Andrew Peller's (TSE:ADW.A) Shareholders Will Receive A Bigger Dividend Than Last Year

Andrew Peller Limited (TSE:ADW.A) will increase its dividend on the 8th of October to CA$0.061. This will take the annual payment from 2.6% to 2.8% of the stock price, which is above what most companies in the industry pay.

View our latest analysis for Andrew Peller

Andrew Peller's Payment Has Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, Andrew Peller's earnings easily covered the dividend, but free cash flows were negative. Since a dividend means the company is paying out cash to investors, this could prove to be a problem in the future.

Over the next year, EPS is forecast to expand by 14.9%. If the dividend continues along recent trends, we estimate the payout ratio will be 48%, which is in the range that makes us comfortable with the sustainability of the dividend.

Andrew Peller Has A Solid Track Record

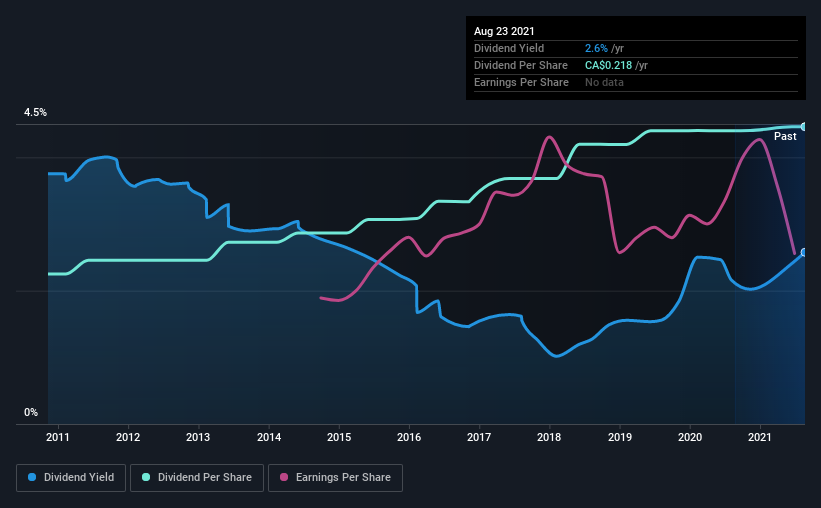

The company has an extended history of paying stable dividends. The dividend has gone from CA$0.11 in 2011 to the most recent annual payment of CA$0.22. This implies that the company grew its distributions at a yearly rate of about 7.1% over that duration. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

Andrew Peller May Find It Hard To Grow The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Unfortunately, Andrew Peller's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year.

Our Thoughts On Andrew Peller's Dividend

Overall, we always like to see the dividend being raised, but we don't think Andrew Peller will make a great income stock. While Andrew Peller is earning enough to cover the payments, the cash flows are lacking. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 2 warning signs for Andrew Peller you should be aware of, and 1 of them is significant. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ADW.A

Andrew Peller

Produces and markets wines and craft beverage alcohol products in Canada.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)