- Canada

- /

- Oil and Gas

- /

- TSX:URE

Here's Why Shareholders May Want To Be Cautious With Increasing Ur-Energy Inc.'s (TSE:URE) CEO Pay Packet

Despite strong share price growth of 97% for Ur-Energy Inc. (TSE:URE) over the last few years, earnings growth has been disappointing, which suggests something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 03 June 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

View our latest analysis for Ur-Energy

Comparing Ur-Energy Inc.'s CEO Compensation With the industry

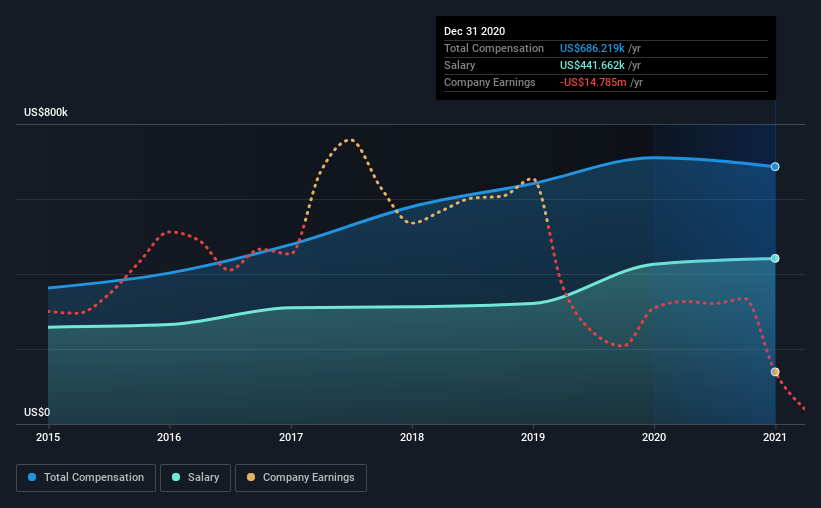

At the time of writing, our data shows that Ur-Energy Inc. has a market capitalization of CA$339m, and reported total annual CEO compensation of US$686k for the year to December 2020. That's a slight decrease of 3.4% on the prior year. Notably, the salary which is US$441.7k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from CA$121m to CA$483m, the reported median CEO total compensation was US$383k. Hence, we can conclude that Jeff Klenda is remunerated higher than the industry median. Furthermore, Jeff Klenda directly owns CA$5.1m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$442k | US$426k | 64% |

| Other | US$245k | US$284k | 36% |

| Total Compensation | US$686k | US$710k | 100% |

Speaking on an industry level, nearly 57% of total compensation represents salary, while the remainder of 43% is other remuneration. According to our research, Ur-Energy has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Ur-Energy Inc.'s Growth

Over the last three years, Ur-Energy Inc. has shrunk its earnings per share by 76% per year. Its revenue is down 76% over the previous year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Ur-Energy Inc. Been A Good Investment?

Most shareholders would probably be pleased with Ur-Energy Inc. for providing a total return of 97% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 3 warning signs for Ur-Energy (of which 1 is potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:URE

Ur-Energy

Engages in the acquisition, exploration, development, and operation of uranium mineral properties in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives