- Canada

- /

- Oil and Gas

- /

- TSX:TOU

Major Share Buyback Could Be a Game Changer for Tourmaline Oil (TSX:TOU)

Reviewed by Simply Wall St

- Tourmaline Oil Corp. recently announced a share repurchase program, authorizing the buyback of up to 19,342,343 shares, equivalent to 5% of its issued and outstanding share capital, with all repurchased shares set to be cancelled by August 2026.

- This move to reduce the share count is often interpreted as a signal of management's confidence in the company's long-term prospects and commitment to enhancing shareholder value.

- We'll now examine how this substantial share buyback authorization could influence Tourmaline's investment outlook, especially in light of its future cash flow expectations.

Find companies with promising cash flow potential yet trading below their fair value.

Tourmaline Oil Investment Narrative Recap

Owning Tourmaline Oil fundamentally comes down to confidence in sustained North American natural gas demand, the company's ambitious LNG export plans, and its disciplined capital allocation. While the recently announced share repurchase program could benefit near-term shareholder returns, the key short-term catalyst remains Tourmaline’s ability to maintain production growth and capitalize on premium global gas pricing; however, persistent volatility in AECO gas prices continues to be the central risk that could hinder both revenue and margin expansion. The buyback, while positive for sentiment, does not materially change this risk-reward equation in the near term.

Among recent announcements, Tourmaline’s long-term LNG feed gas supply agreement with Uniper is especially relevant, as it underscores management’s active efforts to secure international market exposure for its natural gas. This partnership aligns directly with the central catalyst of unlocking higher global pricing, potentially supporting cash flows needed to sustain future distributions and buybacks, subject to execution risks and evolving market access dynamics.

Yet, investors should be aware that despite these positive developments, persistent weakness in regional natural gas pricing could still...

Read the full narrative on Tourmaline Oil (it's free!)

Tourmaline Oil's narrative projects CA$10.6 billion revenue and CA$2.6 billion earnings by 2028. This requires 34.2% yearly revenue growth and a CA$1.1 billion earnings increase from CA$1.5 billion today.

Uncover how Tourmaline Oil's forecasts yield a CA$75.16 fair value, a 31% upside to its current price.

Exploring Other Perspectives

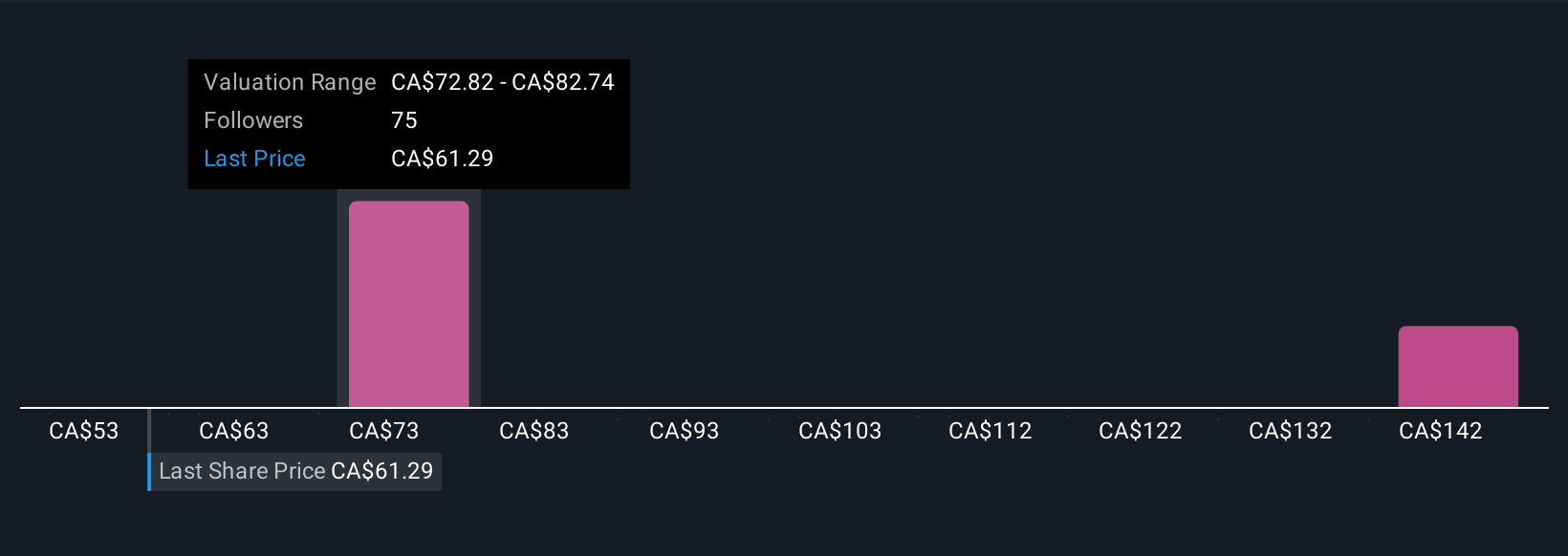

Seven fair value estimates from the Simply Wall St Community span from CA$53 to CA$146.66 per share, showing broad differences in opinions. With export agreements now in focus, the wide spectrum of valuations invites you to consider multiple viewpoints on Tourmaline’s long-term cash flow resilience.

Explore 7 other fair value estimates on Tourmaline Oil - why the stock might be worth 8% less than the current price!

Build Your Own Tourmaline Oil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tourmaline Oil research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tourmaline Oil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tourmaline Oil's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tourmaline Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOU

Tourmaline Oil

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in the Western Canadian Sedimentary Basin.

Good value with reasonable growth potential.

Market Insights

Community Narratives