The Canadian market is navigating a period of economic adjustment, with the Bank of Canada cutting rates amid tariff uncertainties and a recent contraction in GDP. Despite these challenges, opportunities remain for investors seeking growth, particularly in sectors that can benefit from lower borrowing costs and positive real wages. While 'penny stocks' may seem like an outdated term, they continue to offer potential value by highlighting smaller or newer companies with strong financials; we've identified three such stocks that combine stability with the potential for significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.71 | CA$998.61M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.69 | CA$441.37M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.40 | CA$120.99M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$224.43M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.53 | CA$13.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$619.87M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.82 | CA$175.73M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.02 | CA$134.8M | ★★★★★☆ |

Click here to see the full list of 929 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Gear Energy (TSX:GXE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gear Energy Ltd. is a Canadian exploration and production company focused on acquiring, developing, and managing petroleum and natural gas properties, with a market cap of CA$131.79 million.

Operations: The company generates revenue of CA$131.65 million from its oil and gas exploration and production activities.

Market Cap: CA$131.79M

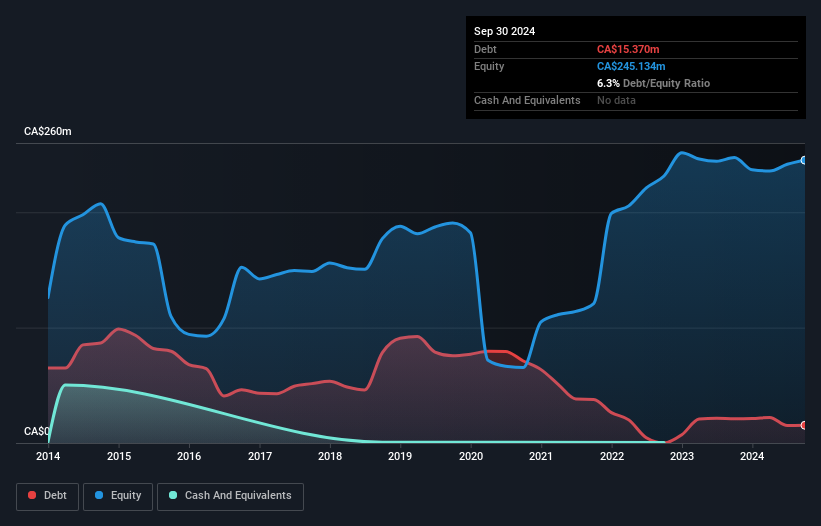

Gear Energy Ltd., with a market cap of CA$131.79 million, is undergoing significant changes as Cenovus Energy Inc. plans to acquire it for approximately CA$160 million. The acquisition deal offers Gear shareholders cash or shares in a new entity, subject to regulatory approvals and other conditions. Despite recent earnings showing stable revenue and net income compared to the previous year, Gear's profitability has been challenged by declining profit margins and negative earnings growth over the past year. However, its debt management remains strong with satisfactory coverage by operating cash flow and reduced debt levels over time.

- Navigate through the intricacies of Gear Energy with our comprehensive balance sheet health report here.

- Gain insights into Gear Energy's outlook and expected performance with our report on the company's earnings estimates.

Thinkific Labs (TSX:THNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Thinkific Labs Inc. develops, markets, and manages a cloud-based platform serving Canada, the United States, and international markets with a market cap of CA$211.65 million.

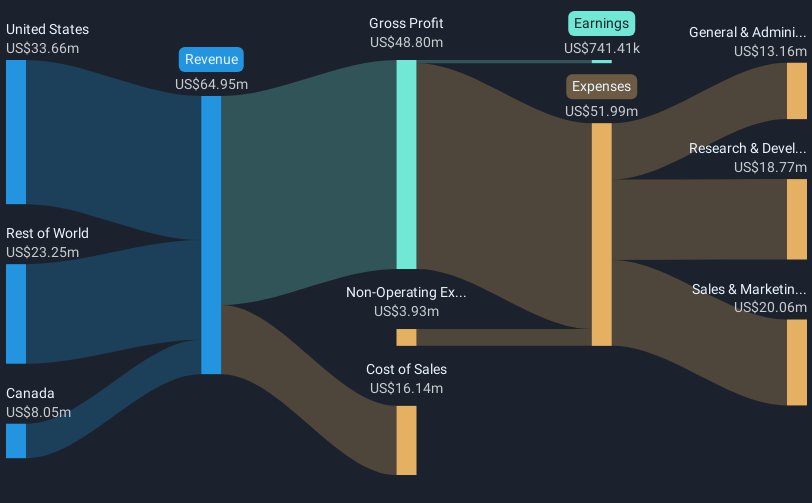

Operations: The company generates revenue of $64.95 million from the development, marketing, and support management of its cloud-based platform.

Market Cap: CA$211.65M

Thinkific Labs, with a market cap of CA$211.65 million, has shown promising developments in the penny stock space. The company reported revenue of US$17.2 million for Q3 2024, marking a substantial increase from the previous year and achieving net income after past losses. Recent AI-driven product enhancements aim to simplify digital entrepreneurship for its global user base, potentially boosting future growth prospects. Additionally, Thinkific's debt-free status and share repurchase program underscore financial stability and shareholder value focus. However, with limited management experience and forecasted earnings decline, investors should approach with cautious optimism.

- Click here and access our complete financial health analysis report to understand the dynamics of Thinkific Labs.

- Understand Thinkific Labs' earnings outlook by examining our growth report.

Lucero Energy (TSXV:LOU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lucero Energy Corp. is an independent oil company focused on acquiring, developing, and producing oil-weighted assets in the Bakken and Three Forks formations in North Dakota's Williston Basin, with a market cap of CA$280.57 million.

Operations: Lucero Energy generates revenue primarily from its oil and gas exploration and production operations, amounting to CA$148.21 million.

Market Cap: CA$280.57M

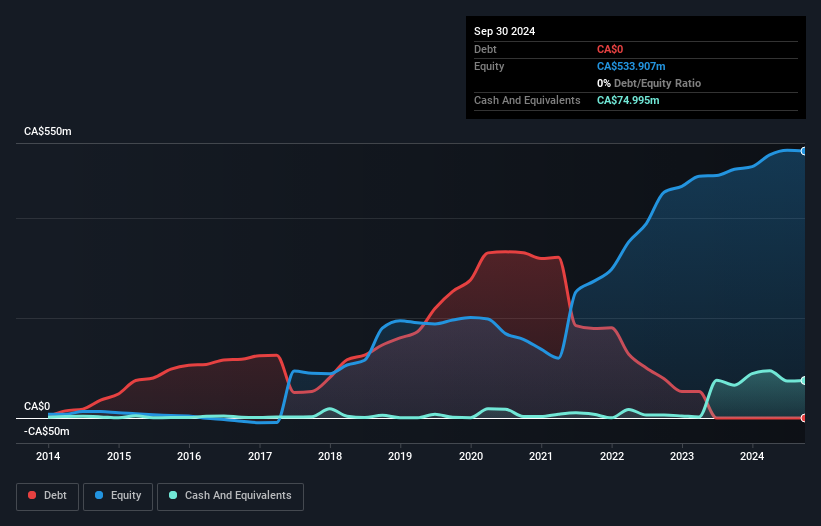

Lucero Energy, with a market cap of CA$280.57 million, is undergoing significant changes as it enters an all-stock acquisition agreement with Vitesse Energy valued at approximately US$230 million. Despite recent earnings declines and reduced oil production, Lucero maintains a stable financial position with no debt and assets exceeding liabilities. The company's management team and board are experienced, supporting strategic decisions during this transition. While its return on equity remains low at 7.5%, the acquisition could potentially enhance value for shareholders by improving financial metrics post-merger, pending necessary approvals expected by Q2 2025.

- Unlock comprehensive insights into our analysis of Lucero Energy stock in this financial health report.

- Examine Lucero Energy's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Reveal the 929 hidden gems among our TSX Penny Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thinkific Labs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:THNC

Thinkific Labs

Engages in the development, marketing, and support management of cloud-based platform in Canada, the United States, and internationally.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives