Stock Analysis

- Canada

- /

- Construction

- /

- TSX:ARE

Exploring 3 TSX Stocks Estimated To Be Undervalued By Up To 49.4%

Reviewed by Simply Wall St

The Canadian market has shown robust growth, with an 11% increase over the past year and earnings expected to rise by 15% annually. In this thriving environment, identifying stocks that are potentially undervalued could offer attractive opportunities for investors looking to capitalize on market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Aecon Group (TSX:ARE) | CA$14.80 | CA$29.25 | 49.4% |

| Trisura Group (TSX:TSU) | CA$44.07 | CA$79.84 | 44.8% |

| Kraken Robotics (TSXV:PNG) | CA$1.14 | CA$2.25 | 49.2% |

| Colliers International Group (TSX:CIGI) | CA$188.01 | CA$370.79 | 49.3% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Amerigo Resources (TSX:ARG) | CA$1.57 | CA$2.75 | 42.9% |

| Pan American Silver (TSX:PAAS) | CA$29.61 | CA$59.06 | 49.9% |

| Green Thumb Industries (CNSX:GTII) | CA$15.30 | CA$30.21 | 49.4% |

| Hamilton Thorne (TSX:HTL) | CA$2.125 | CA$4.07 | 47.8% |

| Kits Eyecare (TSX:KITS) | CA$9.90 | CA$16.89 | 41.4% |

Let's dive into some prime choices out of the screener.

Aecon Group (TSX:ARE)

Overview: Aecon Group Inc. operates as a construction and infrastructure development company serving clients in Canada, the United States, and internationally, with a market capitalization of approximately CA$0.89 billion.

Operations: The company generates revenue through construction and infrastructure development services across various sectors, primarily serving clients in Canada, the United States, and internationally.

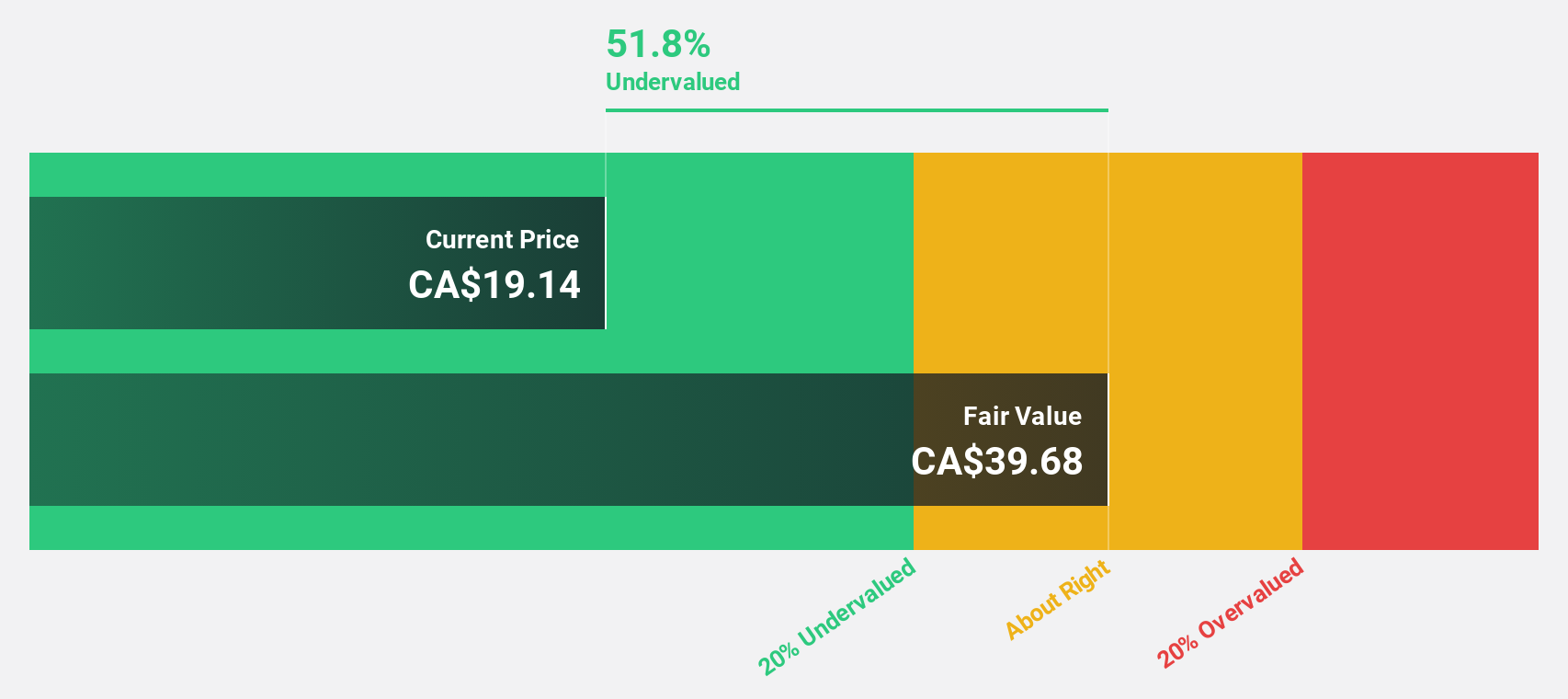

Estimated Discount To Fair Value: 49.4%

Aecon Group Inc. is currently trading below its estimated fair value by over 20%, marking it as potentially undervalued based on discounted cash flow analysis. Despite recent financial struggles, including a significant net loss and reduced sales in the first half of 2024, Aecon maintains a dividend payment and has initiated a share repurchase program, signaling some level of confidence in its financial stability. The company’s earnings are expected to grow significantly, outpacing the Canadian market average. However, this growth must be viewed cautiously due to large one-off items impacting recent results and low profit margins compared to the previous year.

- The analysis detailed in our Aecon Group growth report hints at robust future financial performance.

- Navigate through the intricacies of Aecon Group with our comprehensive financial health report here.

Colliers International Group (TSX:CIGI)

Overview: Colliers International Group Inc. operates as a global provider of commercial real estate professional and investment management services, with a market capitalization of approximately CA$9.11 billion.

Operations: Colliers International Group Inc. generates revenue primarily from the Americas with CA$2.53 billion, followed by Europe, the Middle East & Africa (EMEA) at CA$730.10 million, Asia Pacific with CA$616.58 million, and Investment Management services contributing CA$489.23 million.

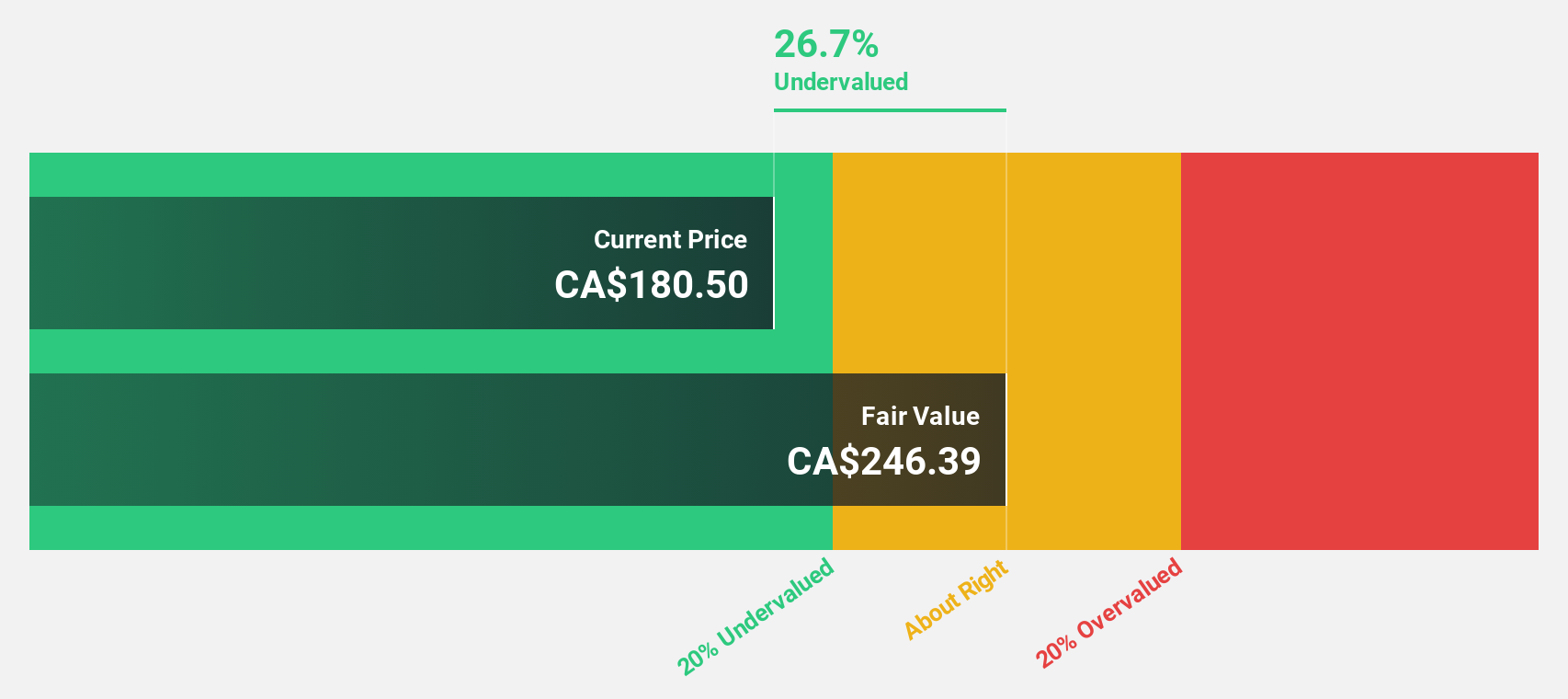

Estimated Discount To Fair Value: 49.3%

Colliers International Group, priced at CA$188.01, appears undervalued with an estimated fair value of CA$370.79. The company's earnings have surged by 119.8% over the past year and are projected to grow by 38.3% annually, outpacing the Canadian market forecast of 14.8%. Despite this robust growth, Colliers faces challenges as its debt is not well covered by operating cash flow, indicating potential financial strain despite trading at 49.3% below its estimated fair value.

- Upon reviewing our latest growth report, Colliers International Group's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Colliers International Group.

Energy Fuels (TSX:EFR)

Overview: Energy Fuels Inc. operates in the United States, focusing on the extraction, recovery, recycling, exploration, permitting, evaluation, and sale of uranium mineral properties with a market cap of approximately CA$1.25 billion.

Operations: The company generates revenue primarily through its miscellaneous metals and mining activities, totaling CA$43.74 million.

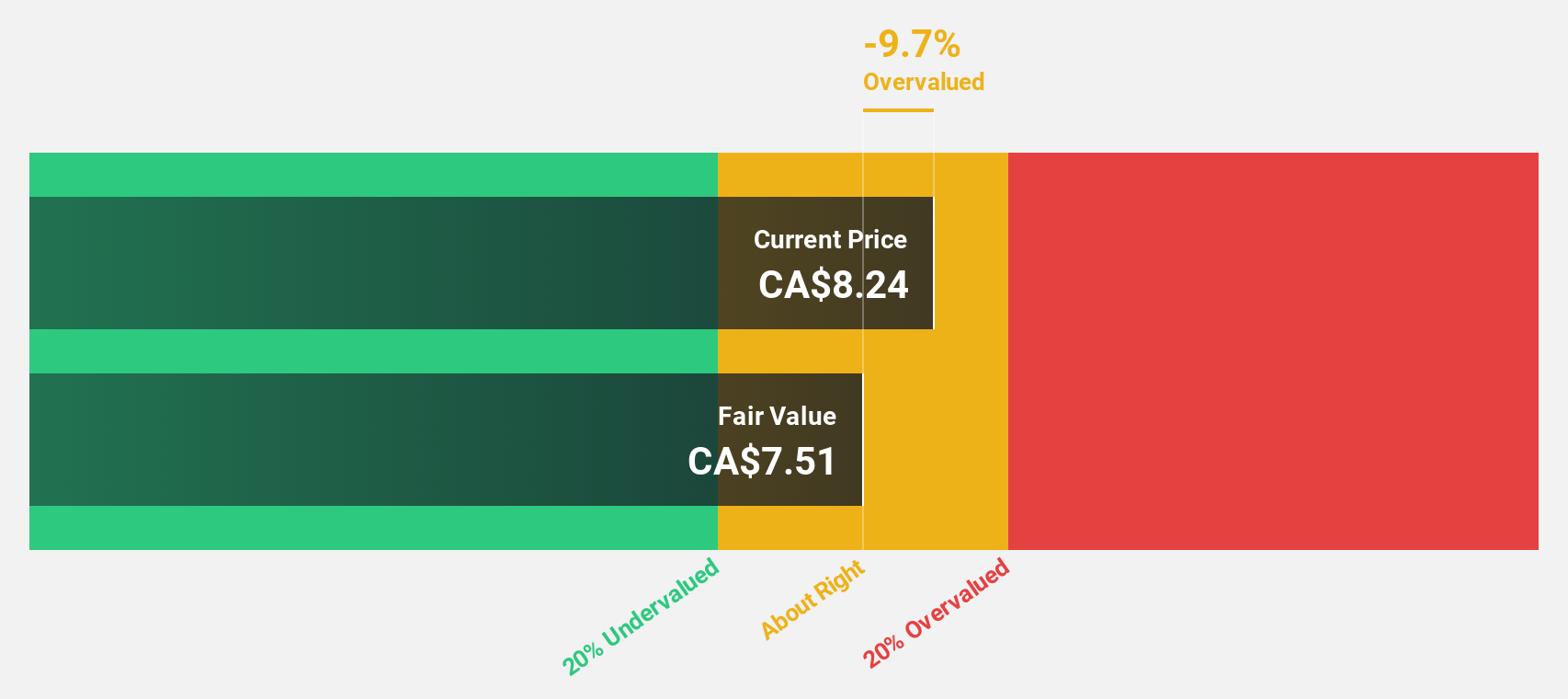

Estimated Discount To Fair Value: 31.2%

Energy Fuels, currently priced at CA$7.75, is significantly undervalued with a fair value estimation of CA$11.27, presenting a substantial discount of 31.2%. Despite recent volatility, including being dropped from several Russell indexes but added to the Russell 2000 Value-Defensive Index, the company shows promising financial prospects. It's expected to achieve profitability within three years with forecasted revenue growth at 40.8% annually and profit growth at 50.8% annually—both well above market averages. However, shareholder dilution over the past year could be a concern for potential investors.

- According our earnings growth report, there's an indication that Energy Fuels might be ready to expand.

- Click here to discover the nuances of Energy Fuels with our detailed financial health report.

Taking Advantage

- Click through to start exploring the rest of the 23 Undervalued TSX Stocks Based On Cash Flows now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARE

Aecon Group

Aecon Group Inc., together with its subsidiaries, provide construction and infrastructure development services to private and public sector clients in Canada, the United States, and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.