Undervalued Small Caps With Insider Activity On TSX In December 2024

Reviewed by Simply Wall St

As the Canadian market navigates through a period of shifting bond yields and potential rate cuts by the Bank of Canada, small-cap stocks on the TSX are garnering attention amid these economic adjustments. In this environment, evaluating companies with insider activity can provide insights into potential opportunities, as insiders may have confidence in their company's prospects despite broader market fluctuations.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Parex Resources | 3.6x | 0.8x | 23.72% | ★★★★★★ |

| Primaris Real Estate Investment Trust | 12.7x | 3.4x | 44.11% | ★★★★★☆ |

| Calfrac Well Services | 11.6x | 0.2x | 37.03% | ★★★★★☆ |

| Nexus Industrial REIT | 12.6x | 3.2x | 28.86% | ★★★★★☆ |

| H&R Real Estate Investment Trust | NA | 2.8x | 41.75% | ★★★★★☆ |

| Aris Mining | NA | 1.2x | 47.40% | ★★★★★☆ |

| First National Financial | 13.3x | 3.8x | 43.76% | ★★★★☆☆ |

| Baytex Energy | NA | 0.8x | -112.06% | ★★★★☆☆ |

| Minto Apartment Real Estate Investment Trust | NA | 5.5x | 20.32% | ★★★★☆☆ |

| Hemisphere Energy | 6.0x | 2.3x | -109.45% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Centerra Gold is a mining company engaged in the exploration, development, and operation of gold and molybdenum properties, with a market cap of approximately CAD 2.70 billion.

Operations: Centerra Gold generates revenue primarily from its three segments: Öksüt, Molybdenum, and Mount Milligan. The company's cost of goods sold (COGS) significantly impacts its gross profit margin, which has shown variability over the years, reaching 44.22% in mid-2024. Operating expenses and non-operating expenses also play a crucial role in determining net income outcomes for the company.

PE: 11.3x

Centerra Gold, a Canadian mining company, has been making strategic moves with its share repurchase program, having bought back 5.3 million shares for $33.9 million by September 2024. Despite a dip in quarterly earnings to $28.79 million from $60.62 million the previous year, the firm maintains steady production guidance and insider confidence through consistent dividends of CAD 0.07 per share. The recent drilling collaboration at Cherry Creek hints at potential resource expansion, aligning with their growth forecast of 3.47% annually in earnings.

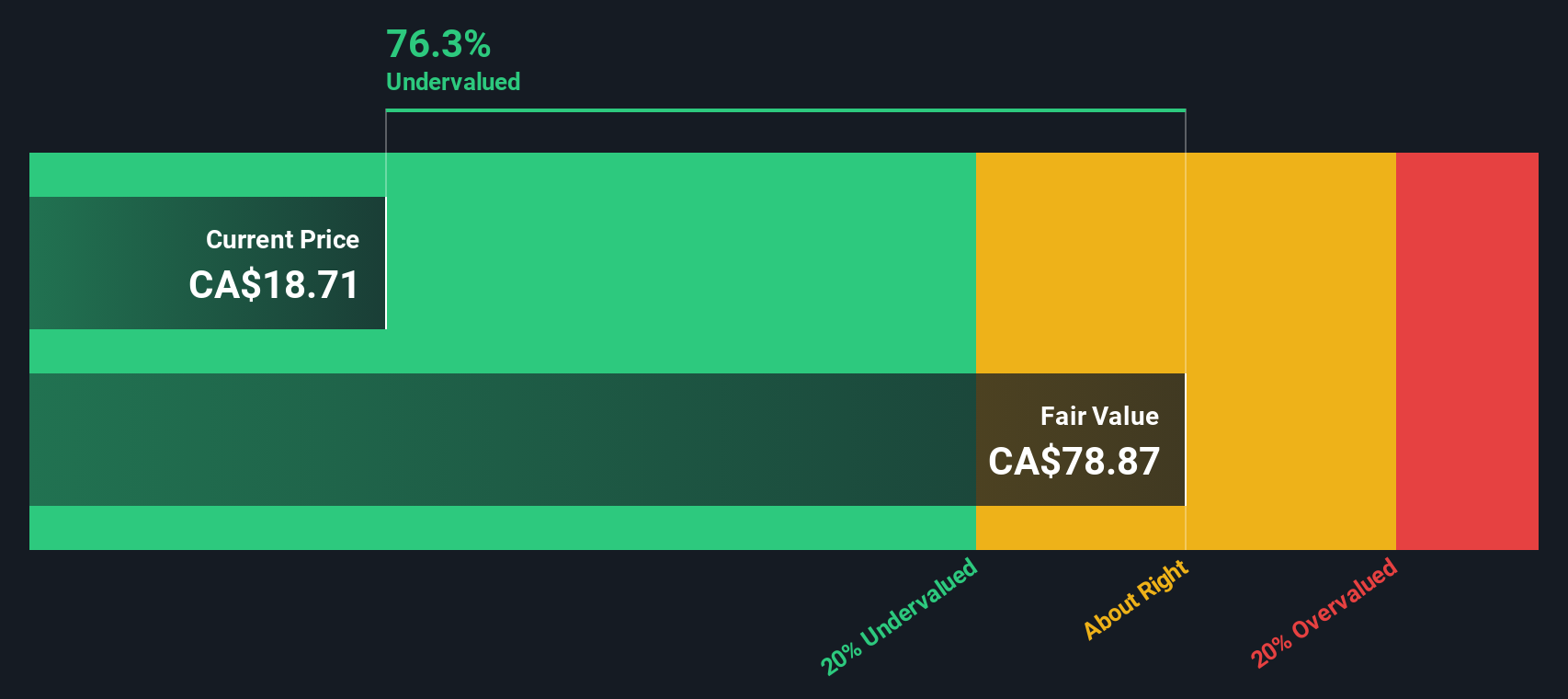

High Liner Foods (TSX:HLF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: High Liner Foods is a company that specializes in the manufacturing and marketing of prepared and packaged frozen seafood, with a market cap of C$0.47 billion.

Operations: The company generates revenue primarily from the manufacturing and marketing of prepared and packaged frozen seafood, with recent figures showing a gross profit margin of 22.36%. Operating expenses include significant allocations to general and administrative costs as well as sales and marketing expenses.

PE: 5.3x

High Liner Foods has shown promising financial performance, with net income rising to US$18.35 million in Q3 2024 from US$5.49 million the previous year, despite a drop in sales to US$228.88 million from US$259.7 million. The company’s commitment to shareholder value is evident through its increased quarterly dividend of C$0.17 and a strategic share repurchase plan totaling 299,669 shares for C$2.65 million by September 28, 2024. Insider confidence is reflected by Darryl Bergman purchasing 5,129 shares valued at approximately C$78,987 recently, signaling potential growth opportunities amidst their high debt levels and reliance on external funding sources.

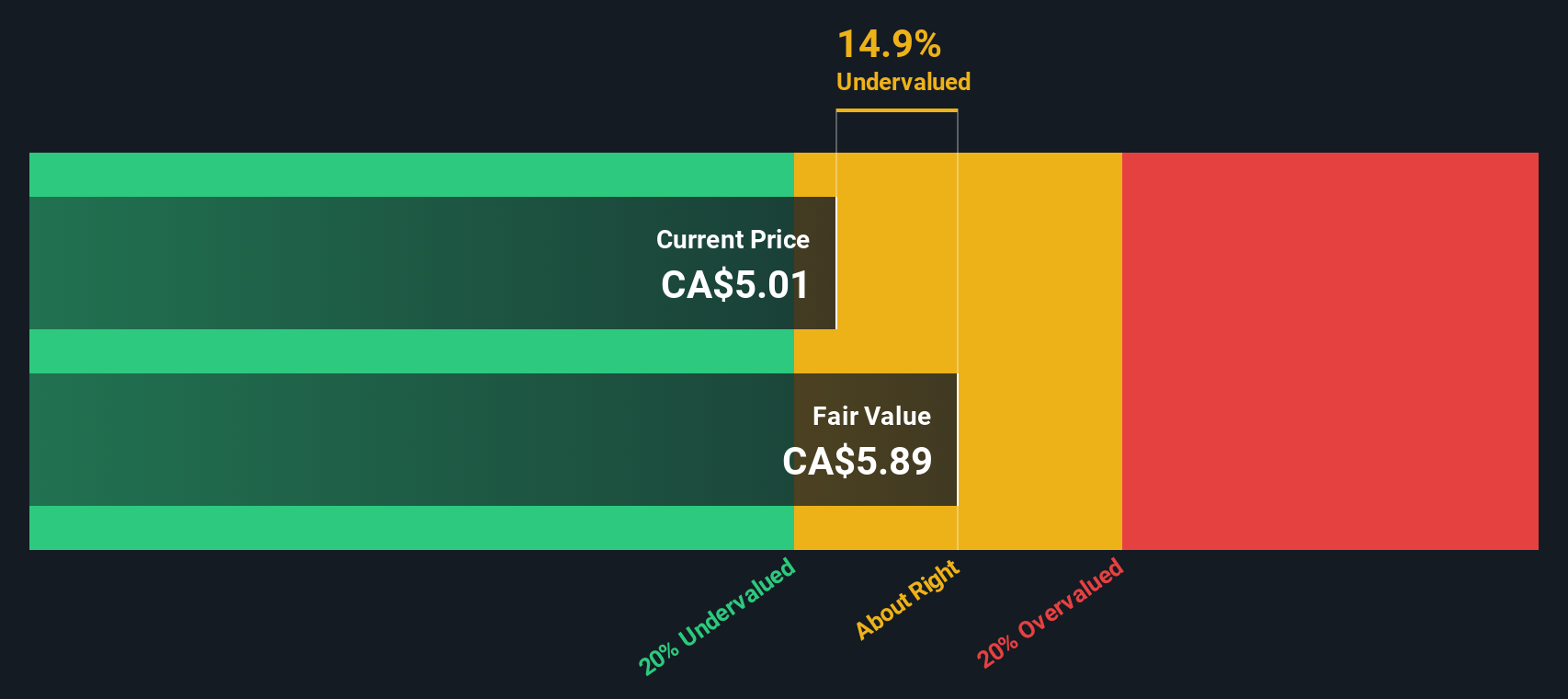

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust is a Canadian company that focuses on owning and managing a portfolio of healthcare real estate properties, with operations valued at approximately CA$483.34 million in the healthcare real estate industry.

Operations: The company generates revenue primarily from the healthcare real estate industry, with recent figures at CA$483.34 million. The cost of goods sold (COGS) was CA$113.96 million, leading to a gross profit margin of 76.42%. Operating expenses include general and administrative costs, which were CA$55.49 million in the latest period. Non-operating expenses have significantly impacted net income margins, which were reported at -93.39% for the same period.

PE: -2.4x

NorthWest Healthcare Properties Real Estate Investment Trust, a Canadian healthcare-focused REIT, is navigating challenges with strategic adjustments. Despite reporting a net loss of C$138.25 million in Q3 2024, it maintains consistent monthly distributions of C$0.03 per unit. The REIT has secured long-term lease extensions in Brazil, enhancing its portfolio's stability with an 18.2-year weighted-average lease expiry. Insider confidence is evident as key figures increase their holdings, signaling potential optimism for future growth amidst external funding risks and leadership transitions planned for mid-2025.

Next Steps

- Explore the 23 names from our Undervalued TSX Small Caps With Insider Buying screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if High Liner Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HLF

High Liner Foods

Processes and markets frozen seafood products in North America.

Excellent balance sheet, good value and pays a dividend.