- Canada

- /

- Metals and Mining

- /

- TSXV:ZON

TSX Penny Stocks With Promise: 3 Picks Under CA$40M Market Cap

Reviewed by Simply Wall St

As 2025 unfolds, the Canadian market is navigating through a landscape shaped by new U.S. policies on energy, tariffs, and technology that have stirred both optimism and uncertainty. Amid these macroeconomic shifts, investors are increasingly exploring opportunities in penny stocks—smaller or newer companies that can offer significant growth potential when backed by solid financials. Despite the term being somewhat outdated, penny stocks continue to capture interest for their affordability and potential upside; here we examine three such stocks that stand out for their financial strength and promising prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.93 | CA$180.96M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.65 | CA$970.33M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.67 | CA$429.16M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.39 | CA$217.54M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$610.81M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.43 | CA$116.42M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.51 | CA$13.75M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.01 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 931 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Eagle Plains Resources (TSXV:EPL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eagle Plains Resources Ltd. is a junior resource company focused on acquiring, exploring, and developing mineral resource properties in Western Canada, with a market cap of CA$12.08 million.

Operations: The company generates CA$8.86 million in revenue from the exploration and development of mineral resources.

Market Cap: CA$12.08M

Eagle Plains Resources Ltd., with a market cap of CA$12.08 million, has recently reported earnings growth and achieved profitability, marking a significant milestone for the company. Its price-to-earnings ratio of 1.9x suggests it is valued below the Canadian market average, potentially indicating an undervalued opportunity within the penny stock segment. The company's debt-free status and strong return on equity at 45.1% further enhance its financial standing. Recent exploration results from its Snowstorm Property highlight promising mineralization prospects, while strategic partnerships with local communities underscore Eagle Plains' commitment to sustainable exploration practices in Western Canada.

- Navigate through the intricacies of Eagle Plains Resources with our comprehensive balance sheet health report here.

- Learn about Eagle Plains Resources' historical performance here.

ROK Resources (TSXV:ROK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ROK Resources Inc. is an independent oil and gas company operating in Canada with a market cap of CA$37.36 million.

Operations: The company's revenue is primarily derived from its Oil & Gas - Exploration & Production segment, which generated CA$75.50 million.

Market Cap: CA$37.36M

ROK Resources Inc., with a market cap of CA$37.36 million, has recently achieved profitability, reporting third-quarter revenue of CA$26.59 million and net income of CA$10.04 million. While earnings have shown improvement, the forecast indicates a potential decline in earnings over the next three years. The company's debt is well covered by operating cash flow at 203.6%, though insider selling has been significant recently. ROK's short-term assets exceed its short-term liabilities but fall short in covering long-term liabilities, suggesting some financial constraints despite recent positive performance indicators such as improved production figures and profitability milestones.

- Take a closer look at ROK Resources' potential here in our financial health report.

- Evaluate ROK Resources' prospects by accessing our earnings growth report.

Zonte Metals (TSXV:ZON)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zonte Metals Inc. focuses on the acquisition and exploration of mineral projects, with a market cap of CA$5.77 million.

Operations: Zonte Metals Inc. has not reported any revenue segments.

Market Cap: CA$5.77M

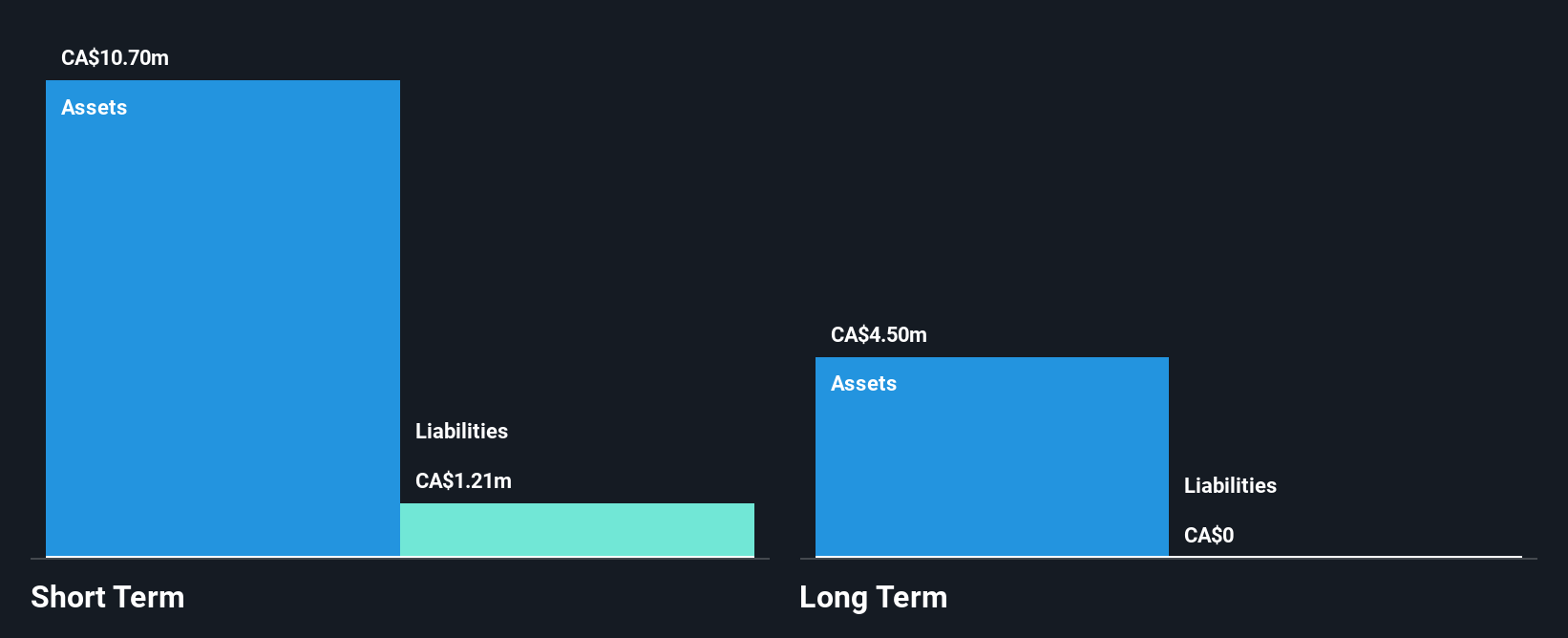

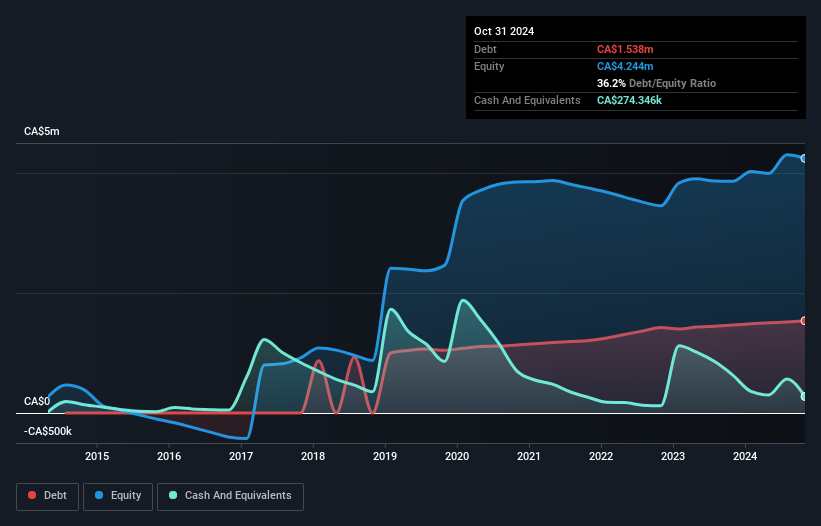

Zonte Metals Inc., with a market cap of CA$5.77 million, remains pre-revenue and unprofitable, facing increased losses over the past five years. The company has recently raised CA$255,900 through private placements to support its exploration activities. Despite a seasoned board of directors averaging 15.5 years in tenure, Zonte's short-term assets (CA$321.9K) do not cover its long-term liabilities (CA$1.5M). However, short-term liabilities are well-covered by current assets. The company's debt-to-equity ratio has improved over the past five years to 36.2%, yet it maintains high volatility compared to most Canadian stocks.

- Click to explore a detailed breakdown of our findings in Zonte Metals' financial health report.

- Explore historical data to track Zonte Metals' performance over time in our past results report.

Key Takeaways

- Investigate our full lineup of 931 TSX Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zonte Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZON

Zonte Metals

Engages in the acquisition and exploration of mineral projects.

Moderate risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)