We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. The flip side of that is that there are more than a few examples of insiders dumping stock prior to a period of weak performance. So shareholders might well want to know whether insiders have been buying or selling shares in Marksmen Energy Inc. (CVE:MAH).

What Is Insider Buying?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Harvard University study found that 'insider purchases earn abnormal returns of more than 6% per year'.

See our latest analysis for Marksmen Energy

Marksmen Energy Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider purchase was by insider Hans Koch for CA$100k worth of shares, at about CA$0.05 per share. That means that even when the share price was higher than CA$0.03 (the recent price), an insider wanted to purchase shares. It's very possible they regret the purchase, but it's more likely they are bullish about the company. We always take careful note of the price insiders pay when purchasing shares. As a general rule, we feel more positive about a stock if insiders have bought shares at above current prices, because that suggests they viewed the stock as good value, even at a higher price.

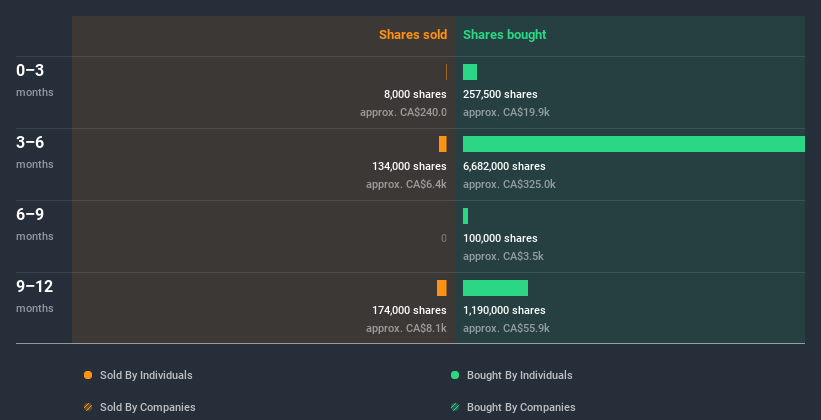

In the last twelve months insiders purchased 8.23m shares for CA$408k. But they sold 316.00k shares for CA$13k. In the last twelve months there was more buying than selling by Marksmen Energy insiders. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Marksmen Energy is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Have Marksmen Energy Insiders Traded Recently?

Over the last three months, we've seen a bit of insider buying at Marksmen Energy. They bought CA$11k worth in that time. However, Chief Financial Officer John McIntyre netted CA$240 for sales. It is nice to see that insiders have bought, but the quantum isn't large enough to get us excited.

Does Marksmen Energy Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Marksmen Energy insiders own about CA$2.1m worth of shares (which is 56% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Do The Marksmen Energy Insider Transactions Indicate?

We note a that there has been a bit of insider buying recently (but no selling). The net investment is not enough to encourage us much. But insiders have shown more of an appetite for the stock, over the last year. It would be great to see more insider buying, but overall it seems like Marksmen Energy insiders are reasonably well aligned (owning significant chunk of the company's shares) and optimistic for the future. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Case in point: We've spotted 5 warning signs for Marksmen Energy you should be aware of, and 3 of these are significant.

Of course Marksmen Energy may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Marksmen Energy, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Marksmen Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:MAH

Marksmen Energy

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in the United States and Canada.

Moderate with weak fundamentals.

Market Insights

Community Narratives