Greg Busby has been the CEO of WesCan Energy Corp. (CVE:WCE) since 2012, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for WesCan Energy.

See our latest analysis for WesCan Energy

Comparing WesCan Energy Corp.'s CEO Compensation With the industry

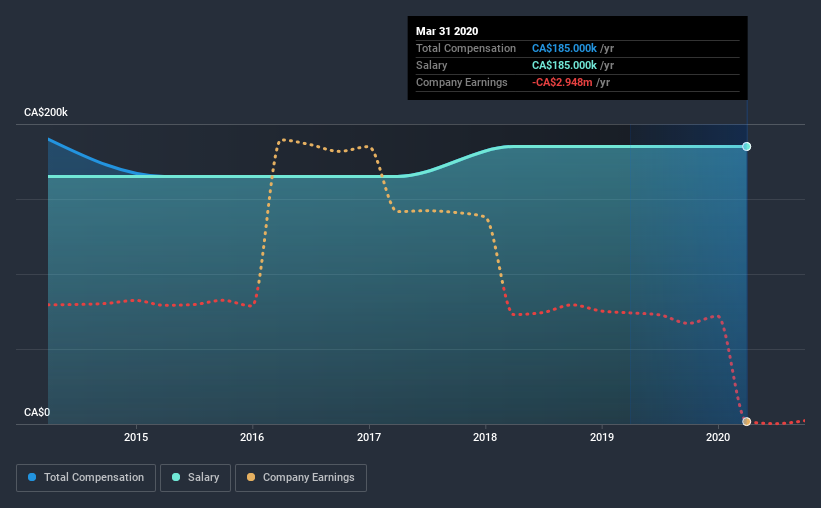

At the time of writing, our data shows that WesCan Energy Corp. has a market capitalization of CA$627k, and reported total annual CEO compensation of CA$185k for the year to March 2020. That is, the compensation was roughly the same as last year. Notably, the salary of CA$185k is the entirety of the CEO compensation.

For comparison, other companies in the industry with market capitalizations below CA$259m, reported a median total CEO compensation of CA$270k. In other words, WesCan Energy pays its CEO lower than the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$185k | CA$185k | 100% |

| Other | - | - | - |

| Total Compensation | CA$185k | CA$185k | 100% |

Speaking on an industry level, nearly 45% of total compensation represents salary, while the remainder of 55% is other remuneration. On a company level, WesCan Energy prefers to reward its CEO through a salary, opting not to pay Greg Busby through non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

WesCan Energy Corp.'s Growth

Over the last three years, WesCan Energy Corp. has shrunk its earnings per share by 101% per year. It saw its revenue drop 39% over the last year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has WesCan Energy Corp. Been A Good Investment?

With a three year total loss of 50% for the shareholders, WesCan Energy Corp. would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

WesCan Energy rewards its CEO solely through a salary, ignoring non-salary benefits completely. As we noted earlier, WesCan Energy pays its CEO lower than the norm for similar-sized companies belonging to the same industry. EPS growth has failed to impress us, and the same can be said about shareholder returns. We can't say the CEO compensation is high, but shareholders will be cold to a bump at this stage, considering negative investor returns.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 5 warning signs for WesCan Energy that investors should look into moving forward.

Important note: WesCan Energy is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade WesCan Energy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WesCan Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:WCE

WesCan Energy

A junior public resource company, engages in the development, exploration, and production of oil and gas properties and reserves in Canada and the United States.

Slight risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026