substantial run-rate cost savings, margin expansion, and improved net earnings. There is further upside as the final tranche of targeted efficiencies is achieved in the U.S. by fiscal year-end.

What makes this forecast so bold? One of the key levers for fair value is a powerful upswing in earning power, pushed by margin gains and a premium profit multiple. Want to see what hinges the calculation on future profit transformation? Unlock the full story to uncover the assumptions and see whether this valuation is on solid ground.

Result: Fair Value of $34.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing consumer shifts toward plant-based alternatives and the impact of volatile milk supply could quickly challenge optimism about Saputo’s long-term growth.

Find out about the key risks to this Saputo narrative.

Another View: Are Multiples Sending the Same Signal?

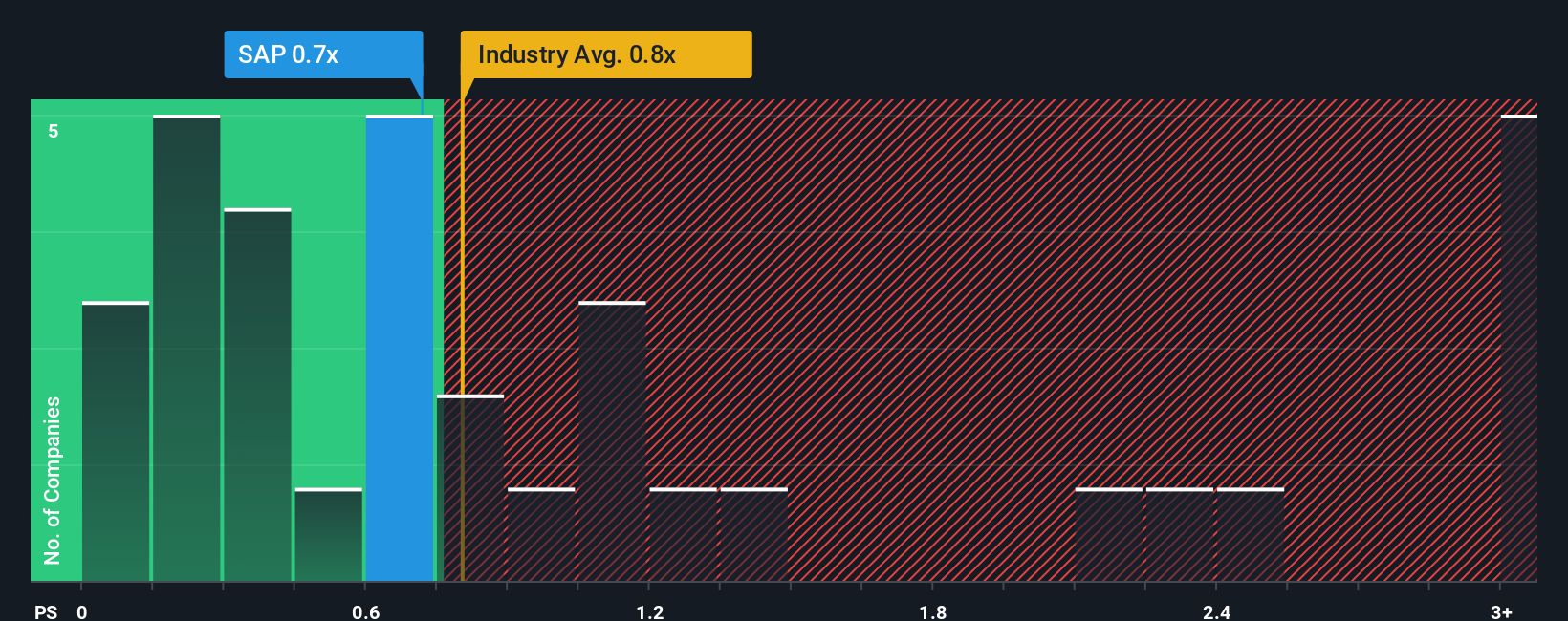

While analyst forecasts find Saputo close to fair value, market-based ratios suggest a tricky picture. Saputo trades at a price-to-sales ratio of 0.7x, which is slightly more expensive than its peer average of 0.6x and above the fair ratio of 0.6x. This means investors are paying a small premium relative to similar companies, raising the risk that expectations are already factored in. Is this caution justified or an early opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Saputo Narrative

If you want to dig into the numbers or see things from a fresh angle, you can shape your own Saputo investment story in just a few minutes. Do it your way

A great starting point for your Saputo research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more smart ways to grow your portfolio?

Stay ahead of the curve by acting now on promising investment ideas that others might overlook, and make sure you’re not missing tomorrow’s winners.

- Uncover higher-than-average yields by checking out these 19 dividend stocks with yields > 3% for income-focused opportunities with reliable payouts.

- Capitalize on market innovation and see how these 24 AI penny stocks are reshaping industries with cutting-edge artificial intelligence solutions.

- Seize unique value plays instantly with these 885 undervalued stocks based on cash flows, which identifies stocks the market may be underrating right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SAP

Saputo

Produces, markets, and distributes dairy products in Canada, the United States, Australia, Argentina, and the United Kingdom.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives