- Canada

- /

- Oil and Gas

- /

- TSX:TVE

Tamarack Valley Energy (TSX:TVE): Assessing Valuation After Strategic Asset Sale and Renewed Focus on Core Operations

Reviewed by Kshitija Bhandaru

Tamarack Valley Energy (TSX:TVE) has closed the sale of its non-core assets in Eastern Alberta, marking a meaningful shift toward focusing exclusively on Clearwater and Charlie Lake operations. The company plans to use the proceeds to reduce net debt. This will provide further flexibility for shareholder returns or growth initiatives tied to its upcoming 2026 budget.

See our latest analysis for Tamarack Valley Energy.

Tamarack’s recent divestiture, combined with a steady stream of dividends, has added a spotlight to its strong momentum. This is reflected in a year-to-date share price return of almost 24%. Notably, long-term investors have enjoyed an impressive 61.5% total shareholder return over three years and a staggering 738% over five years, signaling rising confidence in the company's focused strategy and growth potential.

If you're curious about what other companies are rising fast, now’s a great time to branch out and discover fast growing stocks with high insider ownership

With shares trading at a meaningful discount to analyst price targets but having surged in recent years, the key question is whether Tamarack Valley Energy remains undervalued or if the market is already factoring in its next phase of growth.

Most Popular Narrative: 14.6% Undervalued

Tamarack Valley Energy is trading at CA$6.04, notably below the most popular narrative’s fair value estimate of CA$7.08. This creates a contrast between the current market pricing and the valuation regarded as justified by the narrative’s underlying financial outlook.

Ongoing reductions in capital and operating costs, driven by pad drilling efficiencies, drilling speed improvements, and asset high-grading through dispositions, are leading to higher capital efficiencies. These developments are expected to boost free funds flow and support higher shareholder returns (via buybacks and potential dividend increases).

Curious what powers that premium price tag? One key ingredient is sustained margin improvements and ambitious assumptions about capital discipline. The complete narrative reveals the boldest financial bets behind this valuation.

Result: Fair Value of $7.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net debt and ongoing oil price volatility could quickly alter Tamarack Valley Energy’s trajectory and challenge even the most optimistic forecasts.

Find out about the key risks to this Tamarack Valley Energy narrative.

Another View: What Do Market Multiples Say?

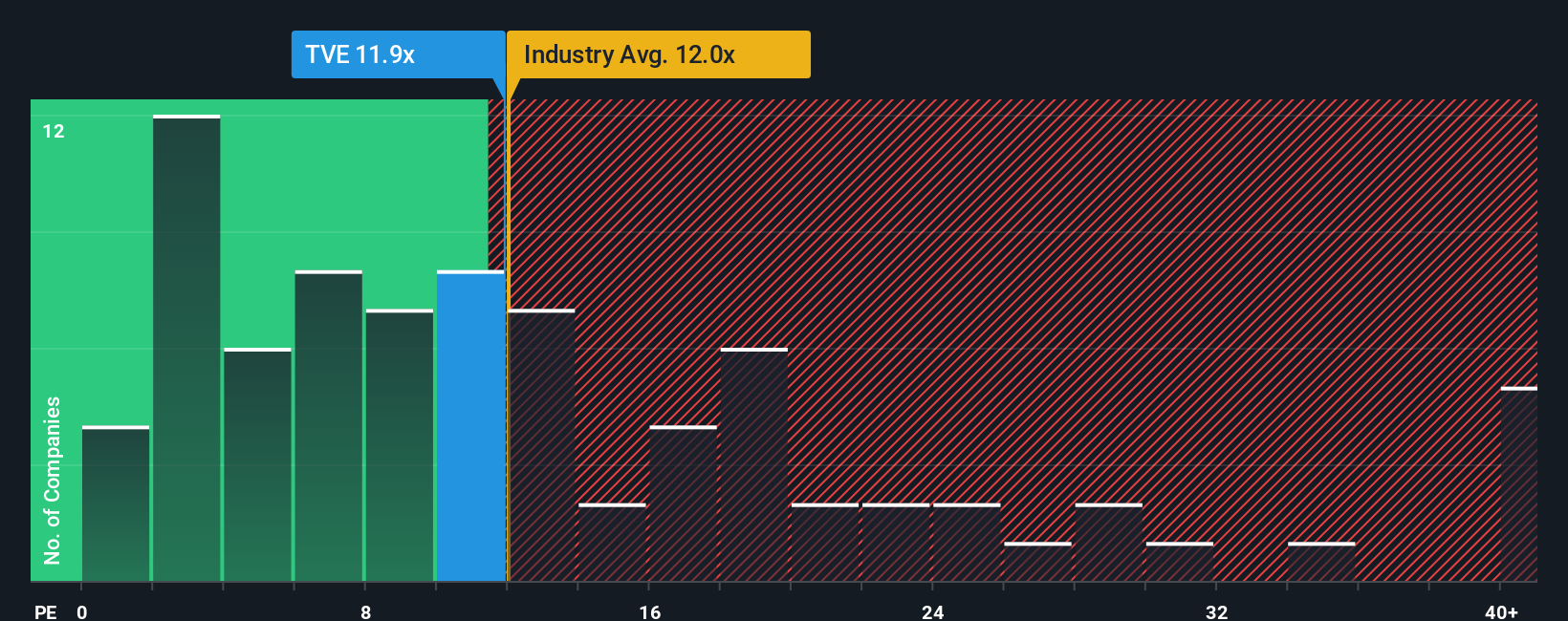

While the most popular narrative suggests Tamarack Valley Energy is undervalued, its price-to-earnings ratio sits at 11.9x, which is almost double the peer average of 6.2x and above the fair ratio of 8.2x. This premium signals that the market may be pricing in higher expectations, which could mean greater volatility ahead if future results disappoint. Is this optimism justified, or could it expose investors to downside risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tamarack Valley Energy Narrative

If you want to challenge these perspectives or prefer to dive into the numbers on your own, you can shape a personal view on Tamarack Valley Energy in just a few minutes, all with Do it your way.

A great starting point for your Tamarack Valley Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Your next big winner could be closer than you think. Let Simply Wall Street guide you straight to unique growth stories, overlooked opportunities, and future-ready sectors.

- Tap into steady income and compounding returns by checking out these 18 dividend stocks with yields > 3% with reliable yields above 3%.

- Unlock the future of healthcare by seeing which pioneers are advancing with these 33 healthcare AI stocks as they transform medicine through artificial intelligence.

- Catch emerging trends as you sift through these 79 cryptocurrency and blockchain stocks powering progress in digital assets and the blockchain revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tamarack Valley Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVE

Tamarack Valley Energy

Engages in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids in the Western Canadian sedimentary basin.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives