High Liner Foods (TSE:HLF) Will Pay A Larger Dividend Than Last Year At $0.13

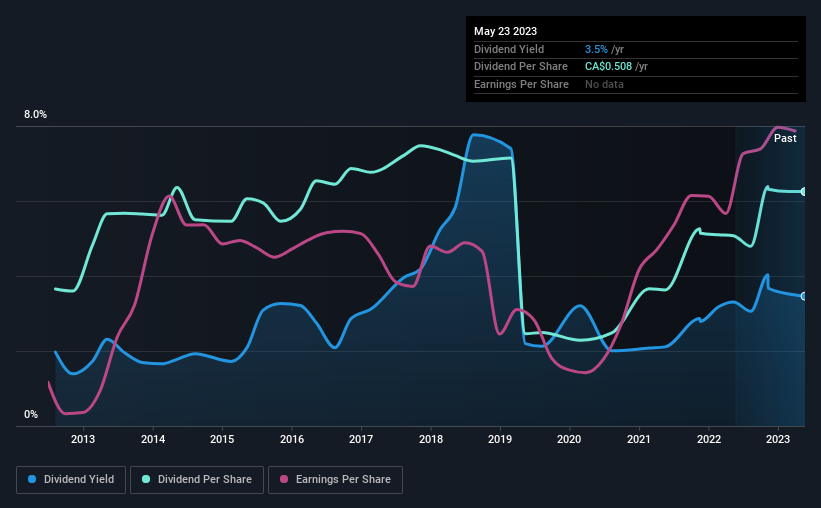

High Liner Foods Incorporated (TSE:HLF) will increase its dividend from last year's comparable payment on the 15th of June to $0.13. This will take the annual payment to 3.5% of the stock price, which is above what most companies in the industry pay.

Check out our latest analysis for High Liner Foods

High Liner Foods' Dividend Is Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Prior to this announcement, High Liner Foods' earnings easily covered the dividend, but free cash flows were negative. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

If the trend of the last few years continues, EPS will grow by 11.4% over the next 12 months. Assuming the dividend continues along recent trends, we think the payout ratio could be 27% by next year, which is in a pretty sustainable range.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. The annual payment during the last 10 years was $0.22 in 2013, and the most recent fiscal year payment was $0.376. This works out to be a compound annual growth rate (CAGR) of approximately 5.5% a year over that time. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. High Liner Foods has impressed us by growing EPS at 11% per year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

In Summary

Overall, we always like to see the dividend being raised, but we don't think High Liner Foods will make a great income stock. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 2 warning signs for High Liner Foods (1 is a bit unpleasant!) that you should be aware of before investing. Is High Liner Foods not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if High Liner Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HLF

High Liner Foods

Processes and markets prepared and packaged frozen seafood products in North America.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives