With Canada's election now behind it, the focus has shifted to economic growth and trade diversification, as policymakers aim to address these pressing issues. Amidst this backdrop of potential fiscal stimulus and possible interest rate cuts from the Bank of Canada, dividend stocks can offer a steady income stream and stability for investors seeking resilience in their portfolios.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Royal Bank of Canada (TSX:RY) | 3.58% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 7.09% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.15% | ★★★★★☆ |

| Savaria (TSX:SIS) | 3.03% | ★★★★★☆ |

| Whitecap Resources (TSX:WCP) | 9.52% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.37% | ★★★★★☆ |

| SECURE Waste Infrastructure (TSX:SES) | 3.16% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.14% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.69% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 6.22% | ★★★★★☆ |

Click here to see the full list of 25 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

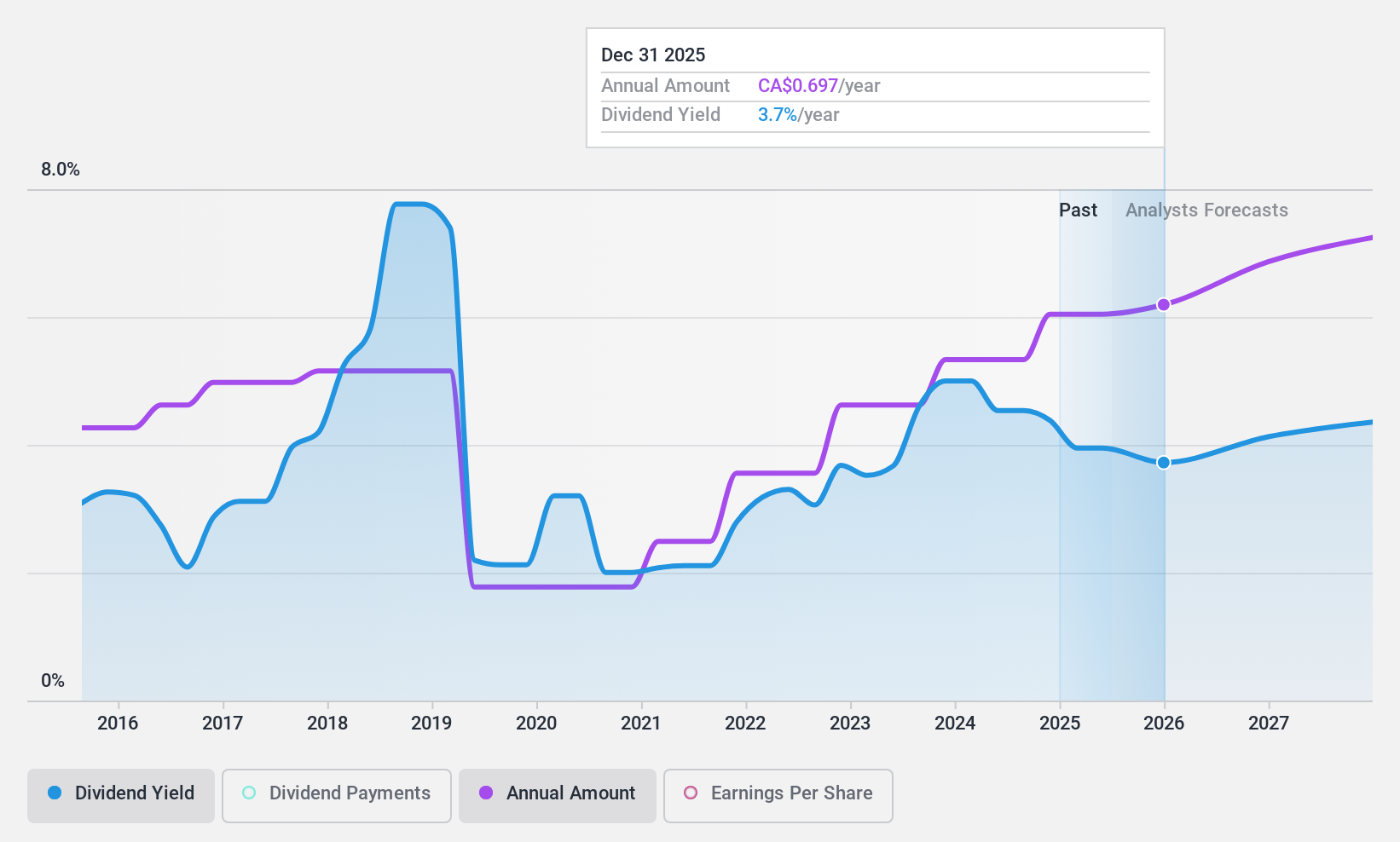

High Liner Foods (TSX:HLF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: High Liner Foods Incorporated processes and markets prepared and packaged frozen seafood products in North America, with a market cap of CA$492.69 million.

Operations: High Liner Foods generates revenue of $959.22 million from its manufacturing and marketing of prepared and packaged frozen seafood segment.

Dividend Yield: 3.8%

High Liner Foods' dividend, yielding 3.85%, is lower than the top Canadian payers and has been volatile over the past decade. Despite this, its dividends are well-covered by earnings and cash flows, with payout ratios of 22.7% and 20.5% respectively, indicating sustainability. Recent earnings showed significant growth in net income to US$60.16 million from US$31.68 million year-over-year, supporting continued dividend payments amidst ongoing M&A pursuits for strategic growth.

- Navigate through the intricacies of High Liner Foods with our comprehensive dividend report here.

- According our valuation report, there's an indication that High Liner Foods' share price might be on the cheaper side.

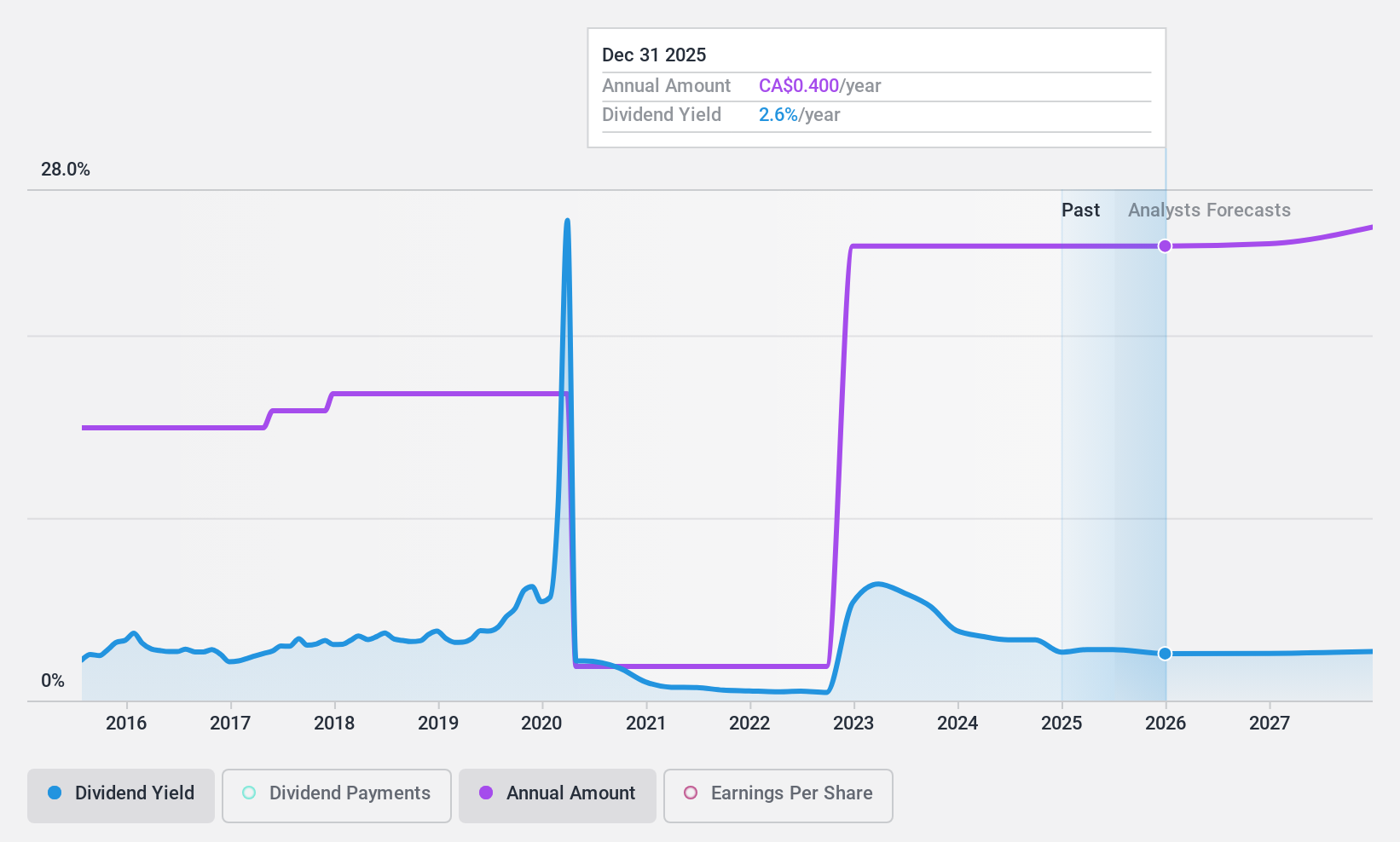

SECURE Waste Infrastructure (TSX:SES)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SECURE Waste Infrastructure Corp. operates in the waste management and energy infrastructure sectors mainly in Canada and the United States, with a market cap of CA$2.94 billion.

Operations: SECURE Waste Infrastructure Corp. generates revenue from two main segments: CA$1.21 billion from Waste Management and CA$9.29 billion from Energy Infrastructure.

Dividend Yield: 3.2%

SECURE Waste Infrastructure's dividend yield of 3.16% is modest compared to top Canadian payers, yet it remains reliable and stable over the past decade. With a payout ratio of 49%, dividends are well-covered by earnings and cash flows. Recent financials indicate decreased net income to C$38 million from C$422 million year-over-year, but ongoing share buybacks suggest confidence in capital management. The company is also exploring strategic acquisitions for growth.

- Click to explore a detailed breakdown of our findings in SECURE Waste Infrastructure's dividend report.

- Upon reviewing our latest valuation report, SECURE Waste Infrastructure's share price might be too pessimistic.

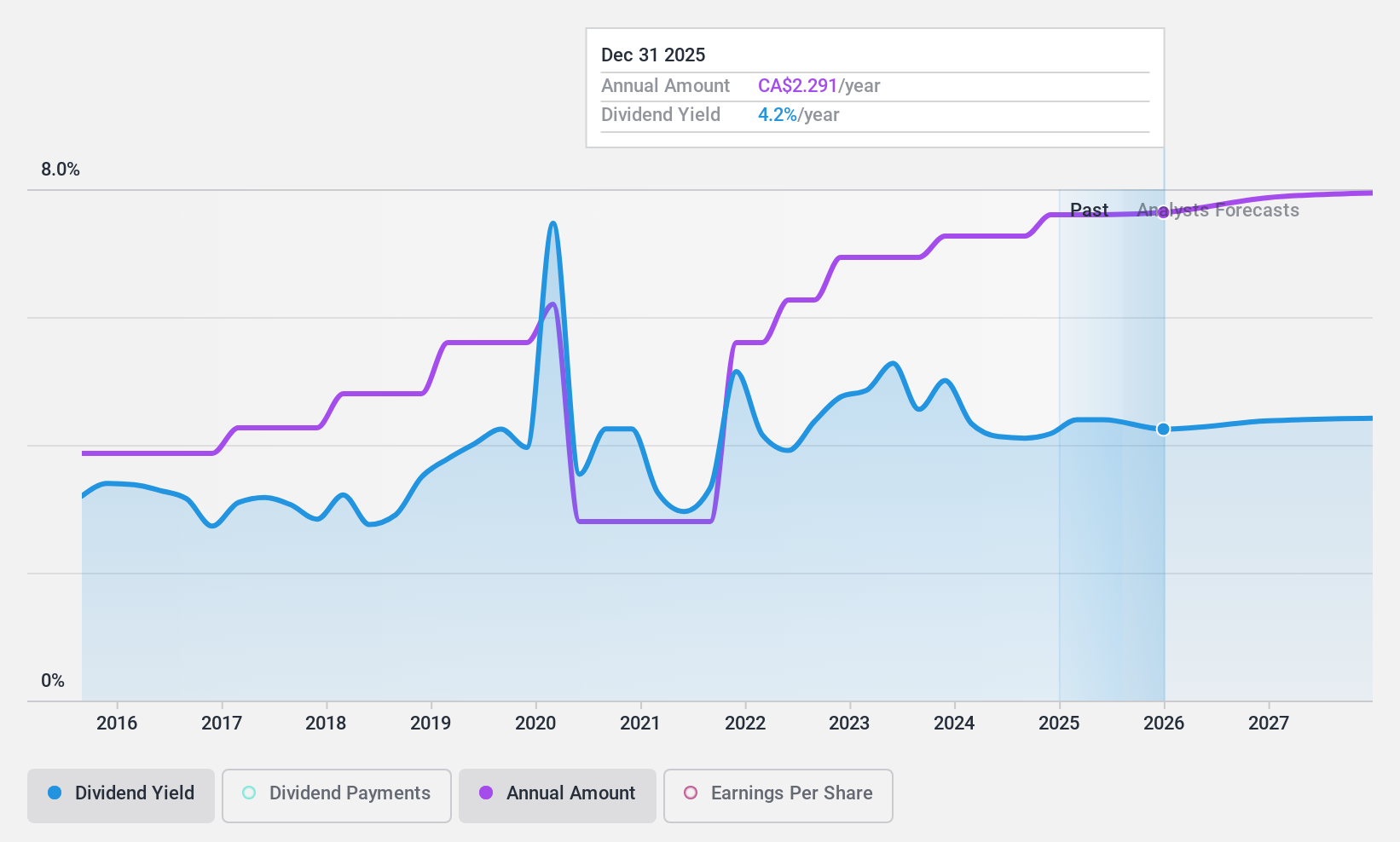

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally with a market cap of approximately CA$59.63 billion.

Operations: Suncor Energy Inc.'s revenue is primarily derived from its Refining and Marketing segment at CA$31.34 billion, followed by the Oil Sands segment at CA$25.62 billion, and Exploration and Production contributing CA$2.25 billion.

Dividend Yield: 4.7%

Suncor Energy's dividend is well-covered by both earnings and cash flows, with a payout ratio of 46.7% and a cash payout ratio of 29.8%. Despite past volatility in dividend payments, recent financials show stable net income growth to C$1.69 billion for Q1 2025. The ongoing share repurchase program, targeting up to 10% of shares, underscores management's commitment to shareholder value despite the forecasted earnings decline over the next three years.

- Unlock comprehensive insights into our analysis of Suncor Energy stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Suncor Energy is priced lower than what may be justified by its financials.

Where To Now?

- Dive into all 25 of the Top TSX Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if High Liner Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HLF

High Liner Foods

Processes and markets prepared and packaged frozen seafood products in North America.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion