- Canada

- /

- Oil and Gas

- /

- TSX:TPZ

Here's Why I Think Topaz Energy (TSE:TPZ) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Topaz Energy (TSE:TPZ). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Topaz Energy

How Fast Is Topaz Energy Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Like a firecracker arcing through the night sky, Topaz Energy's EPS shot from CA$0.099 to CA$0.23, over the last year. Year on year growth of 137% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Not all of Topaz Energy's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. The good news is that Topaz Energy is growing revenues, and EBIT margins improved by 7.9 percentage points to 18%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

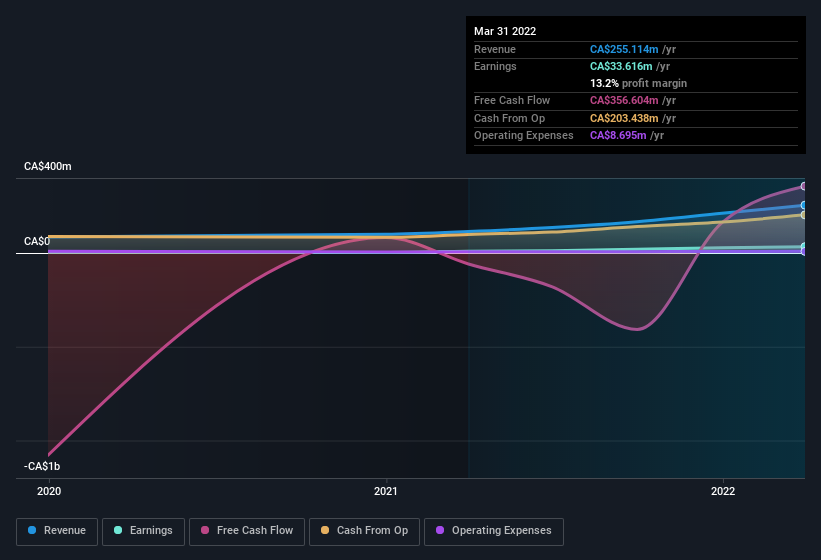

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Topaz Energy's forecast profits?

Are Topaz Energy Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's a pleasure to note that insiders spent CA$6.2m buying Topaz Energy shares, over the last year, without reporting any share sales whatsoever. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. We also note that it was the , William Armstrong, who made the biggest single acquisition, paying CA$1.3m for shares at about CA$17.10 each.

The good news, alongside the insider buying, for Topaz Energy bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have CA$62m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 1.8% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Marty Staples is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalizations between CA$2.5b and CA$8.1b, like Topaz Energy, the median CEO pay is around CA$4.4m.

The Topaz Energy CEO received total compensation of just CA$1.8m in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Topaz Energy Worth Keeping An Eye On?

Topaz Energy's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Topaz Energy belongs on the top of your watchlist. We don't want to rain on the parade too much, but we did also find 2 warning signs for Topaz Energy that you need to be mindful of.

The good news is that Topaz Energy is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Topaz Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TPZ

Topaz Energy

Operates as a royalty and infrastructure energy company in Canada.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives