- Canada

- /

- Oil and Gas

- /

- TSX:VLE

Global's Undervalued Small Caps With Insider Buying To Explore In July 2025

Reviewed by Simply Wall St

As the global markets continue to experience robust activity, with the S&P 500 and Nasdaq Composite reaching record highs for consecutive weeks, small-cap stocks have also shown impressive performance, as evidenced by notable gains in the S&P MidCap 400 and Russell 2000 indexes. This dynamic environment presents an intriguing backdrop for investors looking at small-cap companies, particularly those that may be undervalued yet exhibit potential through insider buying—a factor often seen as a positive signal of confidence from company leadership.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Daiwa House Logistics Trust | 11.5x | 7.0x | 27.19% | ★★★★★☆ |

| A.G. BARR | 18.9x | 1.8x | 47.88% | ★★★★☆☆ |

| Hemisphere Energy | 5.1x | 2.1x | 10.12% | ★★★★☆☆ |

| Sagicor Financial | 10.7x | 0.4x | -176.43% | ★★★★☆☆ |

| Seeing Machines | NA | 2.9x | 43.83% | ★★★★☆☆ |

| Italmobiliare | 12.4x | 1.6x | -232.98% | ★★★☆☆☆ |

| Absolent Air Care Group | 25.7x | 2.0x | 44.38% | ★★★☆☆☆ |

| Westshore Terminals Investment | 15.2x | 4.2x | 34.80% | ★★★☆☆☆ |

| CVS Group | 44.9x | 1.3x | 38.83% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 10.4x | 0.7x | 12.65% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

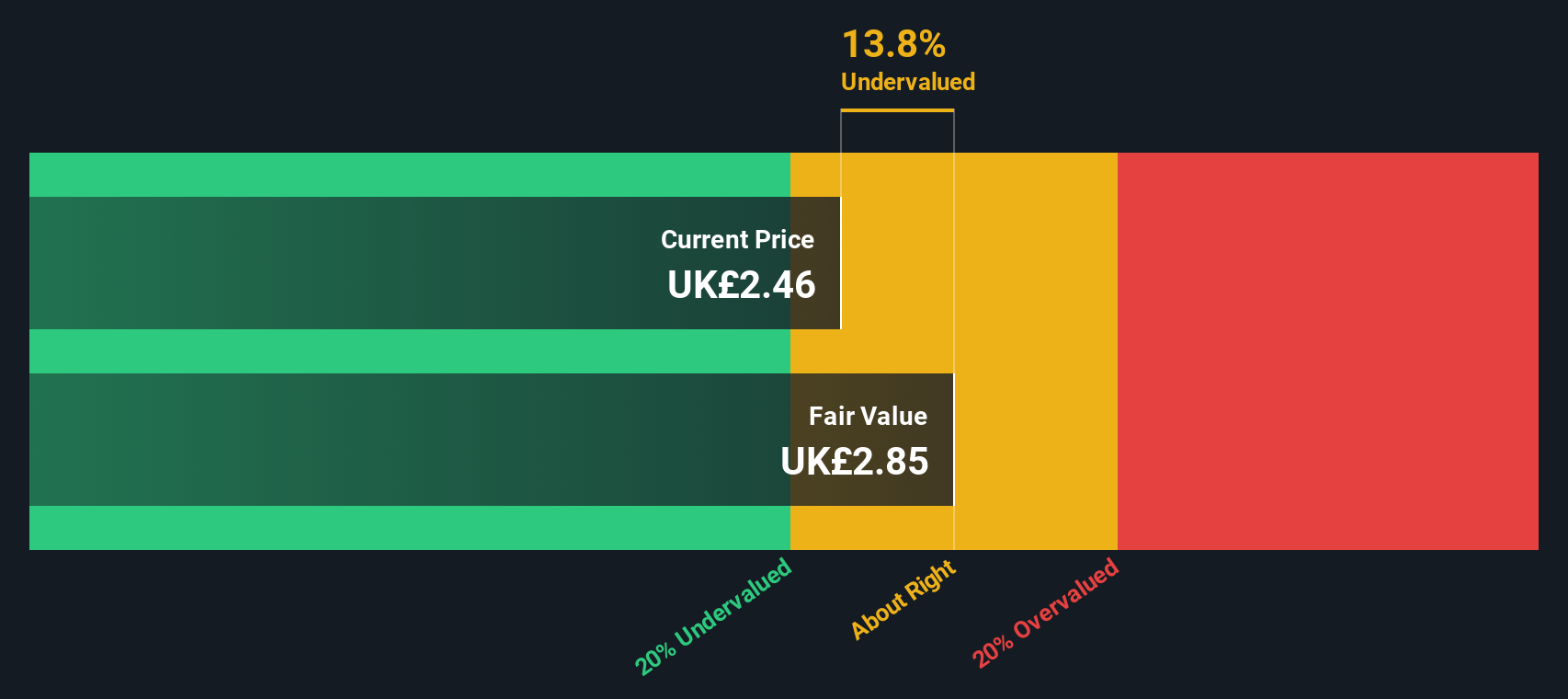

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hollywood Bowl Group operates a chain of ten-pin bowling centers in the UK, focusing on providing recreational activities, with a market capitalization of approximately £0.42 billion.

Operations: The company generates revenue primarily from recreational activities, with a recent figure of £240.46 million. The cost of goods sold (COGS) has been reported at £89.63 million, impacting the gross profit margin which stands at 62.73%. Operating expenses are significant, totaling £89.41 million, while non-operating expenses amount to £32.83 million, affecting overall profitability and resulting in a net income margin of 11.89%.

PE: 14.7x

Hollywood Bowl Group, a smaller company in the leisure sector, recently reported an 8.4% increase in revenue for the first half of 2025, reaching £129.2 million. Despite a slight dip in net income to £20.63 million from the previous year, insider confidence is evident with share purchases over recent months. The appointment of Asheeka Hyde as a Non-Executive Director brings valuable expertise in data and analytics to their board. Earnings are projected to grow by 14% annually, indicating potential value growth amidst its current market valuation challenges.

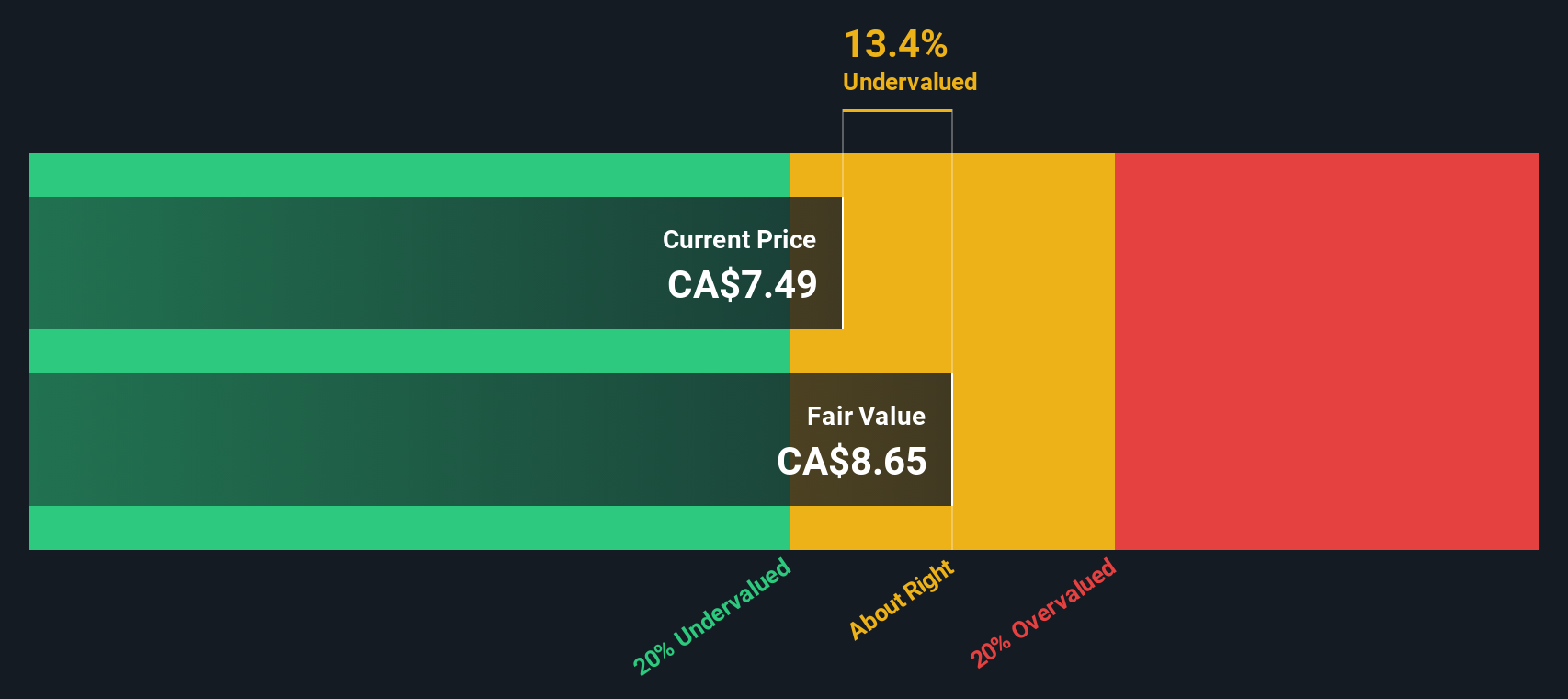

Flagship Communities Real Estate Investment Trust (TSX:MHC.UN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Flagship Communities Real Estate Investment Trust operates in the residential real estate sector, focusing on manufactured housing communities, with a market capitalization of approximately $0.5 billion.

Operations: The company generates revenue primarily from its residential real estate investments, with recent figures showing $92.99 million in this segment. Over the periods analyzed, gross profit margin fluctuated around 66%, indicating a relatively stable cost structure against revenue. Operating expenses have shown a gradual increase, reaching $11.22 million in the latest period.

PE: 3.5x

Flagship Communities Real Estate Investment Trust, a smaller player in the real estate sector, recently announced consistent monthly cash distributions of US$0.0517 per unit for April through June 2025. Despite a rise in sales to US$24.78 million for Q1 2025 from US$19.92 million last year, net income dipped slightly to US$10.46 million. With earnings expected to decline by an average of 64% annually over the next three years and interest payments not fully covered by earnings, potential investors should weigh these factors carefully against insider confidence shown through recent share purchases within the past year.

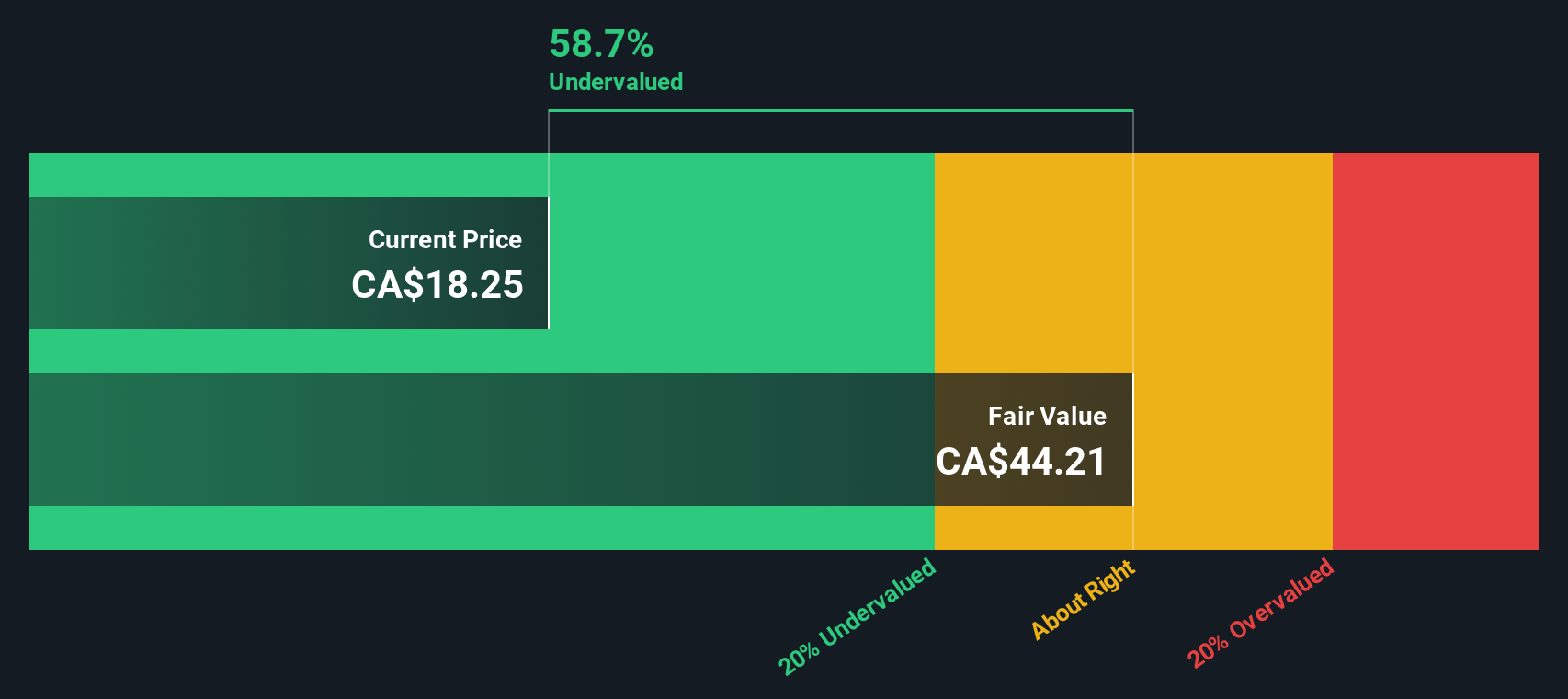

Valeura Energy (TSX:VLE)

Simply Wall St Value Rating: ★★★★★★

Overview: Valeura Energy is an oil and gas company focused on exploration and production, with a market capitalization of approximately $1.12 billion CAD.

Operations: The company generates revenue primarily from oil and gas exploration and production, with recent figures showing $682.54 million in this segment. The gross profit margin has shown an upward trend, reaching 73.12% as of the latest data point. Operating expenses are significant, with depreciation and amortization being a notable component at $195.47 million.

PE: 2.4x

Valeura Energy, a smaller player in the energy sector, recently reported Q2 2025 revenue of US$129.3 million with oil sales of 1.90 million barrels. Despite a production dip due to planned downtime, the company remains on track with its annual guidance, expecting higher output in H2 2025. Their strategic focus includes redeveloping the Wassana field in Thailand, aiming for significant shareholder value and increased reserves. A recent drilling campaign exceeded expectations and bolstered production stability against natural declines.

- Delve into the full analysis valuation report here for a deeper understanding of Valeura Energy.

Gain insights into Valeura Energy's past trends and performance with our Past report.

Where To Now?

- Access the full spectrum of 130 Undervalued Global Small Caps With Insider Buying by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VLE

Valeura Energy

Engages in the exploration, development, and production of petroleum and natural gas in Thailand and in Turkey.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives