- Canada

- /

- Oil and Gas

- /

- TSXV:RZE.H

We Think The Compensation For Razor Energy Corp.'s (CVE:RZE) CEO Looks About Right

Under the guidance of CEO Doug Bailey, Razor Energy Corp. (CVE:RZE) has performed reasonably well recently. As shareholders go into the upcoming AGM on 22 September 2022, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Here is our take on why we think the CEO compensation looks appropriate.

View our latest analysis for Razor Energy

How Does Total Compensation For Doug Bailey Compare With Other Companies In The Industry?

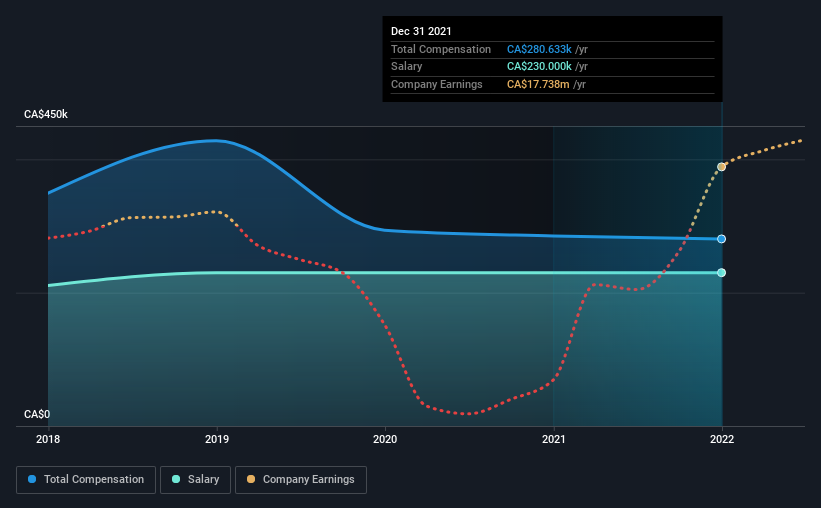

Our data indicates that Razor Energy Corp. has a market capitalization of CA$42m, and total annual CEO compensation was reported as CA$281k for the year to December 2021. That's mostly flat as compared to the prior year's compensation. We note that the salary portion, which stands at CA$230.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under CA$264m, the reported median total CEO compensation was CA$270k. So it looks like Razor Energy compensates Doug Bailey in line with the median for the industry. Moreover, Doug Bailey also holds CA$2.6m worth of Razor Energy stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | CA$230k | CA$230k | 82% |

| Other | CA$51k | CA$55k | 18% |

| Total Compensation | CA$281k | CA$285k | 100% |

On an industry level, around 36% of total compensation represents salary and 64% is other remuneration. Razor Energy pays out 82% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Razor Energy Corp.'s Growth

Razor Energy Corp.'s earnings per share (EPS) grew 67% per year over the last three years. It achieved revenue growth of 81% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Razor Energy Corp. Been A Good Investment?

Razor Energy Corp. has generated a total shareholder return of 15% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 6 warning signs for Razor Energy (2 don't sit too well with us!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:RZE.H

Razor Energy

Engages in the acquisition, exploration, development, and production of oil and natural gas properties in western Canada.

Moderate with proven track record.

Market Insights

Community Narratives