- Canada

- /

- Oil and Gas

- /

- TSXV:HME

Top 3 TSX Dividend Stocks To Consider

Reviewed by Simply Wall St

As we navigate the evolving political and economic landscape in Canada, marked by shifts in government leadership and central-bank policy adjustments, investors are reminded of the importance of focusing on market fundamentals rather than headlines. In this context, dividend stocks remain a compelling option for those seeking stability and income, offering potential opportunities to capitalize on market pullbacks while maintaining a diversified portfolio.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 6.91% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.75% | ★★★★★★ |

| Russel Metals (TSX:RUS) | 4.24% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.25% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.33% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.46% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.44% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.40% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.44% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.06% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top TSX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

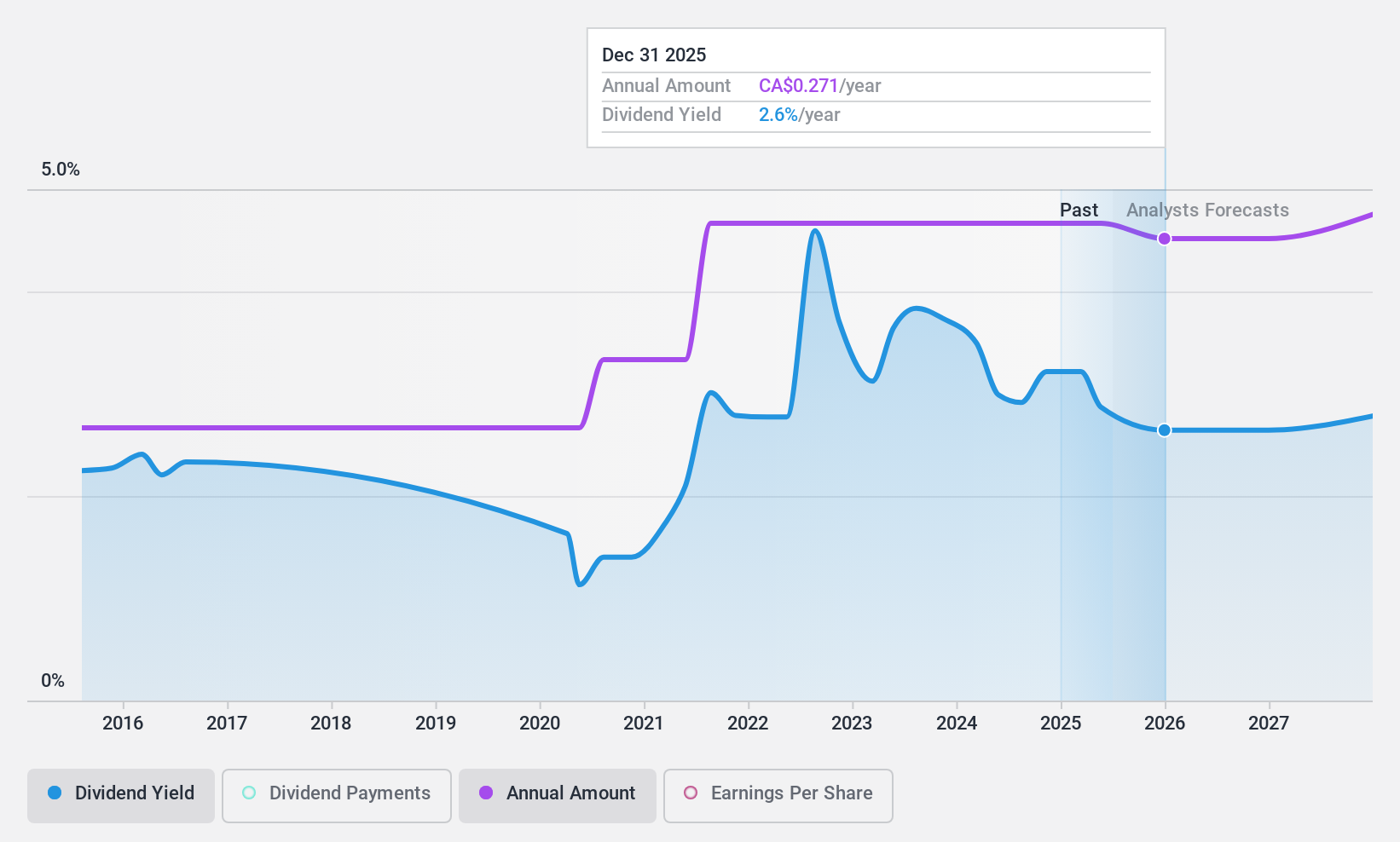

Centerra Gold (TSX:CG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Centerra Gold Inc. is a gold mining company involved in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally, with a market cap of CA$1.78 billion.

Operations: Centerra Gold Inc. generates revenue from its Öksüt ($559.44 million), Molybdenum ($232.42 million), and Mount Milligan ($460.21 million) segments.

Dividend Yield: 3.3%

Centerra Gold's dividend payments have been volatile and unreliable over the past decade, despite recent increases. The dividends are well-covered by earnings and cash flows, with payout ratios of 43.7% and 20.2%, respectively. Currently trading at a significant discount to its estimated fair value, Centerra offers a modest dividend yield of 3.33%, lower than top-tier Canadian payers. Recent buyback activities could potentially enhance shareholder value amid ongoing drilling projects in Nevada.

- Dive into the specifics of Centerra Gold here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Centerra Gold is trading behind its estimated value.

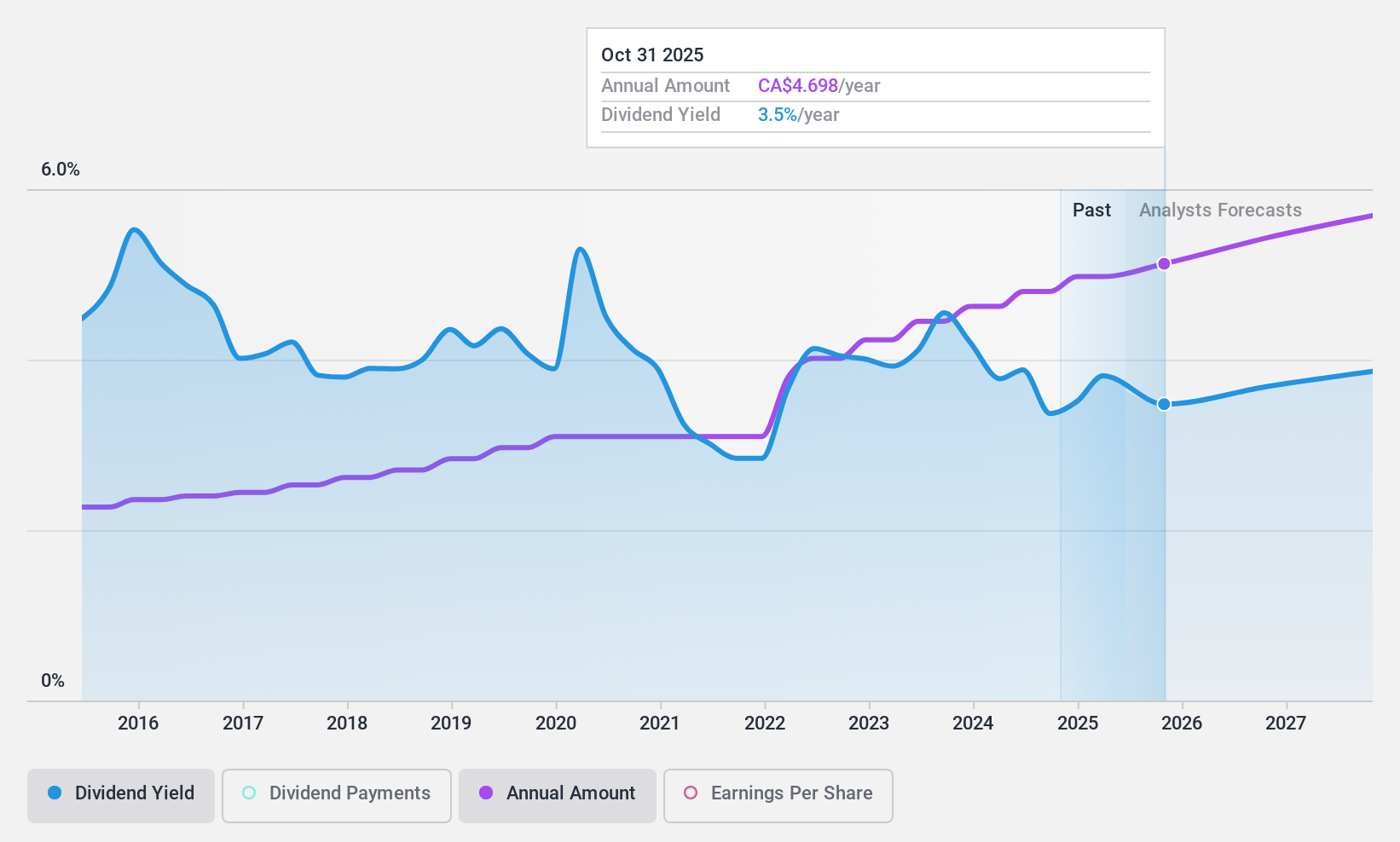

National Bank of Canada (TSX:NA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada offers financial services to individuals, businesses, institutional clients, and governments both domestically and internationally, with a market cap of CA$45.16 billion.

Operations: National Bank of Canada's revenue is primarily derived from its Personal and Commercial segment at CA$4.34 billion, followed by Financial Markets at CA$2.98 billion, Wealth Management at CA$2.79 billion, and U.S. Specialty Finance and International at CA$1.23 billion.

Dividend Yield: 3.4%

National Bank of Canada offers a reliable dividend, increasing steadily over the past decade. With a current yield of 3.44%, it is lower than top-tier Canadian payers but supported by a low payout ratio of 40.1%, ensuring sustainability. Recent earnings growth and strategic leadership changes, including the integration of Canadian Western Bank, may bolster future performance. The bank's fixed-income offerings and preferred stock buybacks reflect its proactive capital management approach.

- Get an in-depth perspective on National Bank of Canada's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that National Bank of Canada is priced lower than what may be justified by its financials.

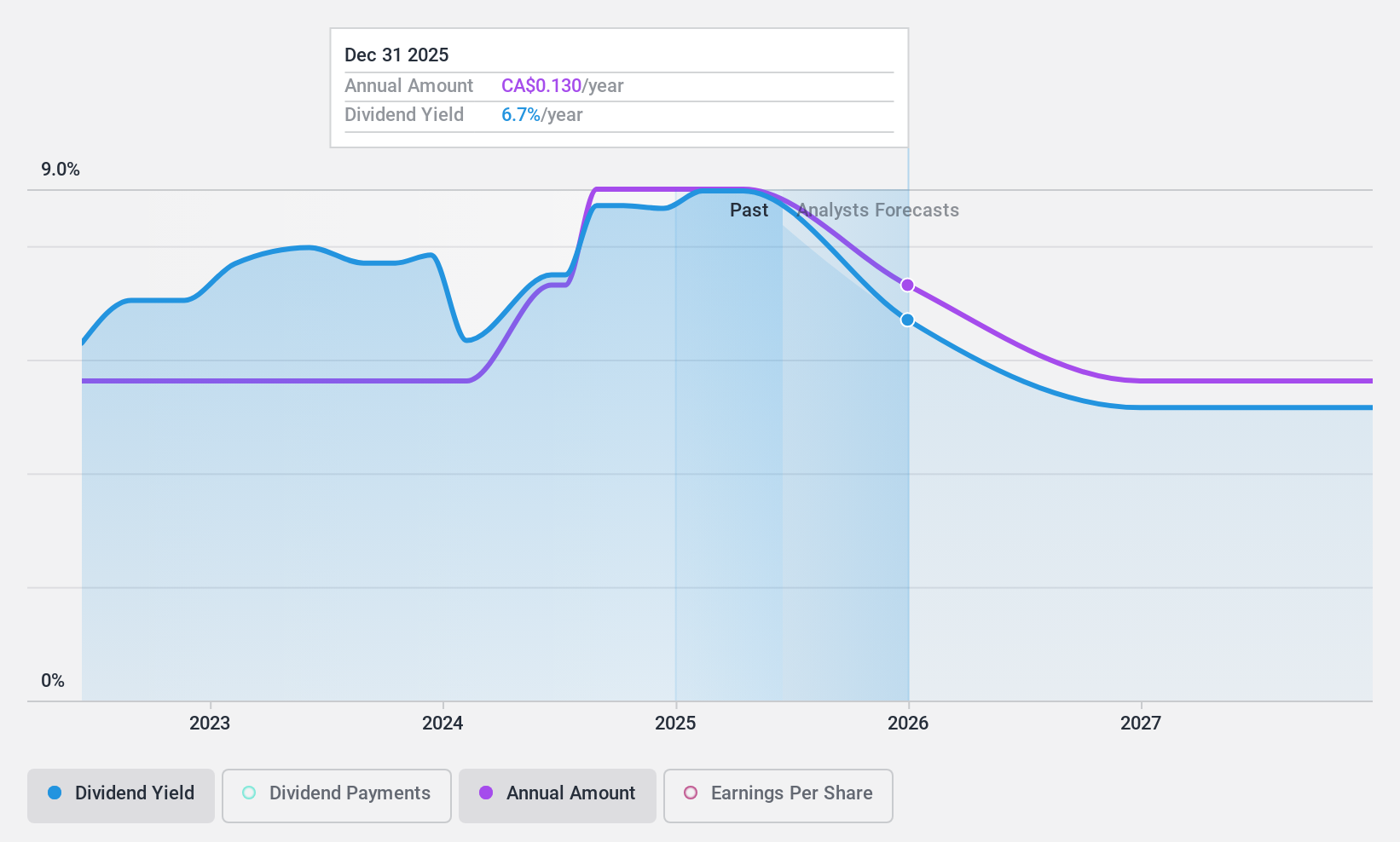

Hemisphere Energy (TSXV:HME)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hemisphere Energy Corporation acquires, explores, develops, and produces petroleum and natural gas interests in Canada with a market cap of CA$180.43 million.

Operations: Hemisphere Energy Corporation generates revenue of CA$78.57 million from its petroleum and natural gas interests in Canada.

Dividend Yield: 8.6%

Hemisphere Energy's dividends are well-covered by earnings and cash flows, with a payout ratio of 33.2% and a cash payout ratio of 57.6%. Despite only three years of dividend history, payments have been stable. The company trades at an attractive price-to-earnings ratio of 6.1x, below the Canadian market average, offering a high yield in the top quartile at 8.65%. Recent financials show steady revenue growth and consistent profitability improvement.

- Take a closer look at Hemisphere Energy's potential here in our dividend report.

- Upon reviewing our latest valuation report, Hemisphere Energy's share price might be too pessimistic.

Next Steps

- Get an in-depth perspective on all 26 Top TSX Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Hemisphere Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HME

Hemisphere Energy

Acquires, explores, develops, and produces petroleum and natural gas properties in Canada.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion