- Canada

- /

- Oil and Gas

- /

- TSX:TPZ

Topaz Energy (TSX:TPZ): Evaluating Valuation After Recent Share Price Volatility

Reviewed by Kshitija Bhandaru

See our latest analysis for Topaz Energy.

While Topaz Energy’s 1-day and 7-day share price returns have been negative, the recent 30-day share price return edges slightly higher, hinting at some near-term resilience. Over the past year, the total shareholder return sits at -2.8%. However, the impressive 35% total return over three years signals that, despite recent volatility, long-term investors have seen meaningful gains. This price action suggests momentum has faded a little in the short term, but the broader track record remains robust.

If this kind of longer-term outperformance has you curious about what’s driving other stocks, take the next step and discover fast growing stocks with high insider ownership.

With the shares still trading below analyst price targets and robust growth in revenue and earnings, the key question is whether Topaz Energy is undervalued right now or if the market already reflects its future prospects.

Most Popular Narrative: 19.5% Undervalued

Topaz Energy’s most popular narrative sets a fair value meaningfully above the last close, drawing attention to the company’s future cash flow potential and growth prospects. This narrative frames the current price as discounting promising assumptions about both Topaz’s earnings power and its business model strengths.

The asset-light royalty model with high cash conversion (91% free cash flow margin) and low operating expenses positions Topaz to maintain strong net margins and resilient earnings as investors continue to seek reliable, high-yielding income sources in a moderate interest rate environment.

Want to know why analysts are forecasting such an ambitious fair value? The story hinges on accelerating profit margins and aggressive future earnings growth. What key assumption unlocks this premium valuation, and could it actually stick? Take a look inside the full narrative to discover the surprising driver behind the target price.

Result: Fair Value of $31.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors such as stricter energy policies or increased reliance on a few major operators could challenge Topaz Energy’s expected growth and future returns.Find out about the key risks to this Topaz Energy narrative.

Another View: Looking Through the Lens of Earnings Multiples

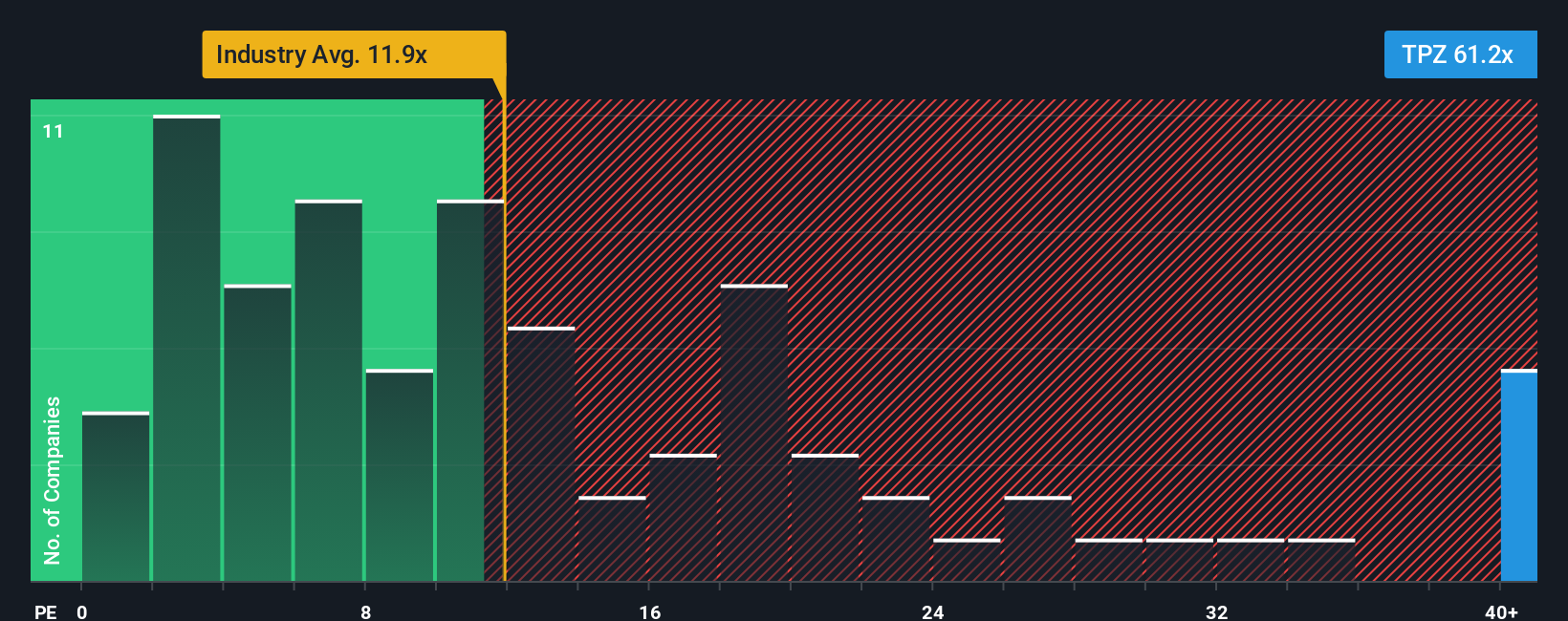

While fair value calculations suggest Topaz Energy is undervalued, a simple look at the company’s price-to-earnings ratio tells a different story. Topaz trades at 61.8 times earnings, which is far higher than both its peers (7.7x) and the broader Canadian oil and gas industry (12.7x), as well as the fair ratio of 16.6x. This sizable gap could mean investors are paying a premium today. This raises questions about whether the market is too optimistic about future growth or if something unique justifies the higher price. What could shift sentiment from premium to a pullback?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Topaz Energy Narrative

If you'd like to see things from a different angle or trust your own research more, it's quick and easy to put together your own narrative. Do it your way

A great starting point for your Topaz Energy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stick to one opportunity when new trends can help them outperform. Make your next move count by checking out these distinctive market themes:

- Capitalize on the latest breakthroughs by scouring these 25 AI penny stocks as they push the boundaries in artificial intelligence and transform entire industries.

- Boost your income potential by choosing from these 18 dividend stocks with yields > 3% that deliver reliable yields significantly above the market average.

- Stay ahead of the curve by targeting these 78 cryptocurrency and blockchain stocks that power the digital economy and reshape global finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topaz Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TPZ

Topaz Energy

Operates as a royalty and infrastructure energy company in Canada.

Reasonable growth potential and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026