- Canada

- /

- Oil and Gas

- /

- TSX:SU

TSX Dividend Stocks To Watch In April 2025

Reviewed by Simply Wall St

As the Canadian market navigates the complexities of global trade dynamics and potential inflationary pressures, investors are keeping a close eye on dividend stocks for their ability to provide steady income amidst economic uncertainty. In this environment, a good dividend stock is characterized by its strong fundamentals and consistent payout history, offering stability even when market volatility remains elevated.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 9.52% | ★★★★★★ |

| SECURE Waste Infrastructure (TSX:SES) | 3.17% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.67% | ★★★★★☆ |

| Savaria (TSX:SIS) | 3.41% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.92% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.81% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.60% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.61% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 7.01% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 6.33% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top TSX Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

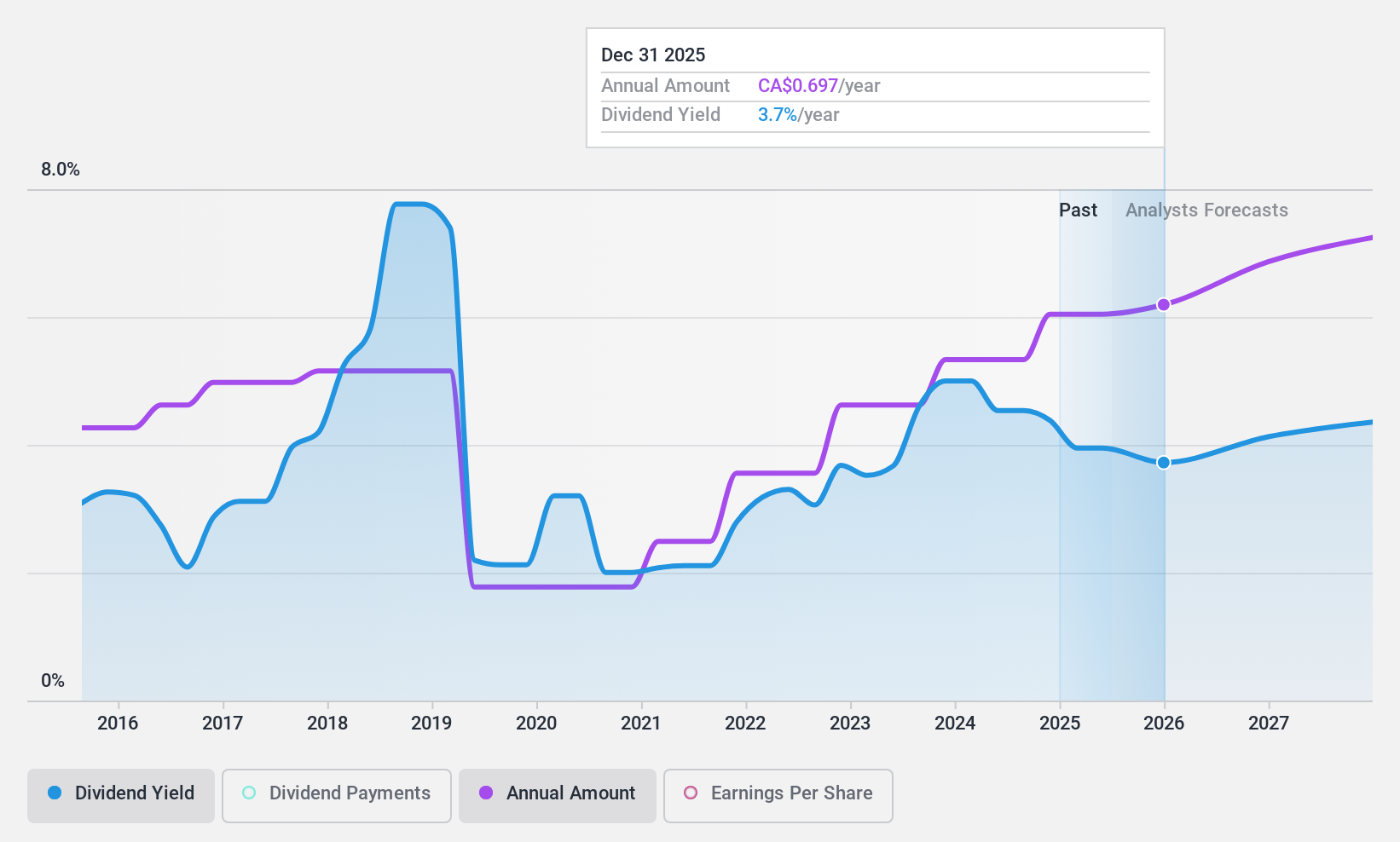

High Liner Foods (TSX:HLF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated processes and markets prepared and packaged frozen seafood products in North America, with a market cap of CA$495.88 million.

Operations: High Liner Foods generates revenue of $959.22 million from its manufacturing and marketing of prepared and packaged frozen seafood products in North America.

Dividend Yield: 4.1%

High Liner Foods' dividend payments are well-covered by earnings and cash flows, with payout ratios of 22.7% and 20.8%, respectively. Despite a history of volatility in dividends, recent increases have been noted over the past decade. The company is trading significantly below its estimated fair value, but it carries a high level of debt. Recent strategic initiatives include seeking M&A opportunities while maintaining balance sheet strength and continuing share buybacks to enhance shareholder value.

- Delve into the full analysis dividend report here for a deeper understanding of High Liner Foods.

- Upon reviewing our latest valuation report, High Liner Foods' share price might be too pessimistic.

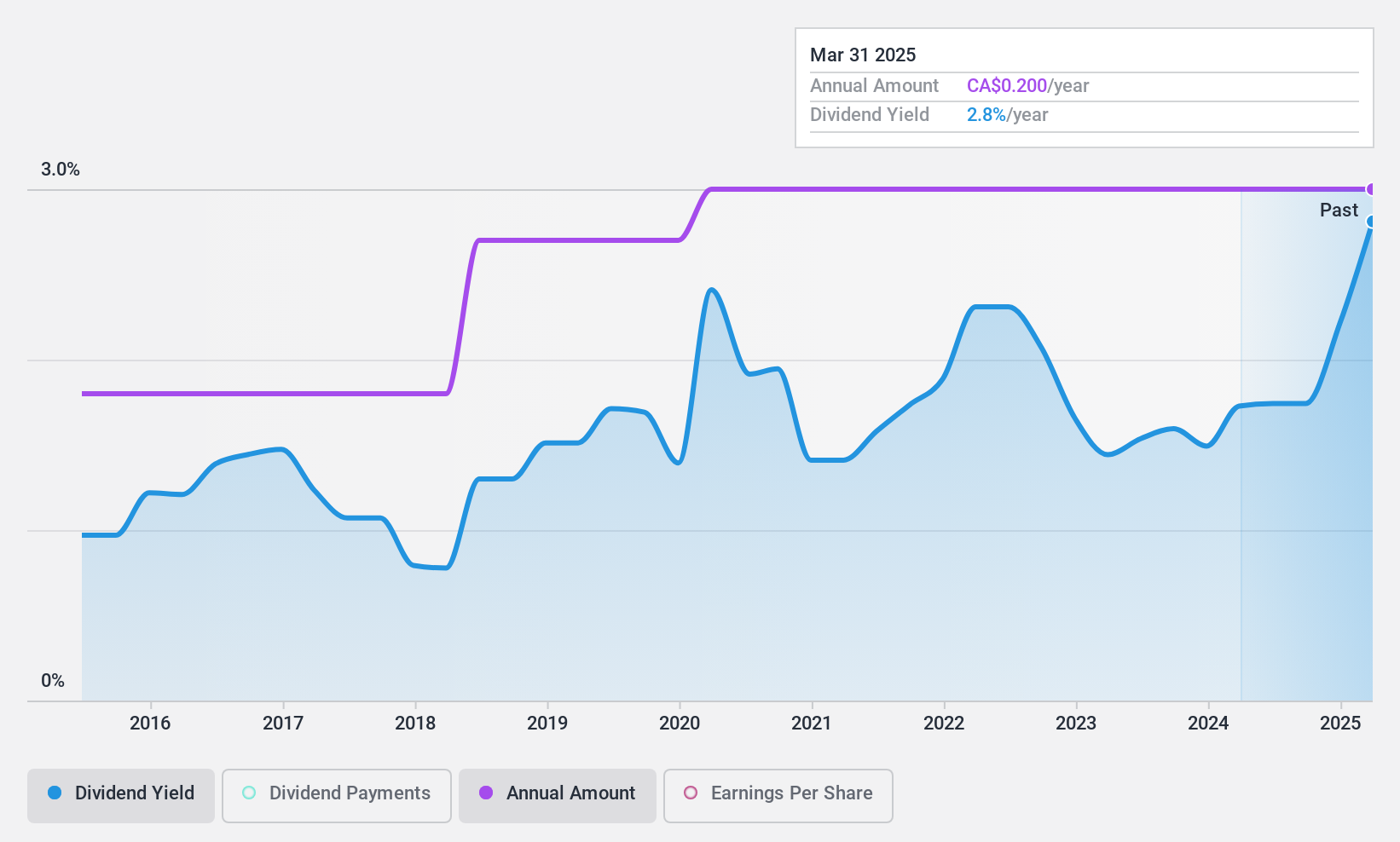

Martinrea International (TSX:MRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Martinrea International Inc. designs, develops, manufactures, and sells engineered lightweight structures and propulsion systems for the automotive sector across North America, Europe, and internationally with a market cap of CA$492.77 million.

Operations: Martinrea International Inc. generates its revenue primarily from the Auto Parts & Accessories segment, amounting to CA$5.01 billion.

Dividend Yield: 3%

Martinrea International's dividend yield of 3.04% is lower than top Canadian dividend payers, but its payments are well-covered by cash flows with a low payout ratio of 9.7%. Despite recent net losses and high debt, dividends have been stable over the past decade. The company is trading significantly below its estimated fair value and has completed a substantial share buyback program, indicating efforts to enhance shareholder value amidst challenging financial performance.

