- Canada

- /

- Oil and Gas

- /

- TSX:EFR

TSX Stocks Estimated To Be Trading Below Fair Value In October 2024

Reviewed by Simply Wall St

The Canadian market has shown robust performance, climbing 1.4% in the last 7 days and rising 24% over the past year, with earnings anticipated to grow by 15% annually in the coming years. In such a thriving environment, identifying stocks that are trading below their fair value can offer potential opportunities for investors seeking to capitalize on market efficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$189.02 | CA$359.27 | 47.4% |

| Computer Modelling Group (TSX:CMG) | CA$11.90 | CA$21.90 | 45.7% |

| Tourmaline Oil (TSX:TOU) | CA$61.85 | CA$120.10 | 48.5% |

| VersaBank (TSX:VBNK) | CA$21.03 | CA$41.35 | 49.1% |

| Trisura Group (TSX:TSU) | CA$44.60 | CA$87.82 | 49.2% |

| Kinaxis (TSX:KXS) | CA$156.95 | CA$283.62 | 44.7% |

| Endeavour Mining (TSX:EDV) | CA$31.97 | CA$55.49 | 42.4% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Sandstorm Gold (TSX:SSL) | CA$8.06 | CA$13.84 | 41.8% |

| Blackline Safety (TSX:BLN) | CA$6.19 | CA$10.98 | 43.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses across Canada, the United States, Europe, and internationally with a market cap of CA$93.45 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to $9.27 billion.

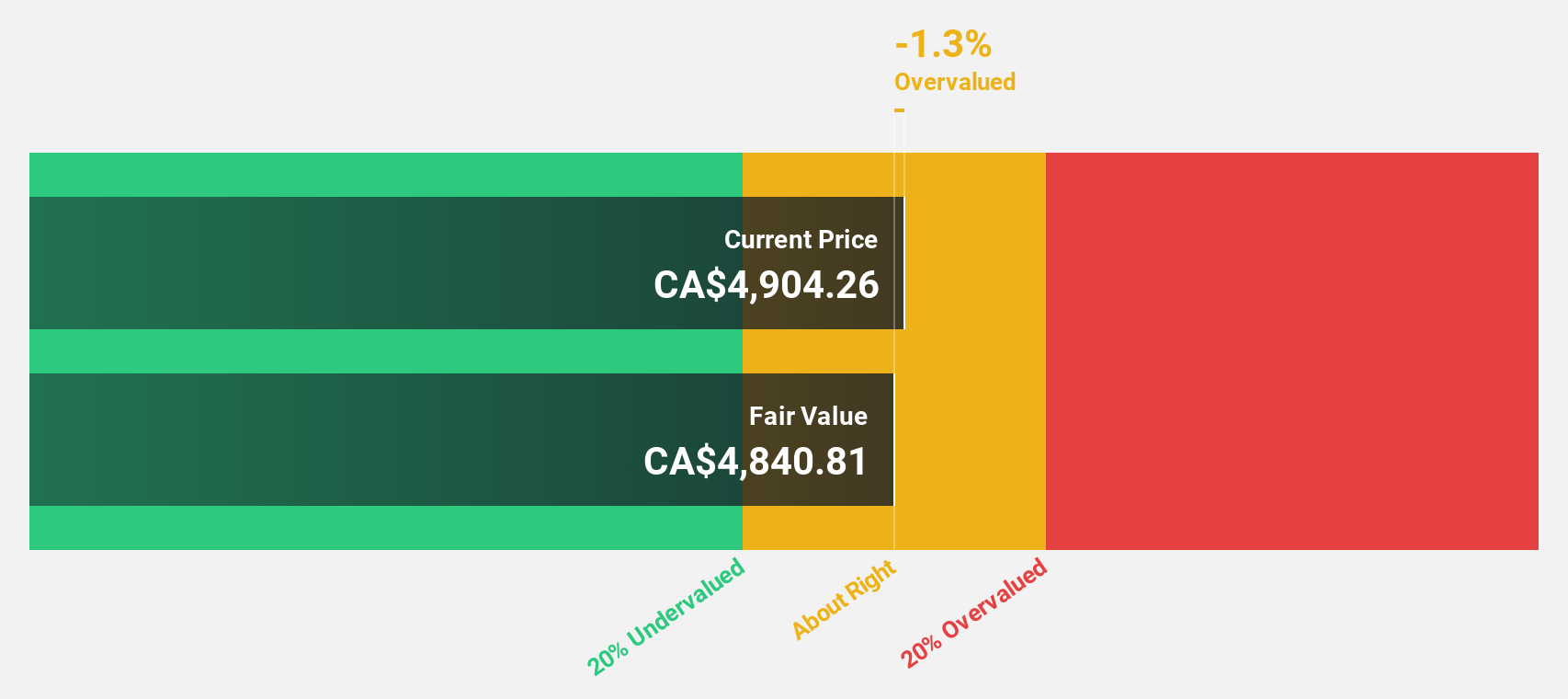

Estimated Discount To Fair Value: 20.8%

Constellation Software's recent earnings report shows strong financial performance, with a significant increase in net income and earnings per share. The company is trading at CA$4,409.80, which is 20.8% below its estimated fair value of CA$5,569.88, indicating it may be undervalued based on cash flows. Although it has high debt levels, its forecasted annual profit growth of 23.55% surpasses the Canadian market average of 14.8%, supporting its potential as an undervalued investment opportunity.

- Our comprehensive growth report raises the possibility that Constellation Software is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Constellation Software stock in this financial health report.

Energy Fuels (TSX:EFR)

Overview: Energy Fuels Inc. is involved in the extraction, recovery, recycling, exploration, permitting, evaluation, and sale of uranium mineral properties in the United States with a market cap of CA$1.53 billion.

Operations: The company's revenue is derived from its Metals & Minings - Miscellaneous segment, amounting to $45.60 million.

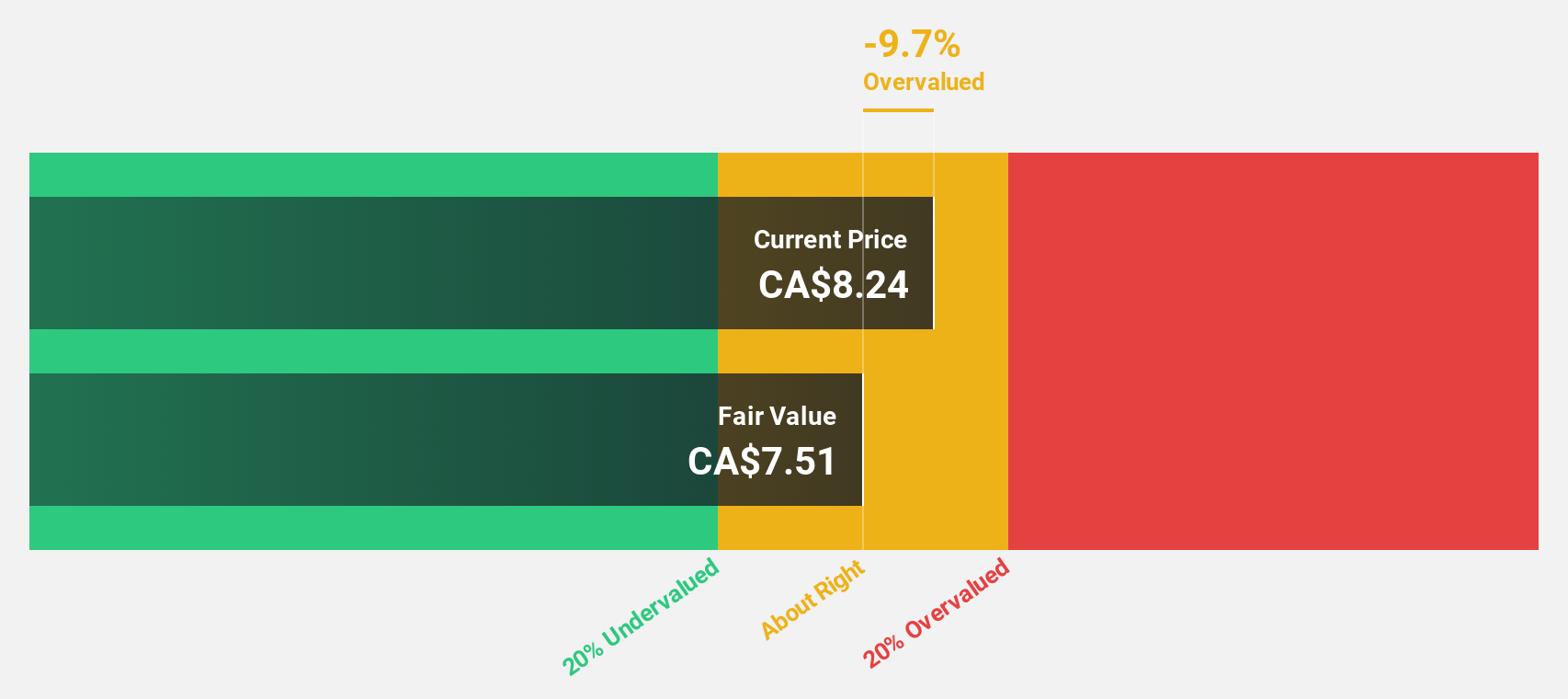

Estimated Discount To Fair Value: 14.7%

Energy Fuels is trading at CA$9.04, 14.7% below its estimated fair value of CA$10.6, suggesting potential undervaluation based on cash flows. Despite recent losses, the company is expected to achieve profitability within three years and has a forecasted revenue growth rate of 43.3% annually, surpassing the Canadian market average of 7.1%. Recent strategic acquisitions and executive changes aim to strengthen its financial position and operational capabilities in the mining sector.

- Insights from our recent growth report point to a promising forecast for Energy Fuels' business outlook.

- Get an in-depth perspective on Energy Fuels' balance sheet by reading our health report here.

Tourmaline Oil (TSX:TOU)

Overview: Tourmaline Oil Corp. is engaged in the exploration and development of oil and natural gas properties in the Western Canadian Sedimentary Basin, with a market cap of CA$22.97 billion.

Operations: The company's revenue is primarily derived from its petroleum and natural gas properties, amounting to CA$4.80 billion.

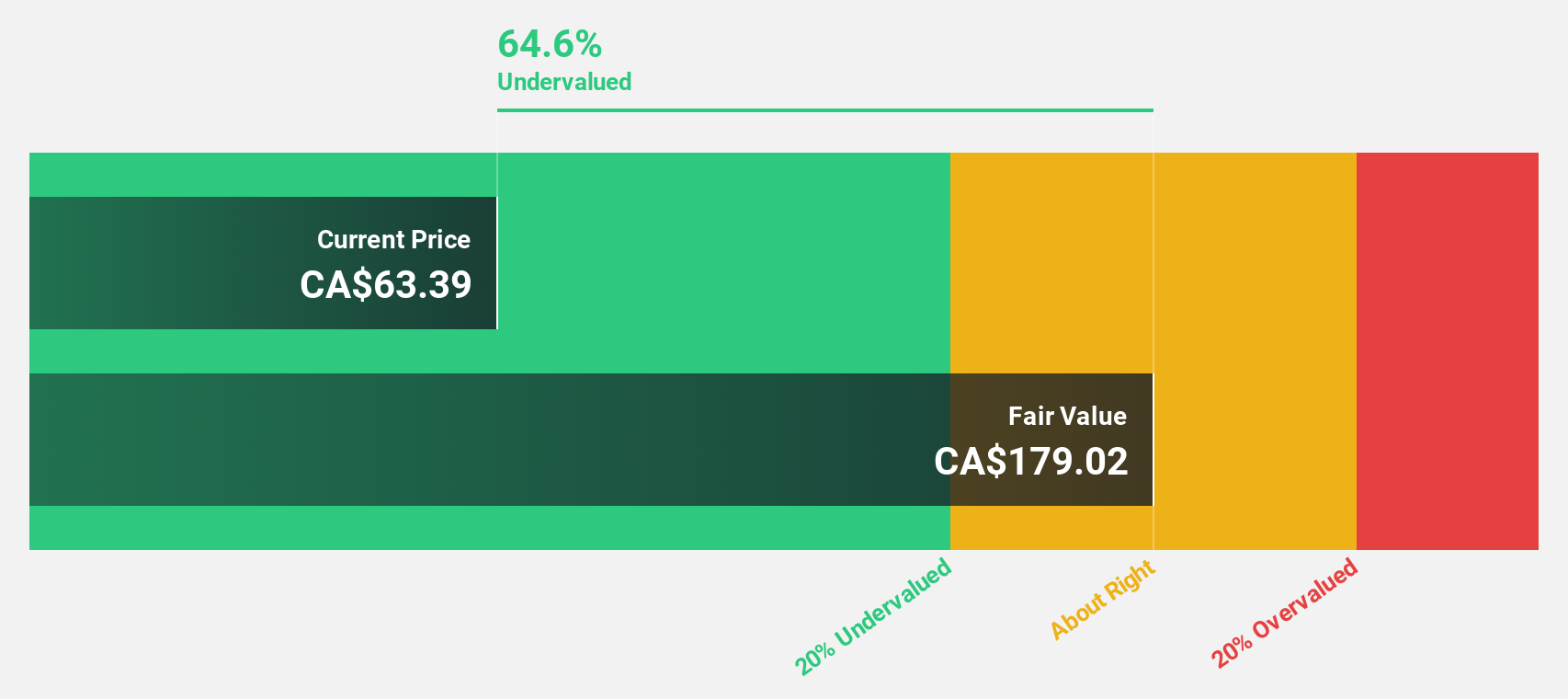

Estimated Discount To Fair Value: 48.5%

Tourmaline Oil, trading at CA$61.85, is significantly undervalued with an estimated fair value of CA$120.1 based on discounted cash flow analysis. Despite a decline in profit margins from 51.7% to 30.7%, earnings are forecasted to grow by 48.5% annually, outpacing the Canadian market's growth rate of 14.7%. Recent dividend increases and buyback announcements highlight financial strength, though insider selling may warrant caution for potential investors.

- Our expertly prepared growth report on Tourmaline Oil implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Tourmaline Oil's balance sheet health report.

Key Takeaways

- Explore the 27 names from our Undervalued TSX Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energy Fuels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EFR

Energy Fuels

Engages in the exploration, recovery, recycling, exploration, operation, development, permitting, evaluation, and sale of uranium mineral properties in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives