Exploring TSX Dividend Stocks: Why To Avoid Nutrien And Consider One Better Option

Reviewed by Sasha Jovanovic

In the realm of Canadian dividend stocks, investors often seek stability and steady income. However, a high dividend payout ratio can signal potential risk rather than reward. Companies like Nutrien, with such financial metrics, may warrant caution as their dividends could be unsustainable over the long term.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.77% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.17% | ★★★★★★ |

| Enghouse Systems (TSX:ENGH) | 3.40% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.46% | ★★★★★☆ |

| Secure Energy Services (TSX:SES) | 3.29% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.86% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.53% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.26% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.23% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 9.07% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Let's dive into one of the prime choices out of the screener and one to possibly skip over.

Top Pick

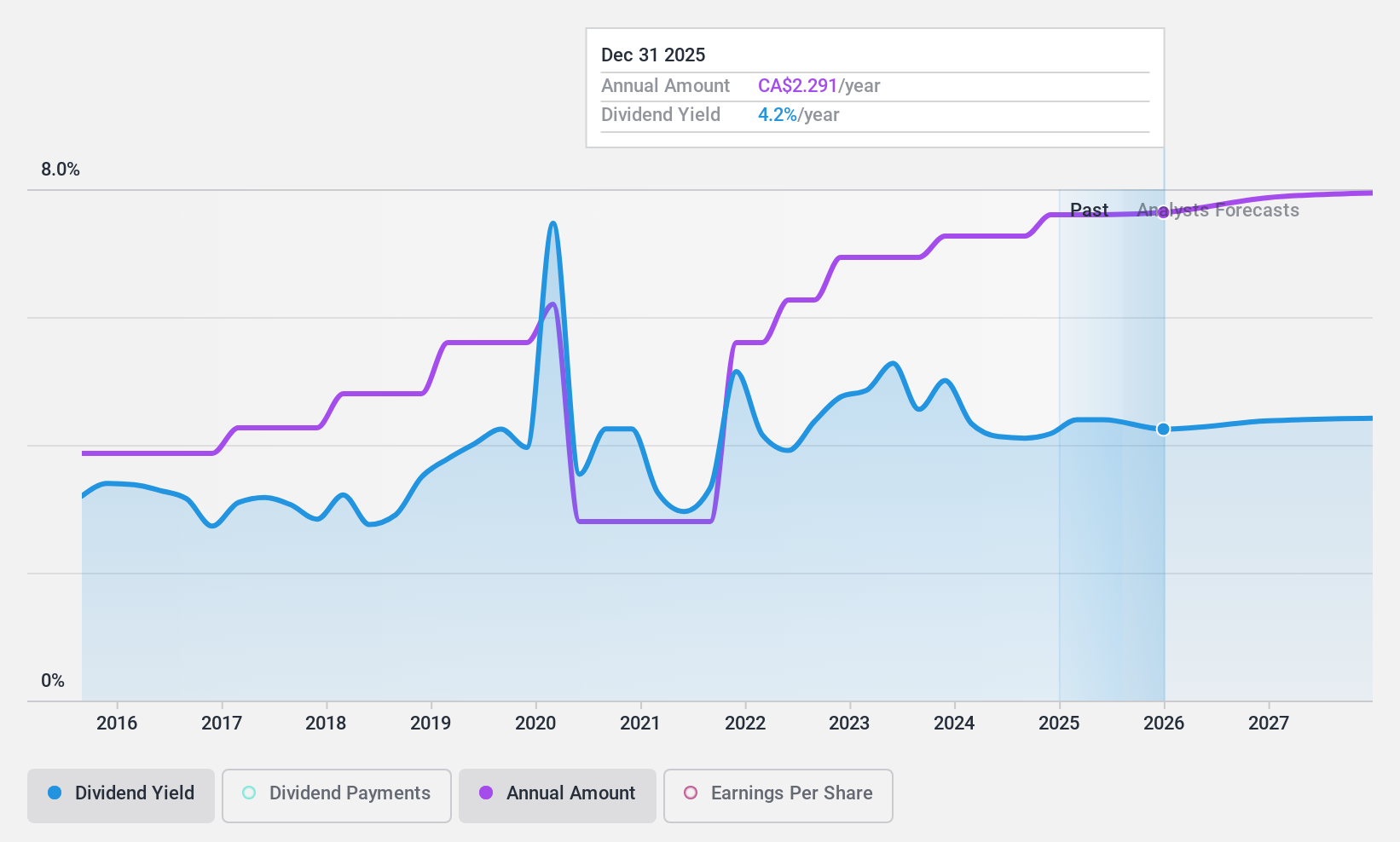

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations in Canada, the United States, and internationally, boasting a market capitalization of approximately CA$66.83 billion.

Operations: The company generates revenue primarily from three segments: Oil Sands at CA$23.76 billion, Refining and Marketing at CA$31.51 billion, and Exploration and Production at CA$2.17 billion.

Dividend Yield: 4.1%

Suncor Energy maintains a sustainable dividend with a payout ratio of 35.2%, ensuring dividends are well-covered by earnings and cash flows, contrasting sharply with some peers struggling with high payout ratios. However, its dividend history has been marked by volatility over the past decade, and it faces an expected earnings decline of 7.4% annually over the next three years. Recent activities include consistent share buybacks and stable quarterly dividends, reinforcing its commitment to shareholder returns despite operational challenges like fluctuating production volumes in oil sands and refinery outputs.

- Click here to discover the nuances of Suncor Energy with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Suncor Energy's share price might be too pessimistic.

One To Reconsider

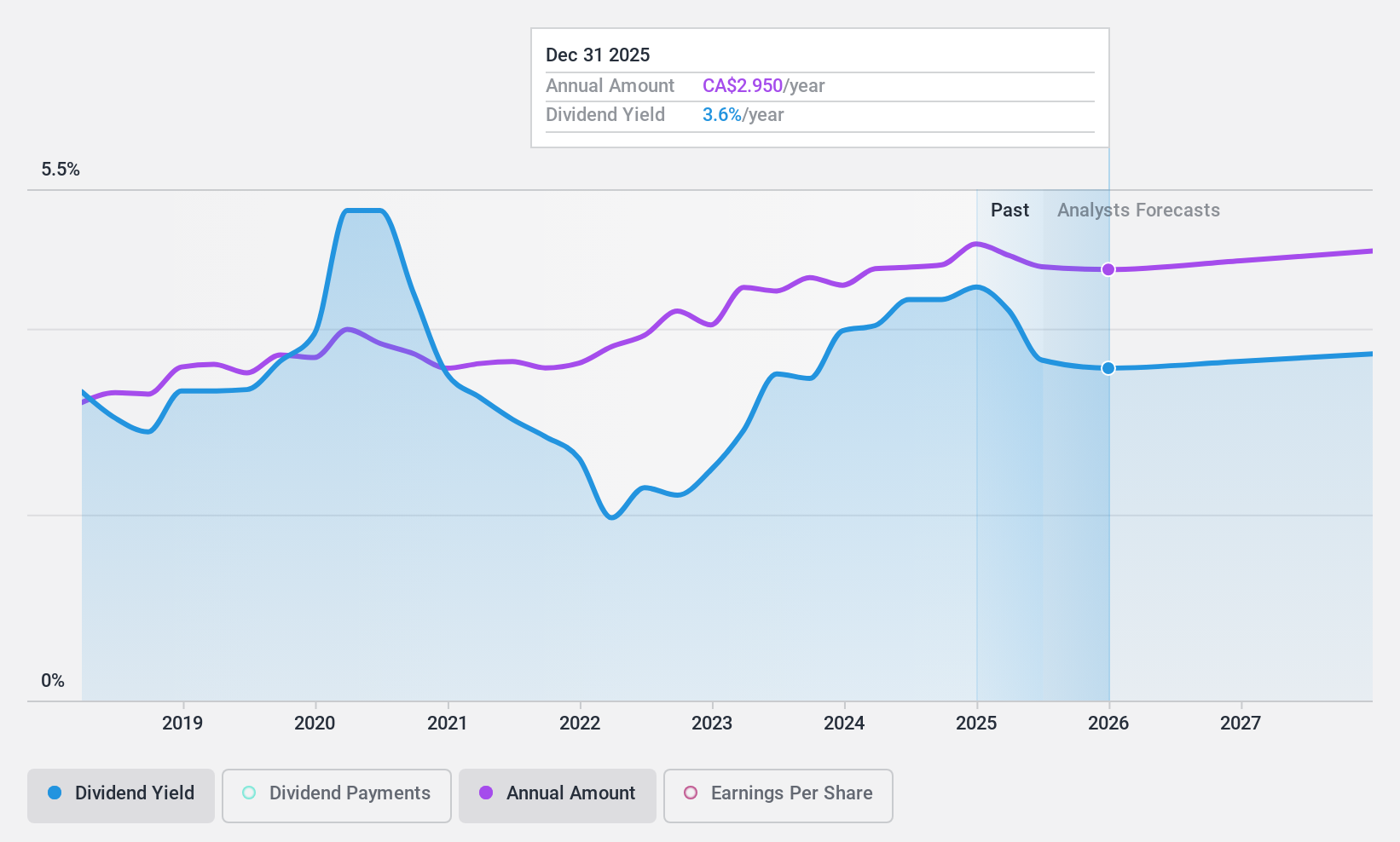

Nutrien (TSX:NTR)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Nutrien Ltd. is a provider of crop inputs and services, with a market capitalization of approximately CA$34.46 billion.

Operations: The company's revenue is generated from several segments: Retail at CA$19.43 billion, Potash at CA$3.57 billion, Nitrogen (including Sulfate) at CA$3.81 billion, and Phosphate (excluding Sulfate) at CA$1.92 billion.

Dividend Yield: 4.3%

Nutrien Ltd. faces challenges as a dividend stock, primarily due to its high payout ratio of 124.7%, indicating dividends are not well covered by earnings. Recent debt financing to manage existing obligations adds further strain, with significant funds directed towards repaying and refinancing rather than sustainable growth or dividend stability. Despite a reasonable cash payout ratio of 37.4%, the overall financial strategy raises concerns about the long-term viability of its dividend commitments, compounded by a below-market dividend yield of 4.32%.

Seize The Opportunity

- Delve into our full catalog of 33 Top TSX Dividend Stocks here.

- Have a stake in one of these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutrien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NTR

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives