- Canada

- /

- Consumer Services

- /

- TSXV:XX

3 TSX Penny Stocks With Market Caps Over CA$20M To Consider

Reviewed by Simply Wall St

Recent developments in monetary policy, including the Bank of Canada's rate cuts and the Federal Reserve's cautious stance on future adjustments, have created a complex landscape for investors. Amid these shifts, penny stocks—though an older term—remain relevant as they often represent smaller or newer companies with potential for growth. This article will explore three TSX-listed penny stocks that combine solid financials with promising opportunities, offering a chance to uncover hidden value in quality investments.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.51 | CA$63.22M | ✅ 3 ⚠️ 4 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.25 | CA$1.96M | ✅ 2 ⚠️ 4 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.95 | CA$625.38M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.93 | CA$18.83M | ✅ 2 ⚠️ 4 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.31 | CA$369.82M | ✅ 2 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.84 | CA$202.01M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$187.48M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.49 | CA$8.85M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 425 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Dundee (TSX:DC.A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dundee Corporation is a publicly owned investment manager with a market cap of CA$272.59 million.

Operations: The company generates revenue primarily from its Mining Services segment, which amounts to CA$1.46 million.

Market Cap: CA$272.59M

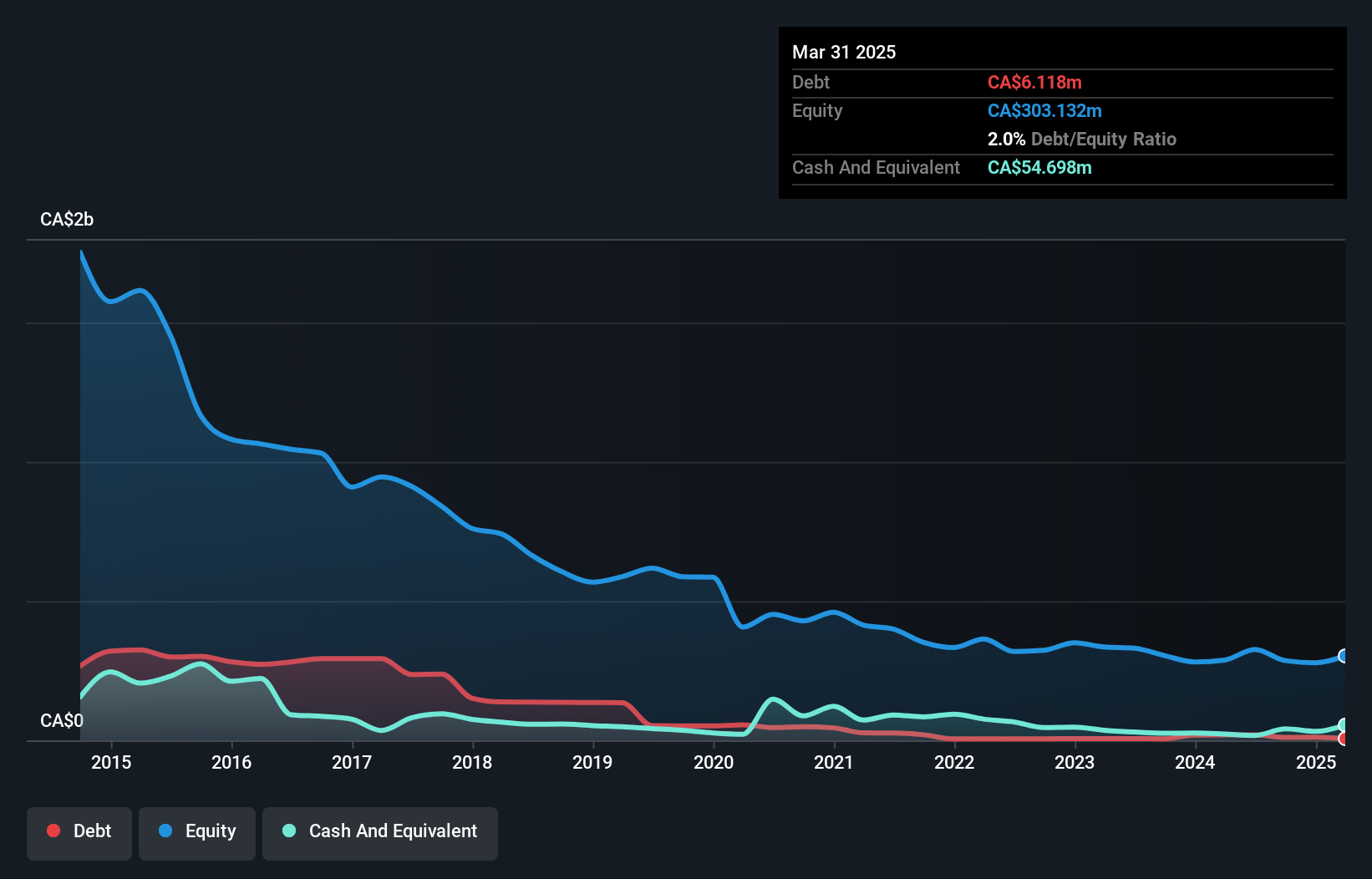

Dundee Corporation's recent financial performance highlights a mixed picture for investors interested in penny stocks. The company is pre-revenue, with sales of CA$0.76 million for the second quarter of 2025, down from CA$1.23 million the previous year. Despite this, Dundee maintains more cash than total debt and has reduced its debt-to-equity ratio significantly over five years. While earnings grew by 38.8% last year, this was below its five-year average growth rate of 52.3%. A large one-off gain impacted recent results, and operating cash flow remains negative, indicating challenges in covering debt through operations alone.

- Get an in-depth perspective on Dundee's performance by reading our balance sheet health report here.

- Gain insights into Dundee's past trends and performance with our report on the company's historical track record.

Hemisphere Energy (TSXV:HME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hemisphere Energy Corporation acquires, explores, develops, and produces petroleum and natural gas properties in Canada with a market cap of CA$187.48 million.

Operations: The company generates revenue of CA$82.14 million from its petroleum and natural gas interests in Canada.

Market Cap: CA$187.48M

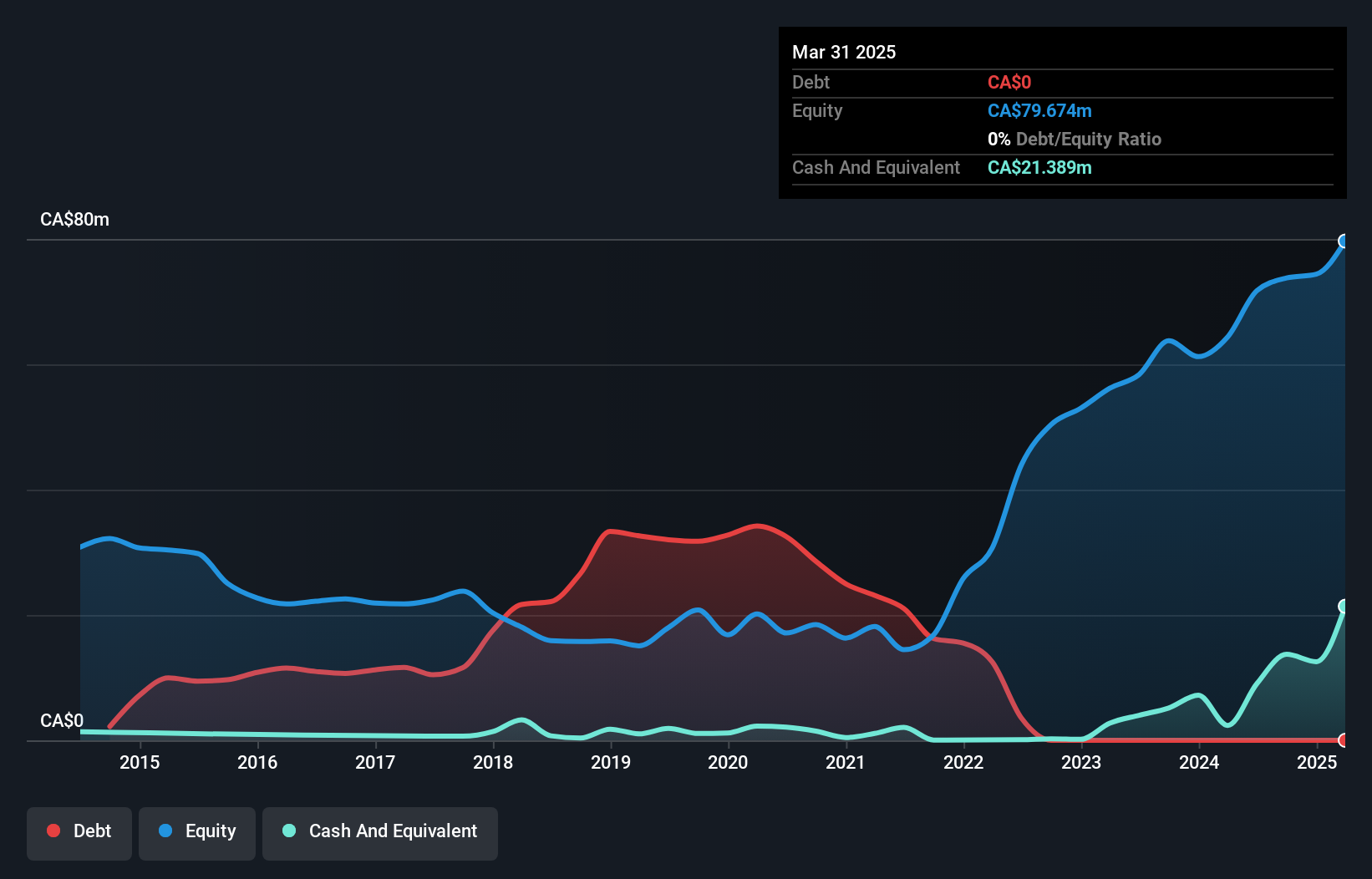

Hemisphere Energy's recent performance underscores its position within the penny stock segment, balancing growth and challenges. Despite a decline in quarterly revenue to CA$19.45 million from CA$22.66 million a year ago, Hemisphere maintains profitability with net income of CA$7.05 million and offers dividends, including a special dividend reflecting financial strength. The company is debt-free, enhancing its financial stability and reducing risk for investors concerned about leverage. However, while earnings have grown significantly over five years at 48.2% annually, recent growth has slowed to 7.8%, trailing industry averages slightly but still supported by high-quality earnings and strong return on equity at 40%.

- Take a closer look at Hemisphere Energy's potential here in our financial health report.

- Assess Hemisphere Energy's future earnings estimates with our detailed growth reports.

Avante (TSXV:XX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avante Corp. is engaged in developing security technologies, products, and solutions across Canada, the United States, Israel, Egypt, Italy, Kuwait, the United Kingdom, and other international markets with a market cap of CA$21.85 million.

Operations: The company's revenue segments include CA$4.30 million from Nssg and CA$29.68 million from Avante Security.

Market Cap: CA$21.85M

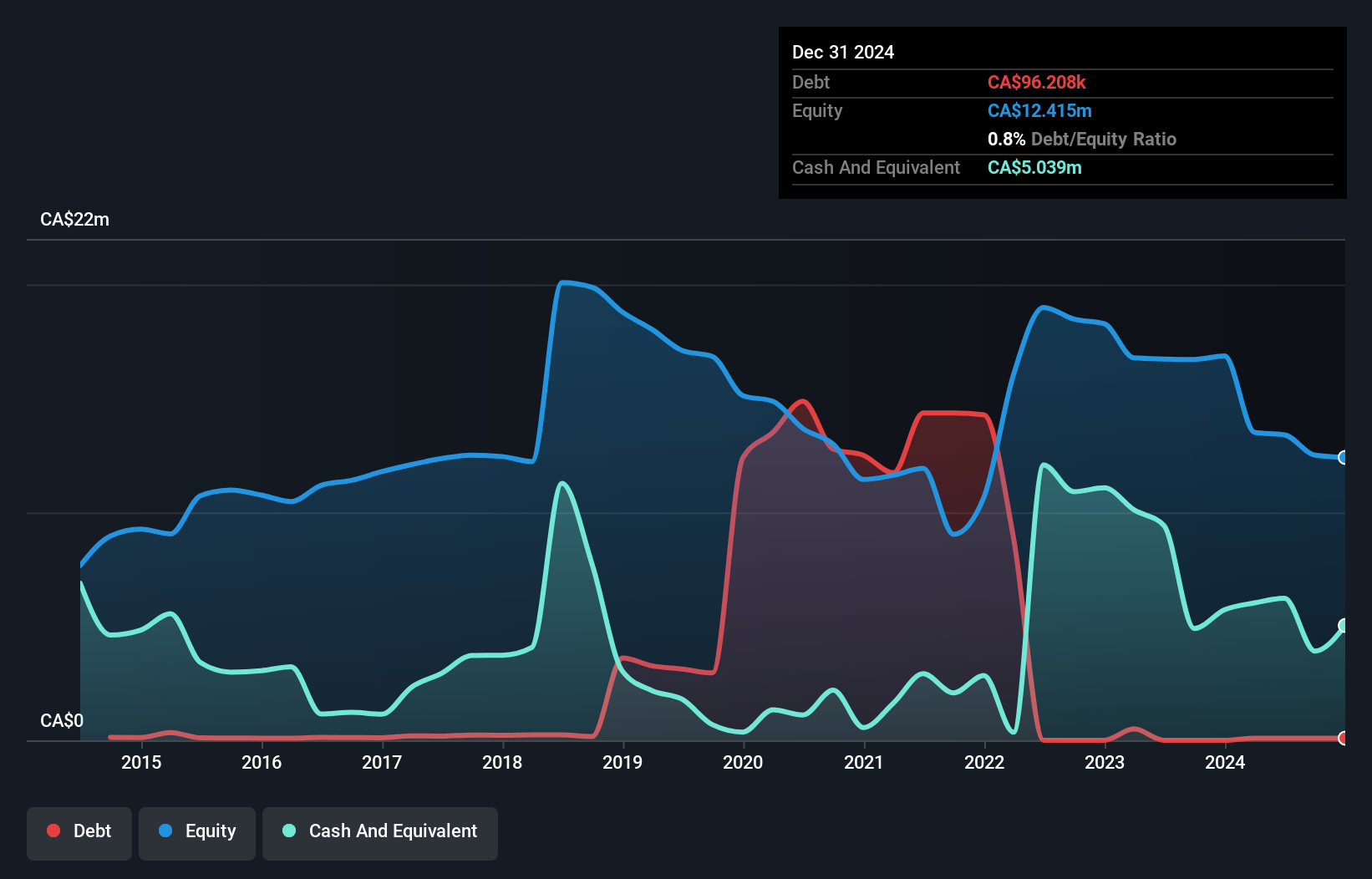

Avante Corp.'s financial landscape highlights its potential within the penny stock market, marked by a mix of growth and ongoing challenges. The company reported annual sales of CA$33.76 million, up from CA$24.95 million, but remains unprofitable with a net loss of CA$2.03 million. Despite this, Avante has reduced its debt significantly over the past five years and maintains more cash than total debt, suggesting financial prudence. Its short-term assets comfortably cover liabilities, while management emphasizes recurring revenue growth for Fiscal 2026 as part of their long-term objectives amidst stable weekly volatility at 7%.

- Click to explore a detailed breakdown of our findings in Avante's financial health report.

- Learn about Avante's future growth trajectory here.

Where To Now?

- Take a closer look at our TSX Penny Stocks list of 425 companies by clicking here.

- Interested In Other Possibilities? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:XX

Avante

Develops security technologies, products, and solutions in Canada, the United States, Israel, Egypt, Italy, Kuwait, the United Kingdom, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion