- Canada

- /

- Metals and Mining

- /

- TSX:SIL

Undiscovered Gems In Canada For November 2024

Reviewed by Simply Wall St

In the wake of a decisive U.S. election outcome, Canadian markets are experiencing renewed optimism, with the TSX reaching record highs alongside its American counterparts. As investors navigate this post-election landscape, attention turns to long-term fundamentals and identifying promising opportunities within Canada's small-cap sector. A good stock in this environment often displays strong fundamentals and potential for growth, making it well-positioned to benefit from favorable economic conditions and market sentiment shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.24% | 12.63% | 23.89% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Maxim Power | 25.01% | 13.56% | 17.14% | ★★★★★☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Corby Spirit and Wine | 75.89% | 5.97% | -5.75% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.39% | 46.03% | ★★★★☆☆ |

| Genesis Land Development | 47.40% | 28.61% | 52.30% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Corby Spirit and Wine (TSX:CSW.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Corby Spirit and Wine Limited, along with its subsidiaries, engages in the production, marketing, and importation of spirits, wines, and ready-to-drink cocktails across Canada, the United States, the United Kingdom, and other international markets with a market cap of CA$352.95 million.

Operations: Corby Spirit and Wine generates revenue primarily from Case Goods, contributing CA$198.75 million, followed by Commissions at CA$26.59 million.

Corby Spirit and Wine, a notable player in Canada's beverage industry, has shown resilience with earnings growth of 8.9% over the past year, outpacing the industry average. Despite a high net debt to equity ratio of 58.3%, their interest payments are well covered by EBIT at 7.2x coverage, indicating strong financial management. The company's price-to-earnings ratio stands attractively at 14.8x compared to the industry's 25.8x average. Recently, Corby launched a new RTD product line in collaboration with Ocean Spray®, potentially boosting market presence and consumer engagement across Canada by Spring 2025.

- Get an in-depth perspective on Corby Spirit and Wine's performance by reading our health report here.

Evaluate Corby Spirit and Wine's historical performance by accessing our past performance report.

SilverCrest Metals (TSX:SIL)

Simply Wall St Value Rating: ★★★★★★

Overview: SilverCrest Metals Inc. focuses on acquiring, exploring, and developing precious metal properties in Mexico with a market capitalization of CA$2.13 billion.

Operations: SilverCrest Metals generates revenue primarily from its Las Chispas project, amounting to $261.54 million.

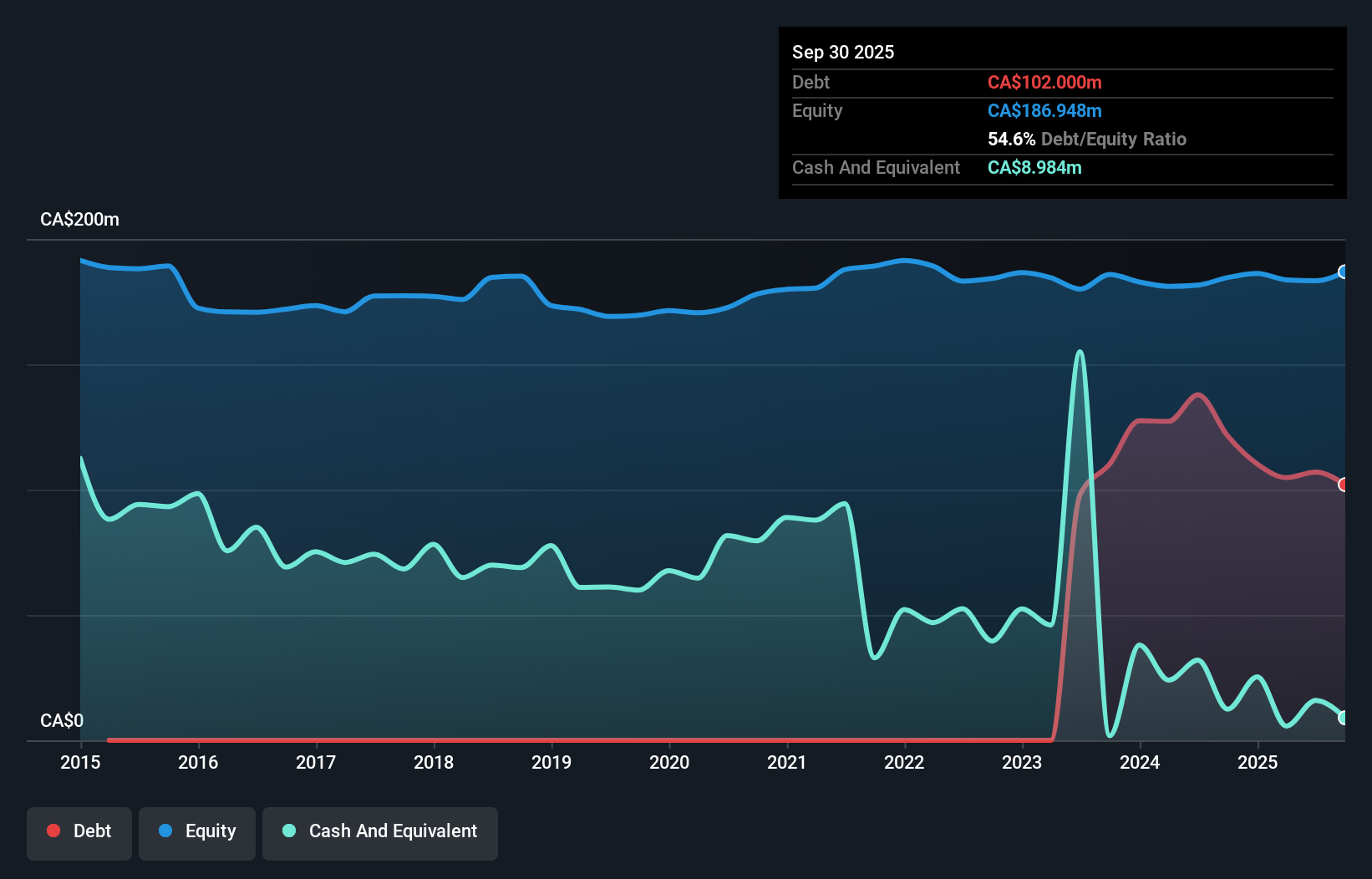

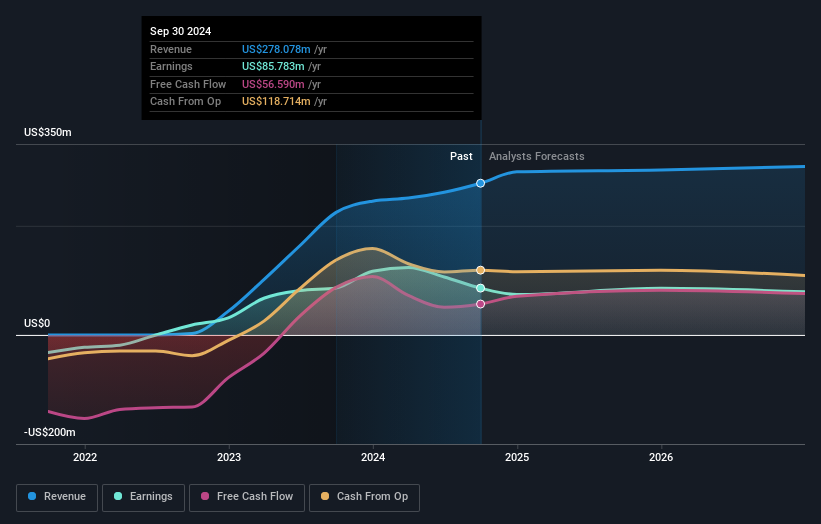

SilverCrest Metals, a nimble player in the mining sector, has demonstrated robust earnings growth of 30.6% over the past year, outpacing its industry peers. Despite having no debt for five years and maintaining high-quality earnings, future projections suggest an average annual decline of 19.2% in earnings over the next three years. Recent production results show a slight dip with gold recovery at 14,928 oz compared to last year's 15,700 oz and silver recovery at 1.41 million oz down from 1.49 million oz; however, ore mined increased significantly to 124,229 tonnes from last year's 83,800 tonnes. Notably poised for transformation through Coeur Mining's acquisition valued at approximately US$1.7 billion—equating to $11.34 per share—this transaction is anticipated to conclude by Q1 of next year pending regulatory approvals and shareholder consent.

- Dive into the specifics of SilverCrest Metals here with our thorough health report.

Understand SilverCrest Metals' track record by examining our Past report.

Alphamin Resources (TSXV:AFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Alphamin Resources Corp., along with its subsidiaries, focuses on the production and sale of tin concentrates and has a market capitalization of CA$1.61 billion.

Operations: Alphamin Resources generates revenue primarily through the production and sale of tin concentrates. The company has a market capitalization of CA$1.61 billion, reflecting its position in the tin industry.

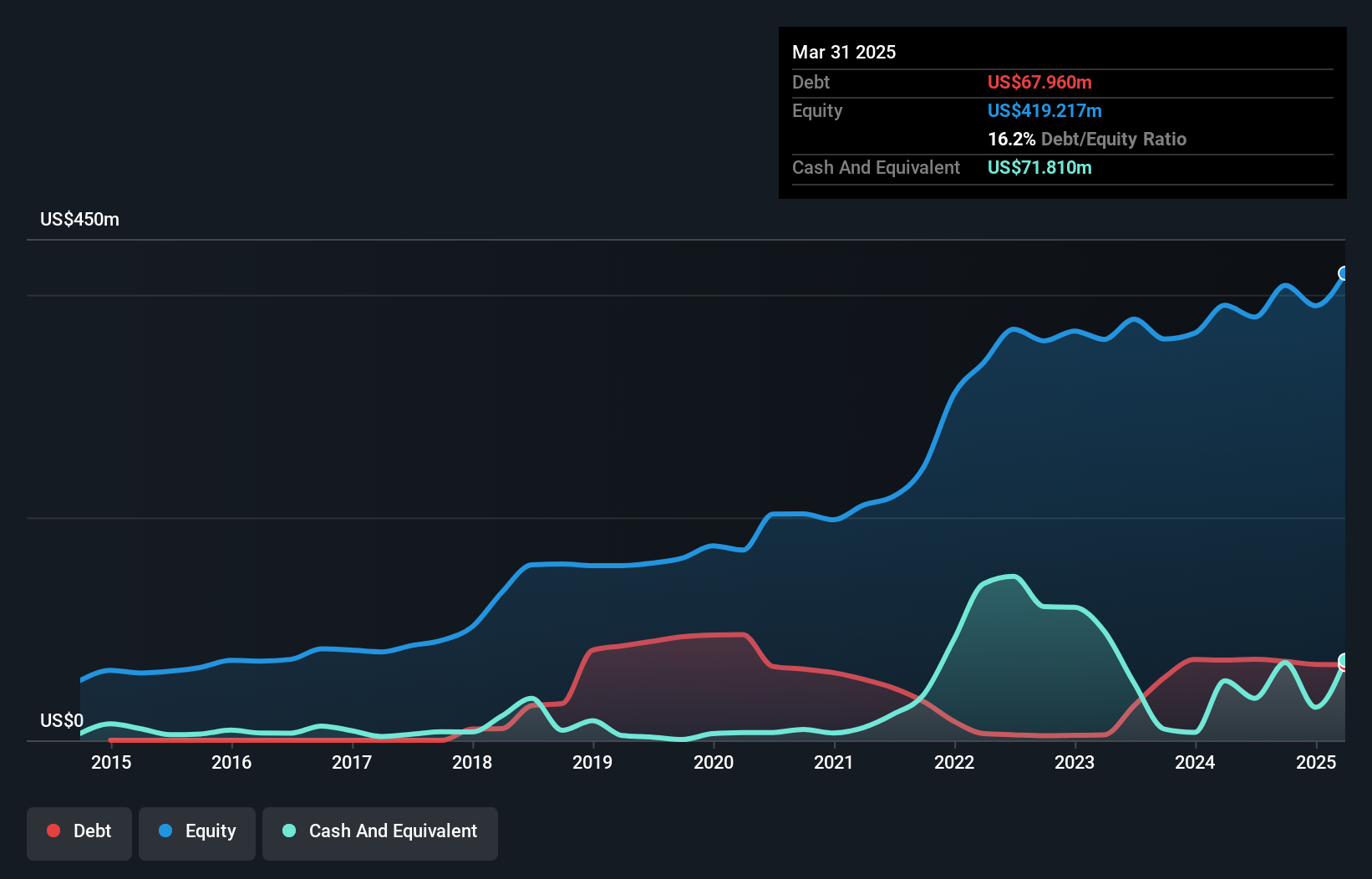

Alphamin Resources, a notable player in the mining sector, has demonstrated robust financial performance with earnings growth of 35.4% over the past year, outpacing industry averages. The company reported impressive sales of US$174.55 million for Q3 2024, a significant increase from US$80.78 million in the same period last year, alongside net income rising to US$32.94 million from US$14.73 million previously. Furthermore, Alphamin's net debt to equity ratio stands at a satisfactory 0.3%, reflecting strong financial health and effective debt management over recent years as it reduced from 56.8% to 17.3%.

Key Takeaways

- Investigate our full lineup of 43 TSX Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SIL

SilverCrest Metals

Engages in the acquiring, exploration, and development of precious metal properties in Mexico.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives