Stock Analysis

- Canada

- /

- Energy Services

- /

- TSX:SES

TSX Dividend Stocks To Watch In July 2024

Reviewed by Simply Wall St

The Canadian market has shown robust growth, with an 11% increase over the past year and earnings expected to grow by 15% annually. In this environment, dividend stocks that offer both stability and potential for income growth are particularly appealing to watch in July 2024.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.73% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.08% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.50% | ★★★★★☆ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.20% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.44% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.75% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.40% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.23% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.41% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.01% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

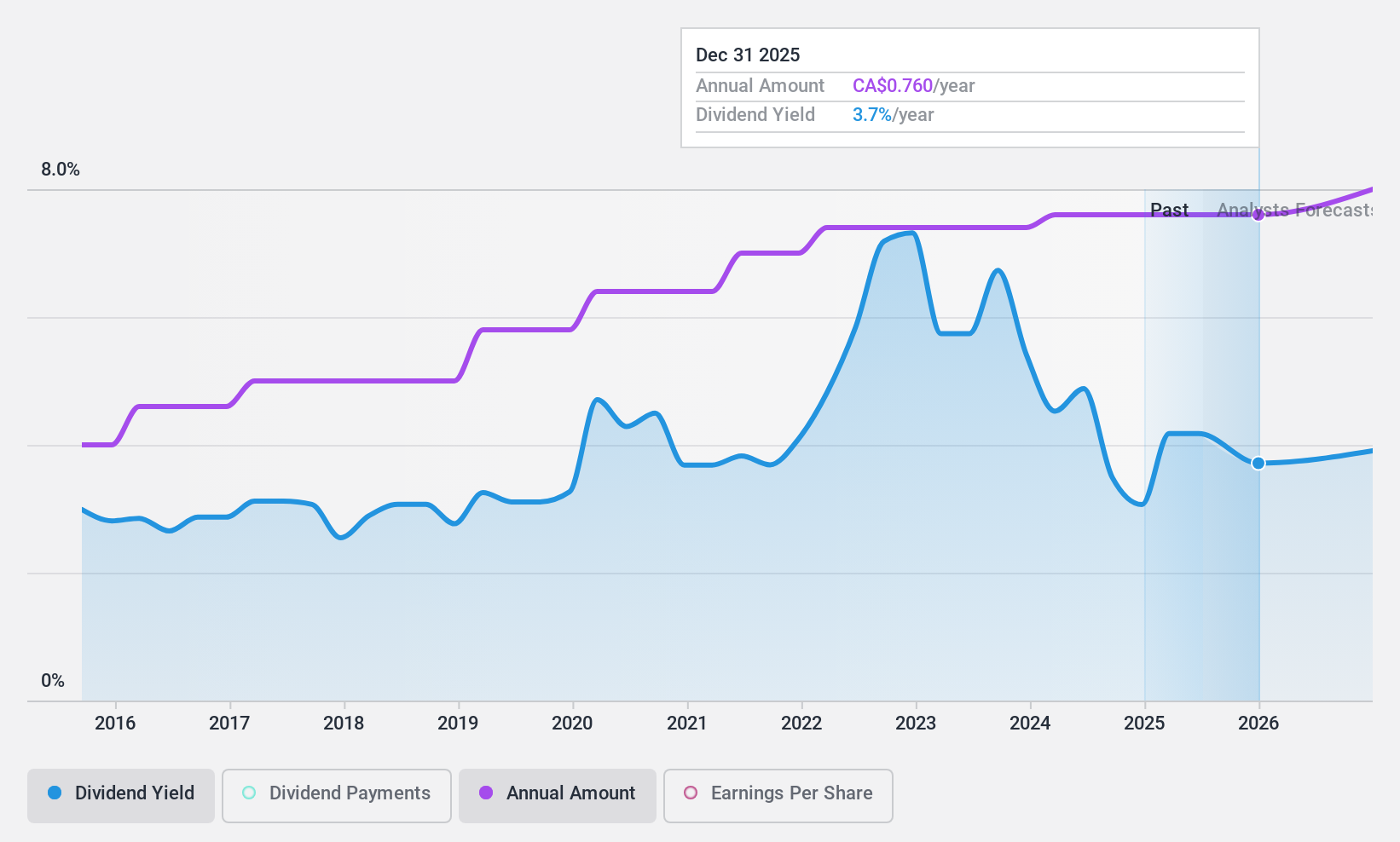

Aecon Group (TSX:ARE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aecon Group Inc. operates as a construction and infrastructure development company serving private and public sector clients in Canada, the United States, and internationally, with a market cap of approximately CA$0.89 billion.

Operations: Aecon Group Inc. generates its revenue from providing construction and infrastructure development services across North America and internationally.

Dividend Yield: 5.1%

Aecon Group Inc. faces challenges with a significant net loss of CA$123.89 million in Q2 2024, contrasting sharply with a net income of CA$28.21 million in the same quarter last year, alongside a sales drop from CA$1.17 billion to CA$853.78 million. Despite these financial setbacks, the company maintains its dividend commitment, declaring a quarterly payout of 19 cents per share and initiating a share buyback program for up to 3.1 million shares or 5% of its share capital, signaling confidence in its stability and future prospects.

- Get an in-depth perspective on Aecon Group's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Aecon Group shares in the market.

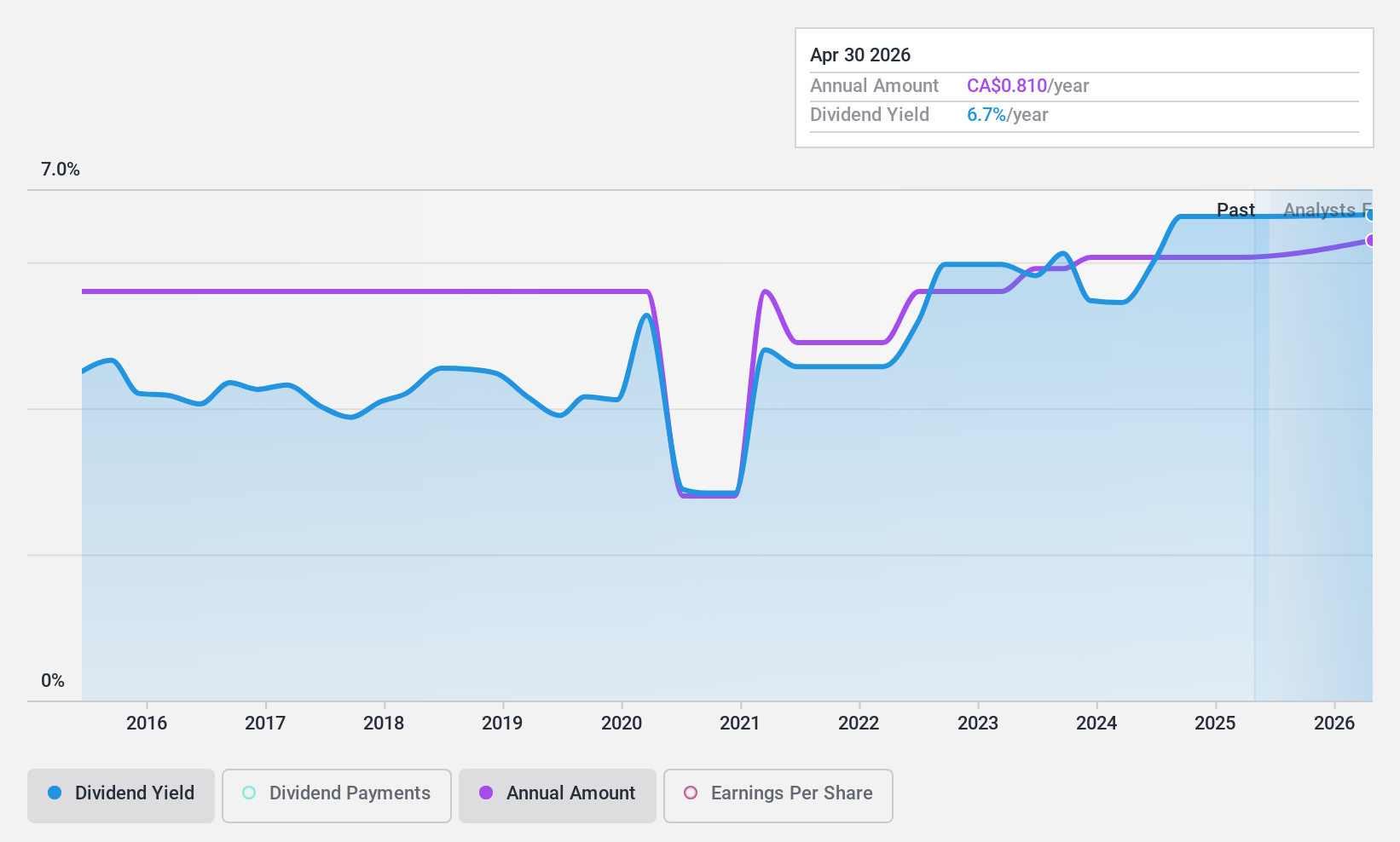

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited specializes in designing, manufacturing, and distributing video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications sectors globally, with a market capitalization of approximately CA$0.97 billion.

Operations: Evertz Technologies generates CA$514.62 million from its television broadcast equipment market segment.

Dividend Yield: 6.1%

Evertz Technologies Limited's dividend yield of 6.05% trails slightly behind the top quartile of Canadian dividend stocks. Despite a history of unstable dividends, recent earnings show a solid coverage with an 84% payout ratio from earnings and 44% from cash flows, suggesting sustainability. The stock is currently valued at 48.2% below estimated fair value, with analysts predicting a potential price increase of 33.2%. Recent financial results indicate a year-over-year decline in quarterly net income and sales but an annual growth in earnings per share and total sales for the fiscal year.

- Click here and access our complete dividend analysis report to understand the dynamics of Evertz Technologies.

- Our expertly prepared valuation report Evertz Technologies implies its share price may be lower than expected.

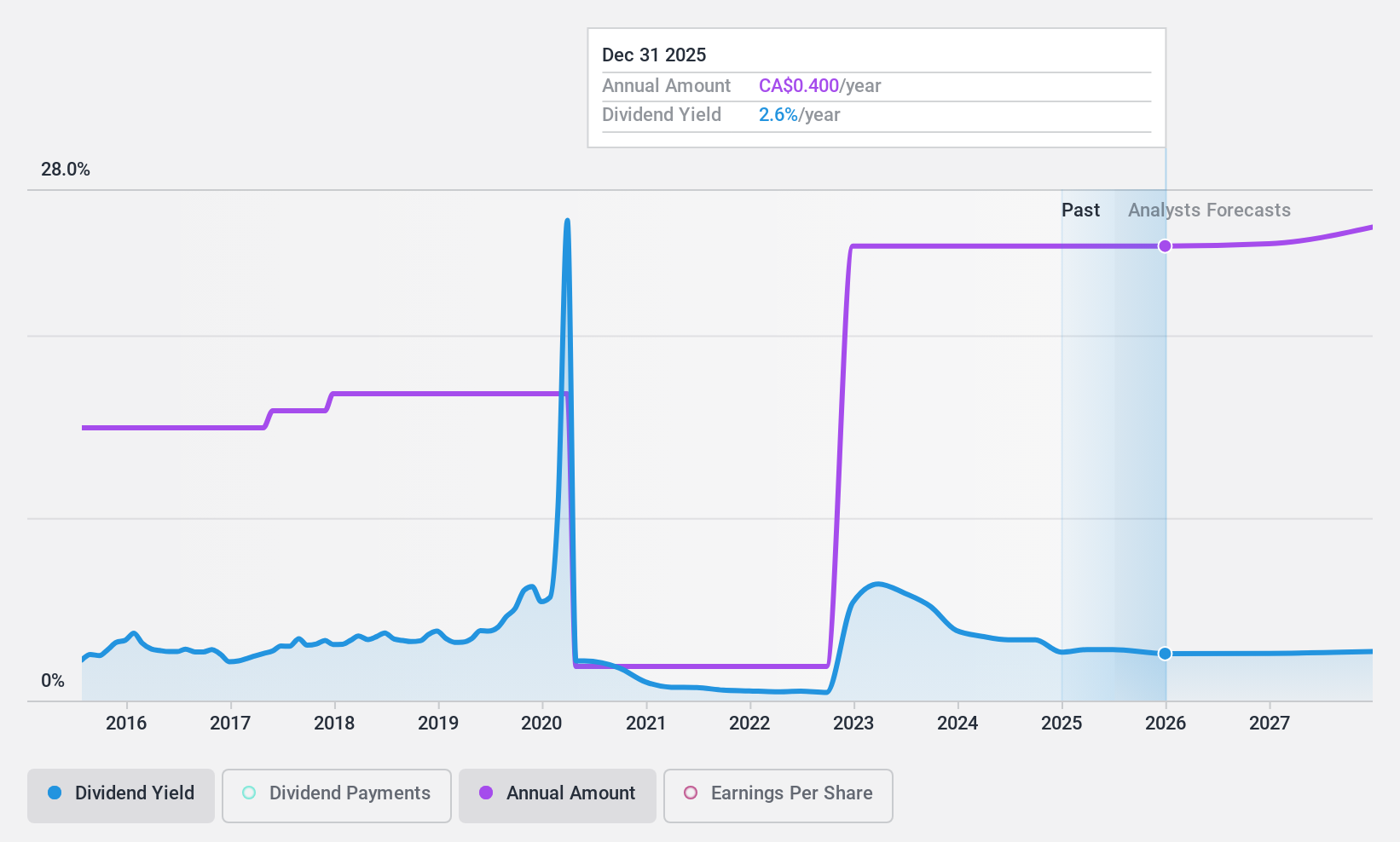

Secure Energy Services (TSX:SES)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Secure Energy Services Inc. operates in waste management and energy infrastructure primarily in Canada and the United States, with a market capitalization of approximately CA$2.73 billion.

Operations: Secure Energy Services Inc. generates CA$7.81 billion from its Energy Infrastructure segment and CA$1.09 billion from Environmental Waste Management.

Dividend Yield: 3.5%

Secure Energy Services Inc. maintains a consistent dividend, recently declaring a $0.10 per share quarterly payout, affirming its appeal to income-focused investors. The company also completed a significant share buyback, repurchasing 7.93% of its shares for CA$250 million, signaling confidence in its financial health and commitment to shareholder value. Despite this, the dividend yield at 3.5% is modest compared to top Canadian dividend stocks and earnings are expected to decline by an average of 29.8% annually over the next three years, raising concerns about long-term sustainability in a challenging market environment.

- Take a closer look at Secure Energy Services' potential here in our dividend report.

- Our valuation report here indicates Secure Energy Services may be undervalued.

Key Takeaways

- Unlock our comprehensive list of 33 Top TSX Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SES

Secure Energy Services

Engages in the waste management and energy infrastructure businesses primarily in Canada and the United States.

Very undervalued with flawless balance sheet and pays a dividend.