- Canada

- /

- Oil and Gas

- /

- TSXV:FUU

TSX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As 2025 begins, the Canadian market is navigating a landscape marked by fluctuating bond yields and cautious optimism about economic growth. Against this backdrop, penny stocks—though an older term—remain relevant for investors seeking opportunities in smaller or newer companies. These stocks can offer surprising value when backed by strong financials, and we'll highlight several that show promise for long-term potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Silvercorp Metals (TSX:SVM) | CA$4.44 | CA$965.98M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.23 | CA$397.24M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.43 | CA$123.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.75 | CA$687.7M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.22 | CA$218.52M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$32.24M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$178.64M | ★★★★★☆ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.02 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 933 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Blue Lagoon Resources (CNSX:BLLG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blue Lagoon Resources Inc. is involved in the acquisition, exploration, and evaluation of mineral properties in Canada with a market cap of CA$16.46 million.

Operations: Currently, there are no reported revenue segments for Blue Lagoon Resources Inc.

Market Cap: CA$16.46M

Blue Lagoon Resources Inc., with a market cap of CA$16.46 million, is pre-revenue and involved in mineral exploration. The company recently received a draft mine permit for its Dome Mountain Gold Project, marking progress toward operational status. Despite significant potential at Dome Mountain, Blue Lagoon remains unprofitable with increased losses over five years. Its short-term assets cover short-term liabilities but not long-term ones, and it has no debt. Recent capital raised through private placements may extend its cash runway beyond one month. Share price volatility remains high compared to most Canadian stocks, reflecting inherent risks in penny stock investments.

- Navigate through the intricacies of Blue Lagoon Resources with our comprehensive balance sheet health report here.

- Examine Blue Lagoon Resources' past performance report to understand how it has performed in prior years.

CanAsia Energy (TSXV:CEC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CanAsia Energy Corp. is a junior oil and gas company with a market cap of CA$11.28 million.

Operations: No revenue segments have been reported.

Market Cap: CA$11.28M

CanAsia Energy Corp., with a market cap of CA$11.28 million, has recently transitioned to profitability, reporting net income of CA$1.95 million for the first nine months of 2024. Despite being pre-revenue with less than US$1m in revenue, it maintains a debt-free balance sheet and covers both short- and long-term liabilities with its CA$7.8 million in short-term assets. The company's Price-to-Earnings ratio is slightly below the Canadian market average, indicating potential value despite high share price volatility over recent months. However, its board's lack of experience could pose governance challenges moving forward.

- Click here and access our complete financial health analysis report to understand the dynamics of CanAsia Energy.

- Assess CanAsia Energy's previous results with our detailed historical performance reports.

F3 Uranium (TSXV:FUU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: F3 Uranium Corp. focuses on acquiring and exploring mineral properties in Canada, with a market cap of CA$136.14 million.

Operations: Currently, there are no revenue segments reported for the company.

Market Cap: CA$136.14M

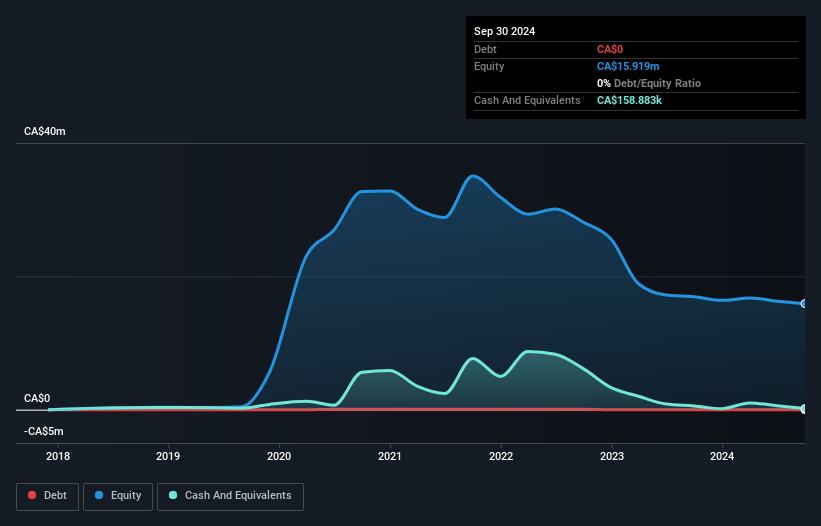

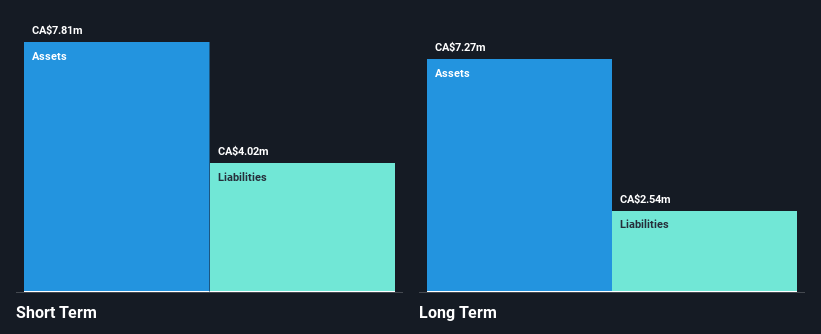

F3 Uranium Corp., with a market cap of CA$136.14 million, is currently pre-revenue and unprofitable, reporting a net loss of CA$5.85 million for the first quarter ending September 30, 2024. The company has focused on its Patterson Lake North property in the Athabasca Basin, announcing promising assay results from its ongoing drill program. Recent capital raised through private placements bolsters its short-term financial position, with short-term assets exceeding liabilities by CA$24.1 million. However, both management and board members have limited tenure averaging 1.8 years, potentially affecting strategic consistency and governance stability.

- Unlock comprehensive insights into our analysis of F3 Uranium stock in this financial health report.

- Understand F3 Uranium's track record by examining our performance history report.

Where To Now?

- Discover the full array of 933 TSX Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:FUU

F3 Uranium

Engages in the acquisition and exploration of mineral properties in Canada.

Excellent balance sheet low.