- Canada

- /

- Oil and Gas

- /

- TSX:WCP

3 TSX Dividend Stocks Offering Yields Up To 7.6%

Reviewed by Simply Wall St

With the Canadian economy experiencing a contraction in November and the Bank of Canada cutting rates amid tariff uncertainties, investors are increasingly looking for stability in dividend stocks that can offer reliable income streams. In this environment, selecting stocks with strong dividend yields can be an effective strategy to navigate economic fluctuations while benefiting from potential capital appreciation.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.64% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.81% | ★★★★★★ |

| Savaria (TSX:SIS) | 3.00% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.19% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.09% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.42% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.07% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.80% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.71% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.05% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top TSX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

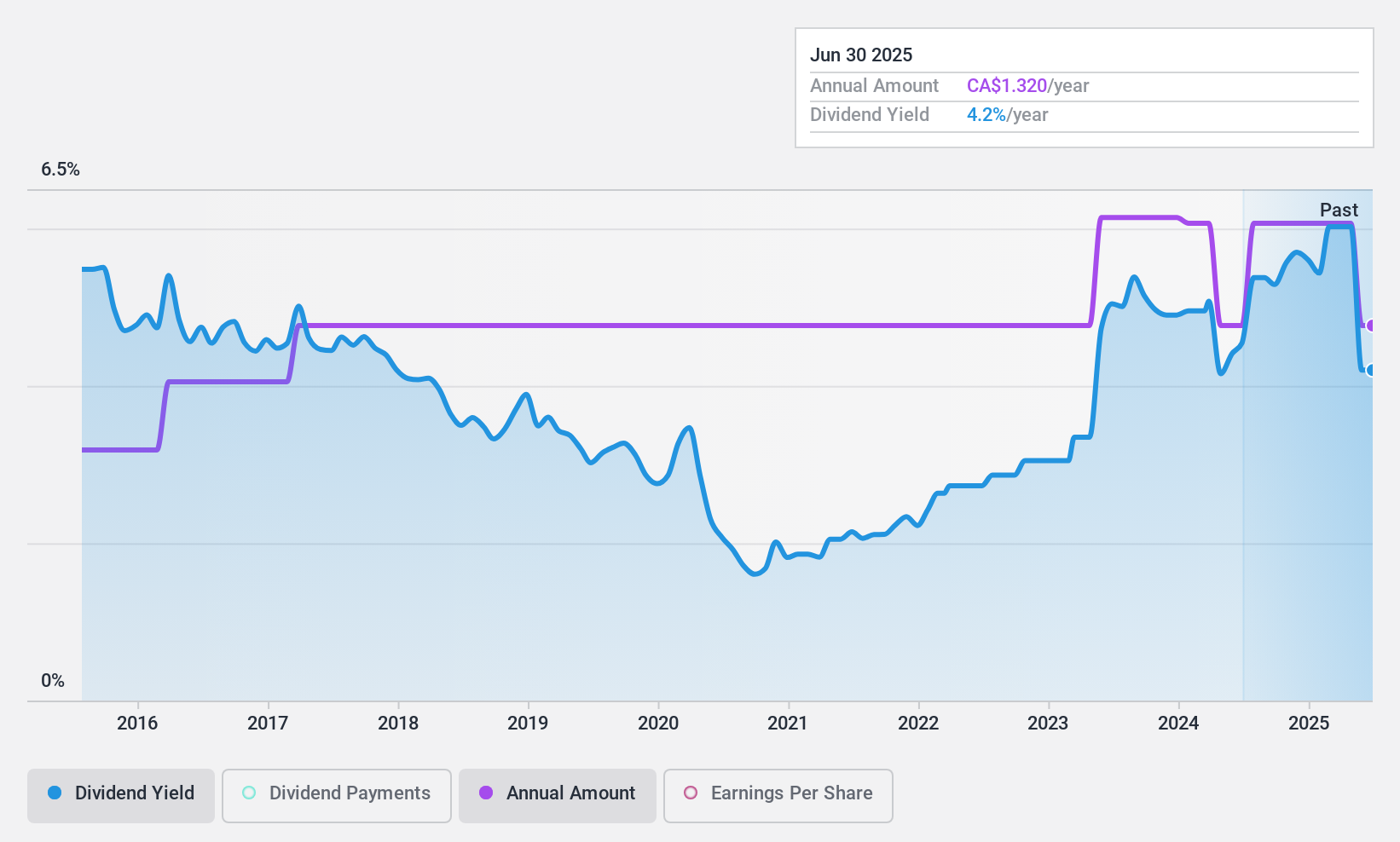

Richards Packaging Income Fund (TSX:RPI.UN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Richards Packaging Income Fund, along with its subsidiaries, operates in North America by designing, manufacturing, and distributing packaging containers and healthcare supplies and products, with a market cap of CA$354.72 million.

Operations: Richards Packaging Income Fund generates revenue from its wholesale miscellaneous segment, amounting to CA$411.82 million.

Dividend Yield: 5.5%

Richards Packaging Income Fund offers a stable dividend history, with payments growing steadily over the past decade. Its dividends are well-covered by earnings and cash flows, boasting payout ratios of 38.7% and 32.6%, respectively. Despite trading at a significant discount to its estimated fair value, its yield of 5.51% is below the top tier in Canada. Recent announcements confirm consistent monthly distributions of C$0.11 per unit through early 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Richards Packaging Income Fund.

- The analysis detailed in our Richards Packaging Income Fund valuation report hints at an deflated share price compared to its estimated value.

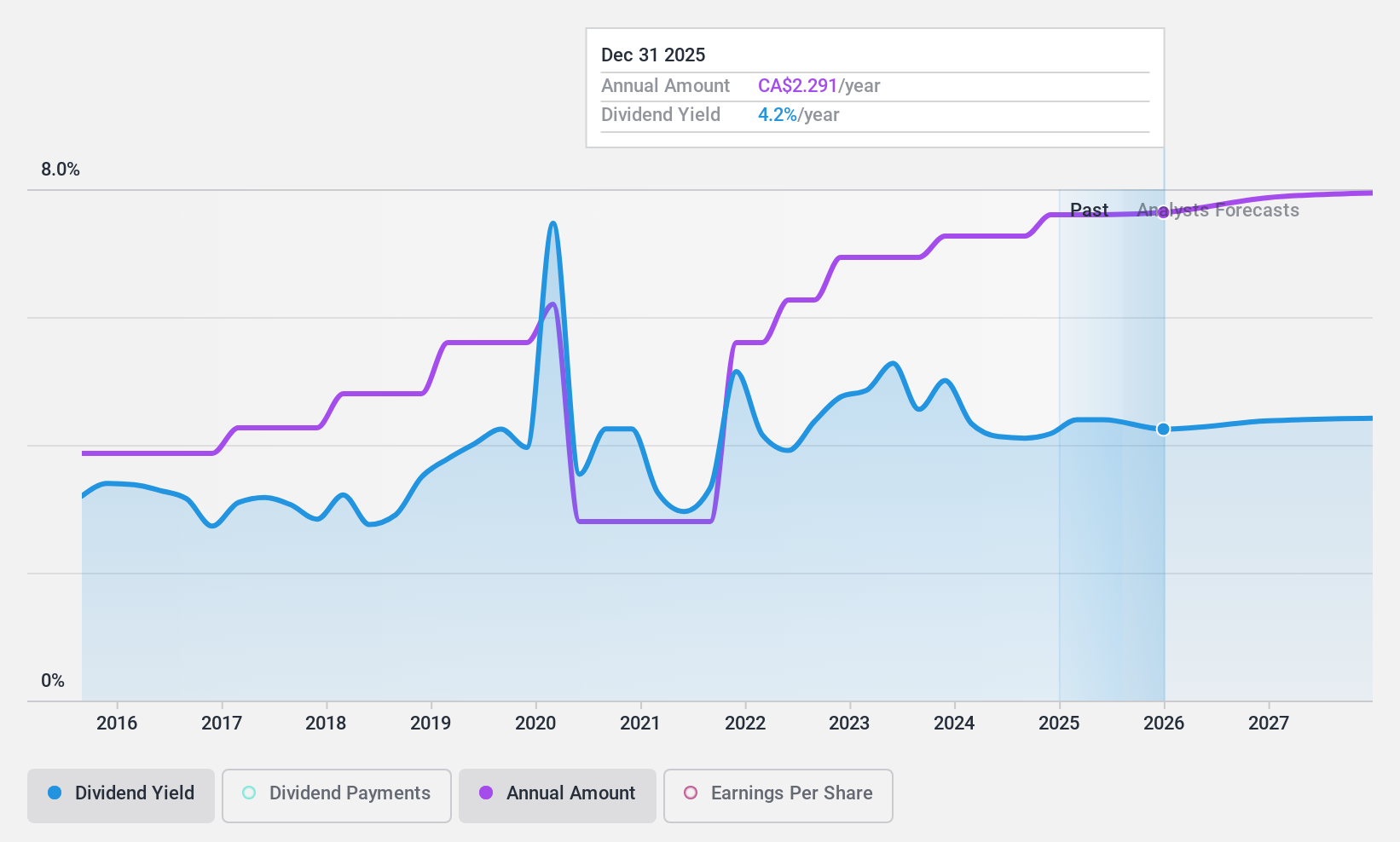

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally, with a market cap of approximately CA$68.61 billion.

Operations: Suncor Energy Inc.'s revenue segments consist of Oil Sands generating CA$25.24 billion, Refining and Marketing contributing CA$31.85 billion, and Exploration and Production adding CA$2.15 billion.

Dividend Yield: 4%

Suncor Energy's dividend is well-covered by earnings and cash flows, with payout ratios of 34.9% and 31.8%, respectively, though its yield of 4.03% is below Canada's top tier. Despite a history of volatile dividends, recent increases reflect management's commitment to returning value to shareholders. The company reported improved production figures for 2024 and completed significant share buybacks totaling CAD 2 billion, reinforcing its financial stability amidst fluctuating earnings growth forecasts.

- Take a closer look at Suncor Energy's potential here in our dividend report.

- The valuation report we've compiled suggests that Suncor Energy's current price could be quite moderate.

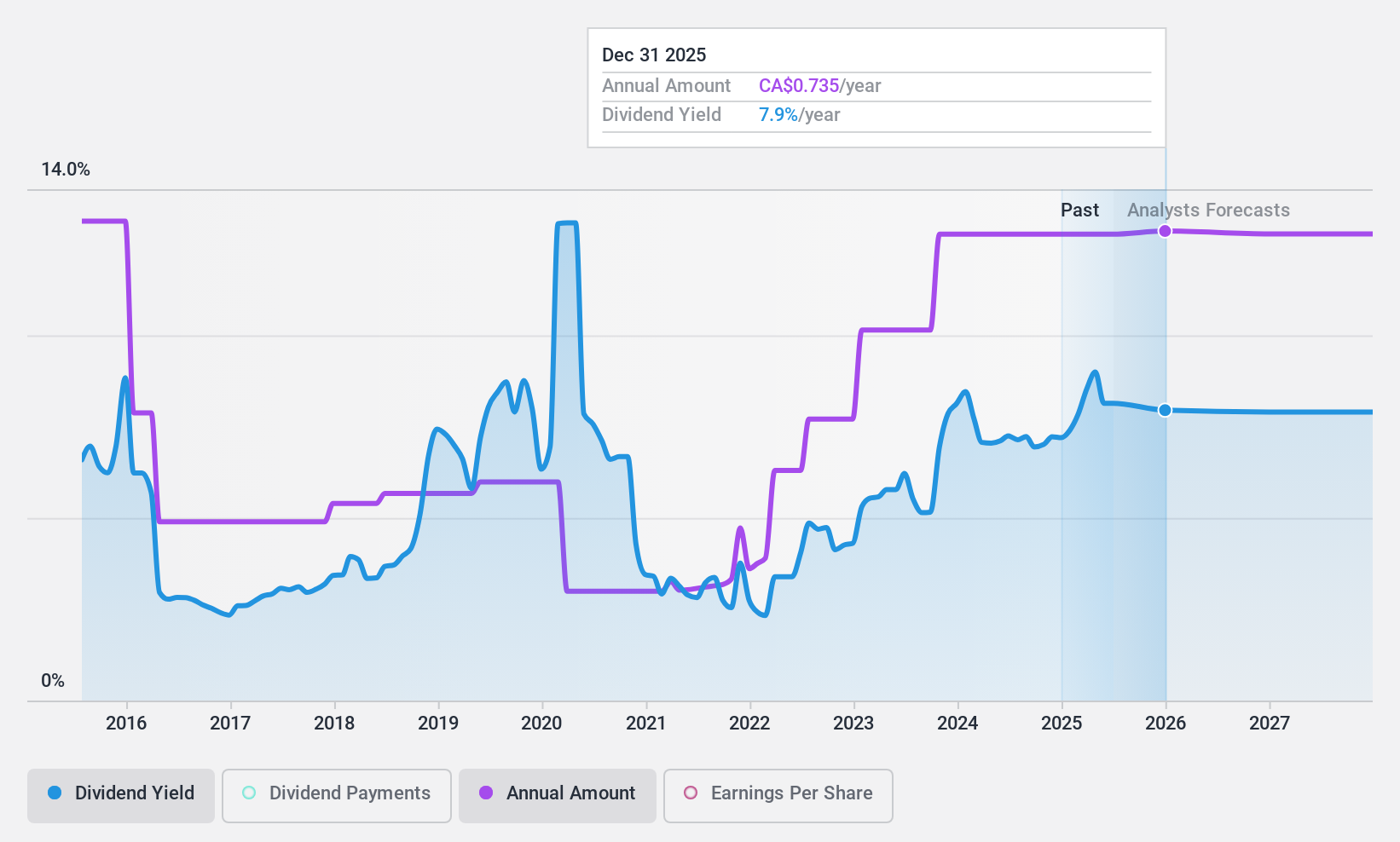

Whitecap Resources (TSX:WCP)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Whitecap Resources Inc. is an oil and gas company that specializes in the acquisition, development, and production of petroleum and natural gas assets in Western Canada, with a market capitalization of CA$5.62 billion.

Operations: Whitecap Resources Inc. generates revenue primarily from its Oil & Gas - Exploration & Production segment, amounting to CA$3.31 billion.

Dividend Yield: 7.6%

Whitecap Resources offers a high dividend yield of 7.64%, placing it in the top 25% of Canadian dividend payers. The company's dividends have been stable and growing over the past decade, supported by earnings and cash flows with payout ratios of 49.3% and 52.5%, respectively. Recent operational success in their drilling program enhances financial stability, though future earnings are forecasted to decline, potentially impacting long-term dividend sustainability despite current strong coverage metrics.

- Unlock comprehensive insights into our analysis of Whitecap Resources stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Whitecap Resources shares in the market.

Summing It All Up

- Dive into all 30 of the Top TSX Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Whitecap Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WCP

Whitecap Resources

An oil and gas company, focuses on the acquisition, development, and production of petroleum and natural gas assets in Western Canada.

Very undervalued 6 star dividend payer.

Market Insights

Community Narratives