- Canada

- /

- Oil and Gas

- /

- TSXV:ALV

Assessing Alvopetro Energy (TSXV:ALV)’s Valuation After 20% Dividend Hike and Murucututu Production Growth

Reviewed by Simply Wall St

Alvopetro Energy (TSXV:ALV) just paired strong November production in Brazil with a 20% bump in its total quarterly dividend, including a special payout. This puts its cash return strategy firmly in the spotlight for investors.

See our latest analysis for Alvopetro Energy.

Despite a softer patch recently, with the latest share price at $6.08 and a weaker 3 month share price return, Alvopetro’s double digit year to date share price gain and strong 1 year total shareholder return suggest that momentum is consolidating rather than collapsing as investors digest the Murucututu driven growth and richer dividend stream.

If Alvopetro’s mix of growth and income has your attention, this could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

With analysts still flagging upside to their price targets and cash flows rising alongside Murucututu production, the key question now is whether Alvopetro remains undervalued or if the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 22.8% Undervalued

With Alvopetro closing at CA$6.08, the most widely followed narrative points to a higher fair value anchored in accelerating cash generation and robust margins.

Strong and stable realized natural gas prices in Brazil, underpinned by inflation indexed, long term contracts with local utilities, support high operating netbacks (87% margin in Q2 2025) and provide visibility on future earnings and net margin stability even in a volatile macro environment.

Want to see what kind of revenue surge and margin profile could justify that upside signal? The narrative leans on aggressive growth and a surprisingly modest future earnings multiple. Curious how those moving parts combine to support the valuation case?

Result: Fair Value of $7.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising capital intensity and Alvopetro’s heavy reliance on Brazilian assets mean that any project missteps or regulatory shifts could quickly challenge this upbeat narrative.

Find out about the key risks to this Alvopetro Energy narrative.

Another Angle on Valuation

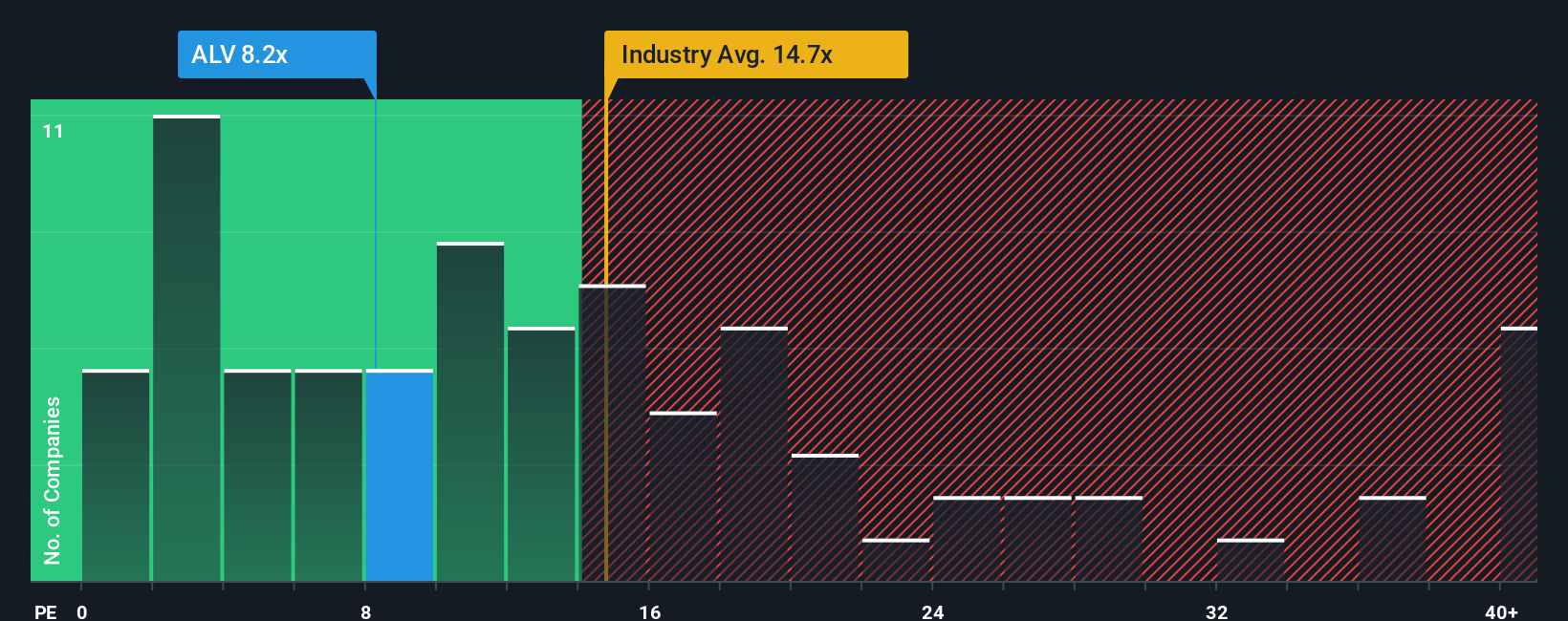

Not everyone leans on narrative based fair values. On plain earnings terms, Alvopetro trades on 8.2 times profits, richer than direct peers at 5.8 times but well below the Canadian Oil and Gas sector at 14.2 times and our 13.7 times fair ratio. Is that a safety margin or a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alvopetro Energy Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in under three minutes: Do it your way.

A great starting point for your Alvopetro Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Serious investors rarely wait around for the next idea to land in their lap. Use the Simply Wall St Screener now so you do not miss tomorrow’s winners.

- Consider exploring mispriced opportunities early by reviewing these 915 undervalued stocks based on cash flows where cash flow analysis suggests the market may not fully reflect the underlying fundamentals.

- Look at innovation-focused opportunities by targeting these 25 AI penny stocks that are positioned within the growing field of artificial intelligence.

- Explore income-focused opportunities with these 13 dividend stocks with yields > 3% that currently offer yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ALV

Alvopetro Energy

Engages in the acquisition, exploration, development, and production of hydrocarbons in Brazil and Canada.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)