Stock Analysis

- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

Exploring Hammond Power Solutions And Two More Undiscovered Canadian Gems

Reviewed by Simply Wall St

Amid a backdrop of fluctuating markets and shifting economic indicators, Canadian small-cap stocks have shown resilience and potential for growth. This dynamic environment underscores the importance of exploring lesser-known investment opportunities that may thrive under current conditions, such as those offered by Hammond Power Solutions and two other undiscovered gems in Canada.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Silvercorp Metals | NA | 5.94% | -10.80% | ★★★★★★ |

| TWC Enterprises | 7.71% | 8.87% | 30.01% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 66.35% | -25.78% | ★★★★★★ |

| Taiga Building Products | NA | 7.62% | 15.46% | ★★★★★★ |

| Frontera Energy | 28.78% | -0.59% | 34.36% | ★★★★★☆ |

| Mako Mining | 28.08% | 39.01% | 48.79% | ★★★★★☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 39.50% | 22.73% | 41.36% | ★★★★☆☆ |

| Senvest Capital | 54.38% | 2.12% | -0.88% | ★★★★☆☆ |

| Fairfax India Holdings | 17.90% | 2.65% | 1.15% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Hammond Power Solutions Inc. designs and manufactures a wide range of transformers, operating across Canada, the United States, Mexico, and India, with a market capitalization of CA$1.23 billion.

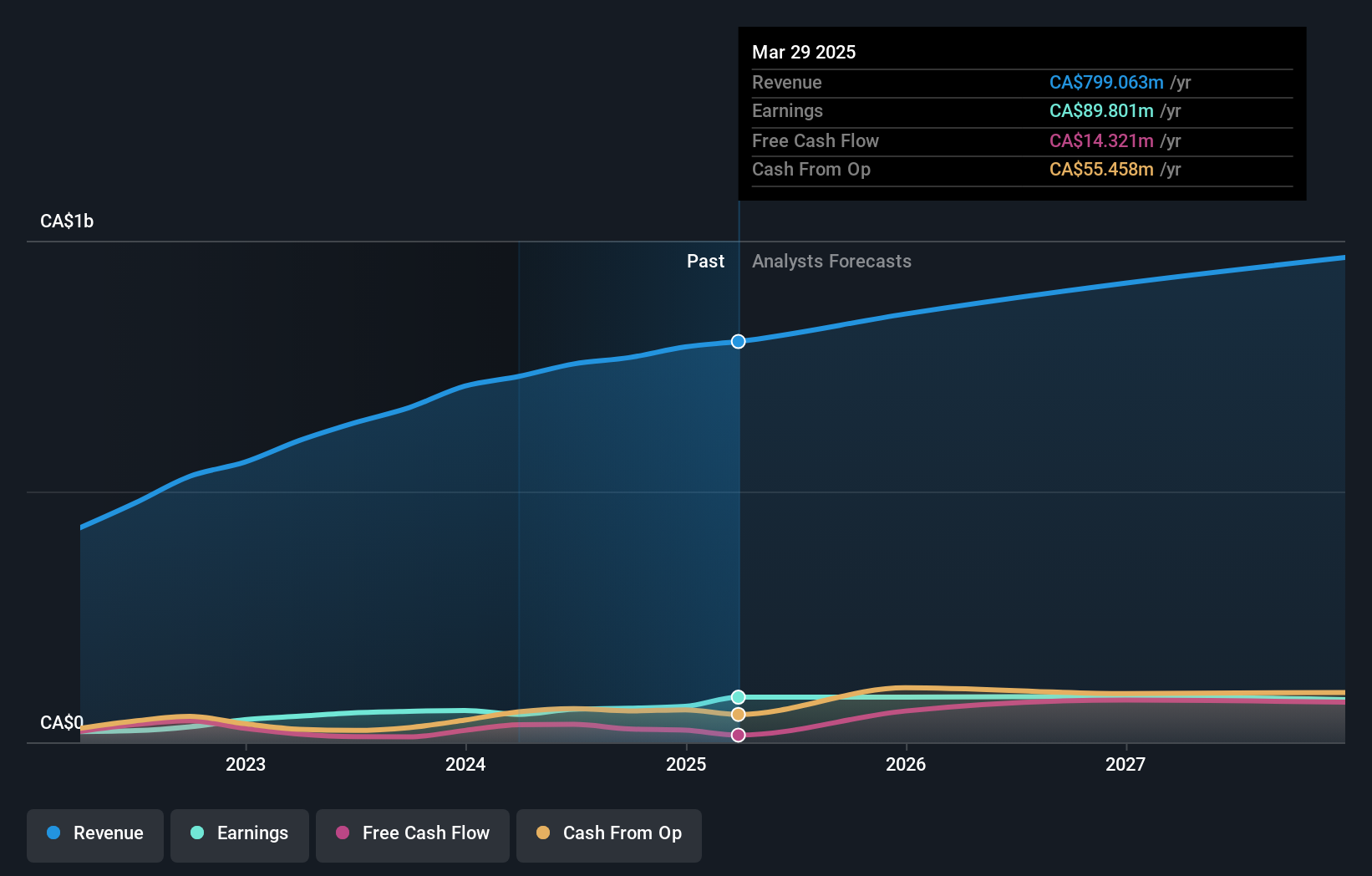

Operations: The company specializes in the manufacture and sale of transformers, generating CA$729.61 million in revenue. It has consistently demonstrated a robust gross profit margin, peaking at 32.51% by the end of 2023, indicative of its ability to manage production costs effectively while maintaining profitability.

Hammond Power Solutions, a lesser-known yet robust performer in the electrical industry, showcases promising financial health and growth prospects. With earnings that have surged by 41.8% annually over the past five years, the company is poised for a forecasted annual growth of 19.27%. Recent financials reveal a second-quarter net income jump to CAD 23.59 million from CAD 13.33 million year-over-year, underscoring its operational efficiency and market adaptability. Additionally, its debt-to-equity ratio improved significantly from 31% to just 9.6%, enhancing its financial stability while trading at an appealing 43% below estimated fair value.

- Unlock comprehensive insights into our analysis of Hammond Power Solutions stock in this health report.

Understand Hammond Power Solutions' track record by examining our Past report.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc. operates as a retailer specializing in food and everyday products and services, serving rural communities and urban neighborhood markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of CA$2.12 billion.

Operations: The company generates revenue primarily through the retail of food and everyday products and services, with recent figures showing a gross profit of CA$824.12 million on revenues of CA$2.50 billion. The business model focuses on managing costs effectively, evidenced by a consistent gross profit margin around 33% in recent periods, highlighting efficient operations despite fluctuating operating expenses and non-operating costs.

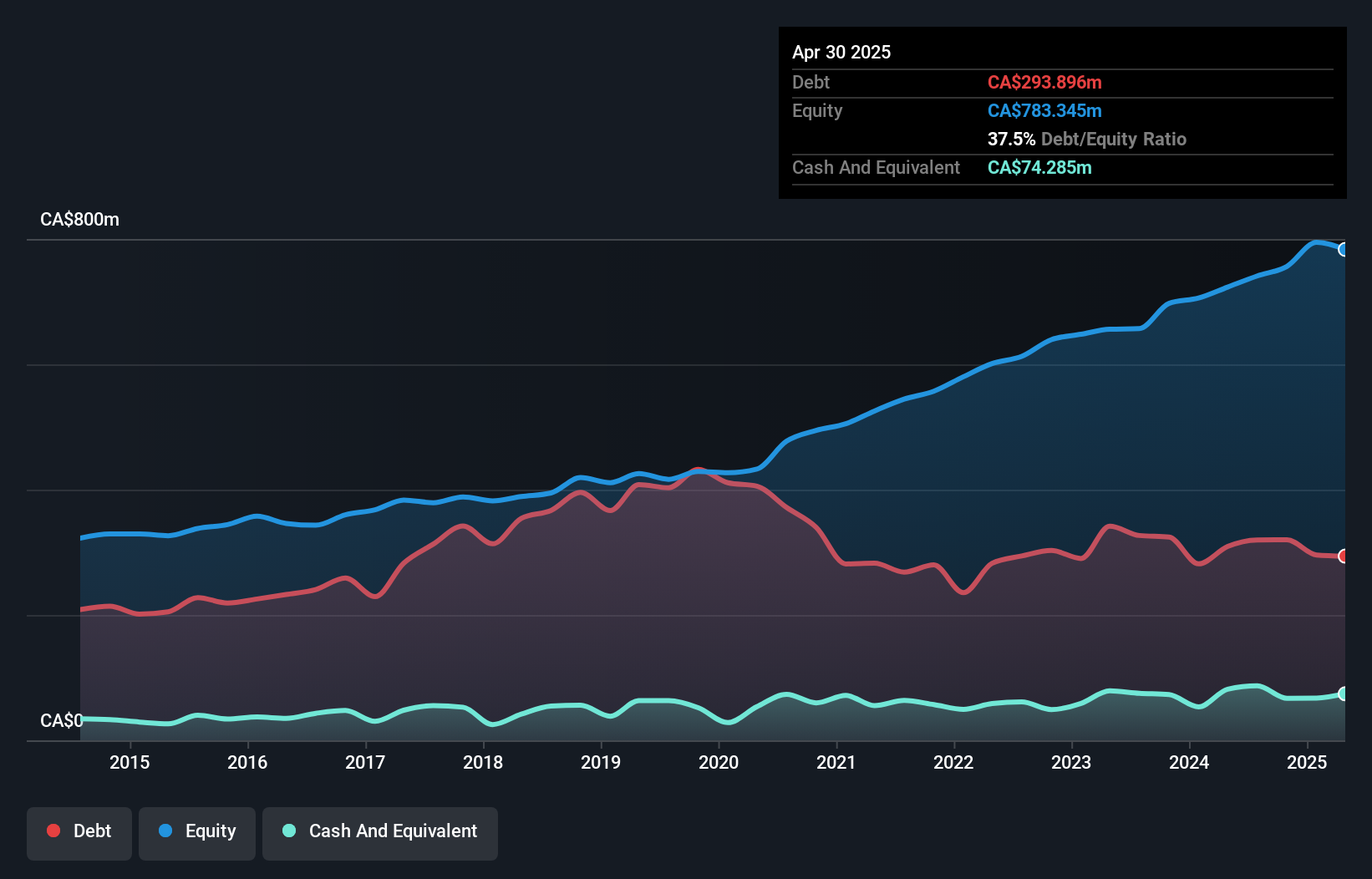

North West Company, a hidden gem in the Canadian market, showcases robust financial health and growth potential. Trading 48.7% below its estimated fair value, North West has outpaced industry earnings growth with a 15.8% increase over the past year compared to the industry's 5.7%. Its debt-to-equity ratio improved significantly from 95.9% to 42.8%, reflecting stronger balance sheet management. Additionally, its net debt to equity is at a satisfactory level of 31.5%, and interest payments are well-covered by EBIT at a rate of 10.9 times.

- Click to explore a detailed breakdown of our findings in North West's health report.

Assess North West's past performance with our detailed historical performance reports.

TerraVest Industries (TSX:TVK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: TerraVest Industries Inc. is a diversified manufacturer providing products and services to the energy, agriculture, mining, and transportation sectors across Canada and the United States, with a market capitalization of CA$1.52 billion.

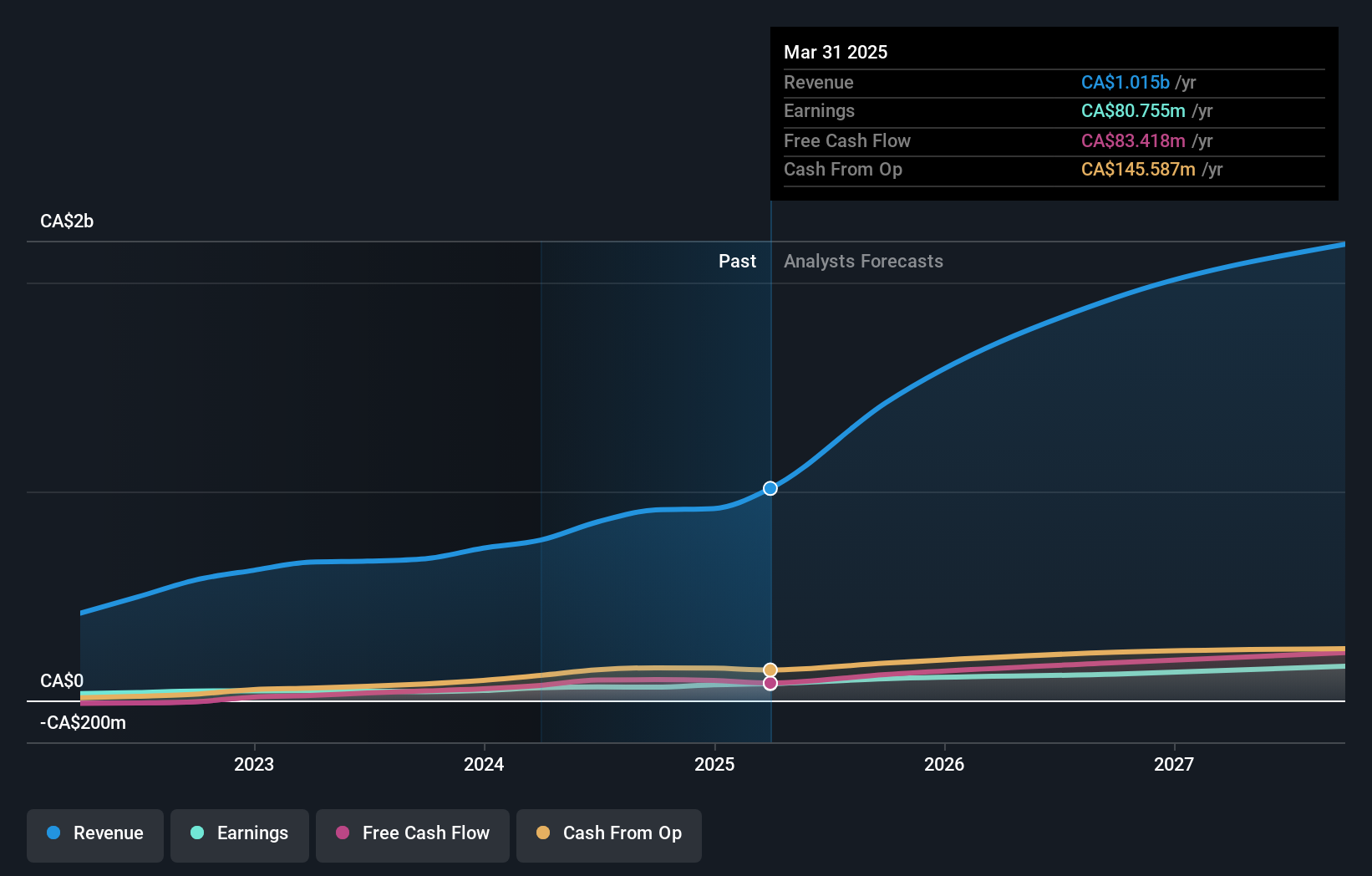

Operations: The company generates revenue through diverse segments including Service (CA$184.52 million), Processing Equipment (CA$123.25 million), Compressed Gas Equipment (CA$216.10 million), and HVAC and Containment Equipment (CA$244.50 million). It has demonstrated a notable increase in gross profit margin, rising from 23.77% in early 2013 to 27.11% by mid-2024, reflecting improved operational efficiency or product mix changes over the period.

TerraVest Industries, a lesser-highlighted gem in Canada's Energy Services sector, has demonstrated robust growth with a 30% earnings increase over the past year, surpassing the industry's 26.7%. Despite its high net debt-to-equity ratio of 92.4%, suggesting significant leverage, the company maintains strong interest coverage at five times EBIT. Recent activities include a substantial equity offering raising CAD 84.2 million and consistent dividend payouts, reflecting confidence in ongoing financial health and shareholder value enhancement.

Taking Advantage

- Discover the full array of 48 TSX Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services to rural communities and urban neighborhood markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet with solid track record and pays a dividend.