- Navigate through the intricacies of Martinrea International with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Martinrea International is trading behind its estimated value.

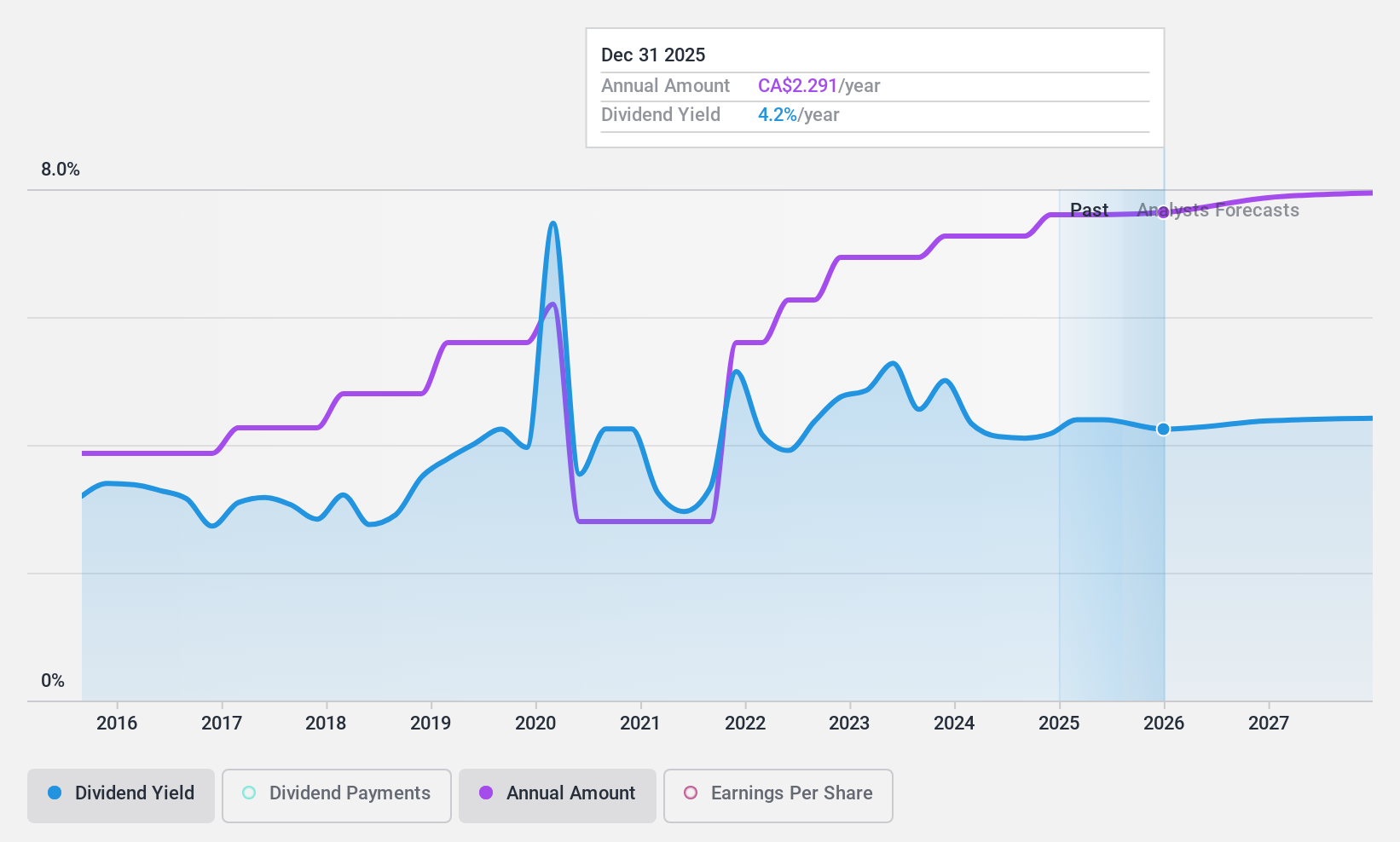

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations in Canada, the United States, and internationally, and has a market cap of CA$58.47 billion.

Operations: Suncor Energy Inc.'s revenue is primarily derived from its Oil Sands segment at CA$25.62 billion, Refining and Marketing at CA$31.34 billion, and Exploration and Production at CA$2.25 billion.

Dividend Yield: 4.8%

Suncor Energy's dividend yield of 4.84% lags behind top Canadian payers, yet dividends are well-supported by a cash payout ratio of 29.8%. Despite past volatility in payments, the company maintains a sustainable payout ratio of 46.7%. Recent share buybacks totaling CAD 3.26 billion signal shareholder value focus, though earnings have declined significantly from CAD 2.82 billion to CAD 818 million year-over-year in Q4 2024, highlighting potential challenges for future dividend stability.

- Unlock comprehensive insights into our analysis of Suncor Energy stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Suncor Energy is priced lower than what may be justified by its financials.

Make It Happen

- Embark on your investment journey to our 28 Top TSX Dividend Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SU

Suncor Energy

Operates as an integrated energy company in Canada, the United States, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives